Delaware Mortgage Rates Weekly Mortgage Rate Update for July 21, 2014

Delaware Mortgage Rates weekly mortgage rate update for the Week of July 21, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates were able to end the week about where they started after a roller coaster ride. If you look at the mortgage bond chart below you can see mortgage bonds sold off at the start of the week but were able to find a bottom on Wednesday and then rebounded higher. We are recommending FLOATING your Delaware Mortgage Rate to start the week to see if mortgage bonds can continue to rally on the negative political news from the Middle East and Ukraine.

In Economic News, mortgage bonds were selling off as corporate earnings report kicked off good but mortgage bonds were able to reverse course as Geopolitical events sparked a “flight to quality” from stocks to bonds. The first event was the Malaysia Airlines Flight 17 being shot down over Ukraine by a Russian made SA-11 Surface to Air Missile shot from within territory controlled by the Russian backed Ukraine Separatists.

In Economic News, mortgage bonds were selling off as corporate earnings report kicked off good but mortgage bonds were able to reverse course as Geopolitical events sparked a “flight to quality” from stocks to bonds. The first event was the Malaysia Airlines Flight 17 being shot down over Ukraine by a Russian made SA-11 Surface to Air Missile shot from within territory controlled by the Russian backed Ukraine Separatists.

The second Geo-Political event that sparked the rally in the bond market is the ground invasion of the Gaza Strip by the Israeli Army. The Israeli Army launched a ground invasion to destroy tunnels from the Gaza Strip into Israeli that Hamas militants have built to launch raids into Israeli. Hamas has fired thousands of rockets into Israeli which broke the truce and cut off peace talks being brokered by Egypt.

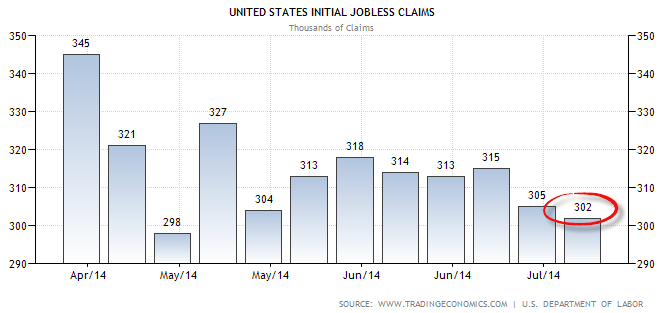

Thursday we saw the release of the Weekly Initial Jobless Claims which came out at 302,000 claims down 3,000 claims from the previous week. Weekly Initial Jobless Claims have been trending lower and the 4-week average set a new recovery low of 309k.

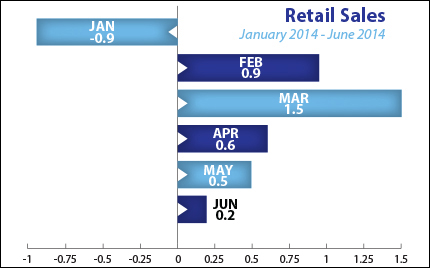

Retail Sales for June 2014 cooled off coming in at only up 0.2% which is the lowest this year since January’s -0.9%. Retail Sales account for almost one-third of consumer spending and are one of the main drivers of US Economic activity so a decline in Retail Sales is something to watch. The softer than expected Retail Sales are in line with the weak GDP report we had for the first quarter of 2014.

Retail Sales for June 2014 cooled off coming in at only up 0.2% which is the lowest this year since January’s -0.9%. Retail Sales account for almost one-third of consumer spending and are one of the main drivers of US Economic activity so a decline in Retail Sales is something to watch. The softer than expected Retail Sales are in line with the weak GDP report we had for the first quarter of 2014.

In Housing News, The National Association of Home Builders (NAHB) Housing Market Index for July 2014 came out much better than expected at 53. This is the first time the index is above 50 this year. This report shows a rebound in the Housing Market. Builders are attributing the jump in the Housing Index to an improving jobs market.

In Housing News, The National Association of Home Builders (NAHB) Housing Market Index for July 2014 came out much better than expected at 53. This is the first time the index is above 50 this year. This report shows a rebound in the Housing Market. Builders are attributing the jump in the Housing Index to an improving jobs market.

Housing Starts for June 2014 were very gloomy as they declined by 9.3% from May to an annual rate of 893,000 units which was well below the 1.020 million expected. Building Permits for June 2014 fell by 4.2% to an annual rate of 963,000 units. Building permits are a sign of future construction. These are both disappointing numbers but not terrible and these reports are both in conflict with the NAHB Housing Market Index. The NAHB report is more recent as it is from July so we will have to see how Housing Starts and Building Permits shake out for July to see how the housing market is doing for New Construction.

Housing Starts for June 2014 were very gloomy as they declined by 9.3% from May to an annual rate of 893,000 units which was well below the 1.020 million expected. Building Permits for June 2014 fell by 4.2% to an annual rate of 963,000 units. Building permits are a sign of future construction. These are both disappointing numbers but not terrible and these reports are both in conflict with the NAHB Housing Market Index. The NAHB report is more recent as it is from July so we will have to see how Housing Starts and Building Permits shake out for July to see how the housing market is doing for New Construction.

The next Delaware First Time Home Buyer Seminar is Saturday, August 23, 2014, n Newark, Delaware and the next Dover Delaware First Time Home Buyer Seminar is August 16, 2014. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, July 26, 2014, in Towson, Maryland and Frederick Maryland First Time Home Buyer Seminar on August 9, 2014, in Frederick, Maryland and Laurel Maryland First Time Home Buyer Seminar on August 20, 2014. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713