Delaware Mortgage Rates Weekly Update for December 1, 2014

Delaware Mortgage Rates weekly mortgage market update for the Week of December 1, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

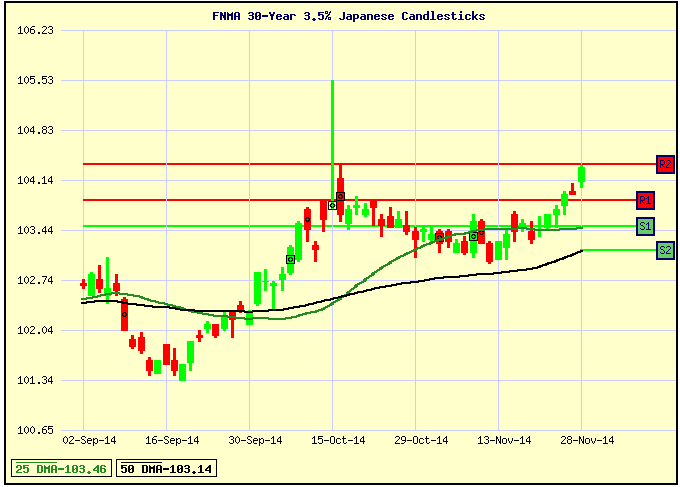

Delaware Mortgage Rates were able to move lower last week as mortgage bonds rallied and broke through the ceiling of resistance. If you look at the mortgage bond chart below, you can see mortgage bonds rallied through the ceiling of resistance which is the red line that is labeled R1 in the chart. This line of resistance has held since October 15th so breaking above this line and closing above it last week is a very bullish sign for mortgage bonds. We are recommending FLOATING your Delaware Mortgage Rate to start the week to see if bonds can build on the momentum they have after breaking through resistance last week.

In Economic News, OPEC decided NOT to cut production which leads the price of Oil to drop $6 a barrel down to just below $68 a barrel as the world market sees a glut of oil supply. The drop in oil prices has to lead to the National price of a gallon of gas to drop to $2.79 which is the lowest price since December 2010.

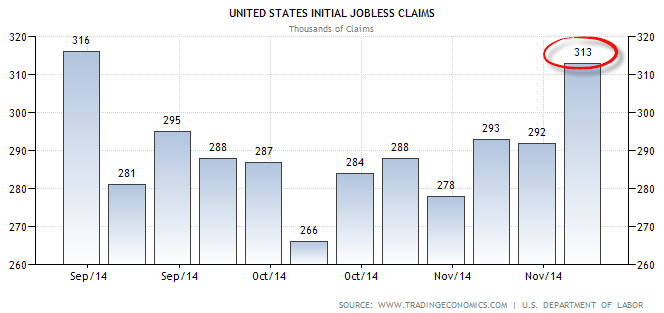

Weekly Initial Jobless Claims spiked higher last to 313,000 claims which were above the 286,000 expected claims and the first time to climb above 300,000 since the beginning of September 2014. This breaks a 10-week cycle of jobless claims below 300,000.

Personal Income & Spending came out lower than expected, personal income and spending were up only 0.2% versus expectations of 0.4% and 0.3% respectively. Lower Personal Spending is bad as the economy runs on consumers spending money. We also saw the release of the Feds favorite measure of inflation which was the Personal Consumption Expenditures (PCE), PCE came out very tame, the headline was up only 0.1% to 1.4% year over year.

The Gross Domestic Product (GDP) preliminary reading for the third quarter of 2014 came in at 3.9% which was better than expectations of 3.3%. This brings the yearly average to just over 2% which is only okay.

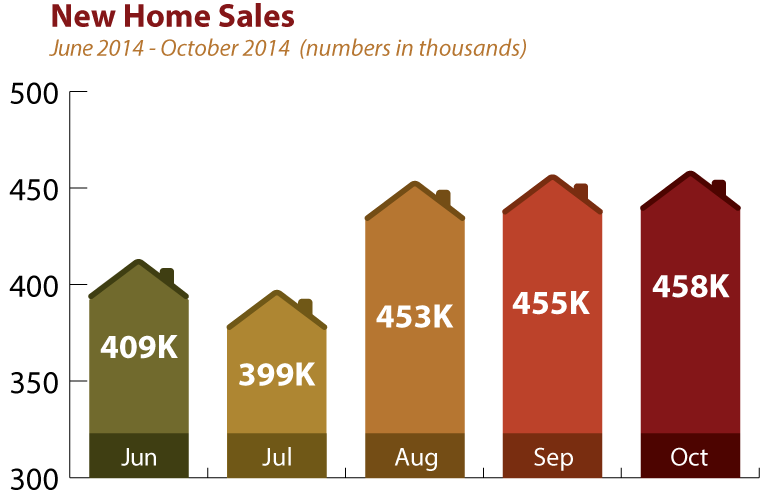

In Housing News, New Home Sales for October 2014 were reported up 0.7% to 458,000 units on an annualized basis. The Median Home Price for New Home Sales jumped up to $305,000 which was a big jump up from the previous median home price of $259,000. Inventories increased from 5.3 to 5.6 month supply.

Pending Home Sales for October 2014 came in slightly lower than expected by dropping 1.1% from September 2014 but still remain healthy and are above year over year levels. Pending homes sales measure the number of contracts signed to purchase existing single-family residences.

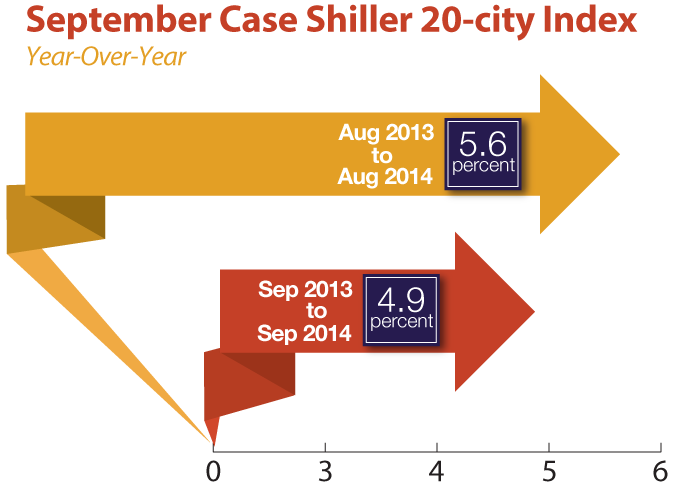

The Case Shiller 20 City Home Price Index for September 2014 came in at 4.9% year over year which is down slightly from August. Robert Shiller stated he is still optimistic about the housing market and says he sees a 10% price appreciation over the next two years which works out to 5% per year.

The next Delaware First Time Home Buyer Seminar is Saturday, December 13, 2014, n Newark, Delaware. There is a Dover Delaware First Time Home Buyer Seminar Saturday, December 6, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, December 20, 2014, in Towson, Maryland Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713