Delaware Mortgage Rates Weekly Update for June 2, 2014

Delaware Mortgage Rates weekly update for the Week of June 2, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates hit seven month low last week as mortgage bonds rallied. If you look at the mortgage bond chart below you can see bond hit high on Thursday but then sold off on profit taking and inflation heating up. Mortgage bonds were able to rally back on Friday and technically filled a rising window which is a very encouraging sign so we are recommending FLOATING your Delaware Mortgage Rate to start the week.

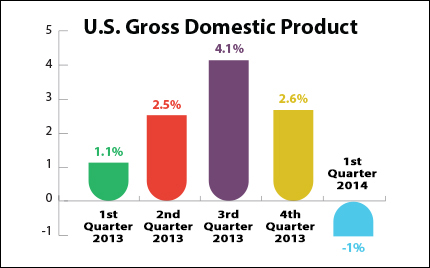

In Economic News, the second reading of Gross Domestic Product (GDP) for the first quarter of 2014 came in at -1.0% which is down from 0.1% from the first reading and is the first negative reading on GDP since the first quarter of 2011. This is down from the 2.6% registered in the final quarter of 2013 and below the -0.5% expected. The weak reading was due in part to declines in private inventory investments, exports, home and office, and plant construction, along with state and local government spending

Inflation is heating up which is not mortgage bond friendly news. We saw the Personal Consumption Expenditure or PCE come in at 0.2% for April 2014. The PCE is the Feds favorite measure of inflation and year over year it was up 1.6% and this is the highest reading in a year and a half for this measure of inflation. Inflation is still at low levels but the rate of change is what is concerning as if this pace keeps up we will be at the Feds target rate sooner rather than later and we could see mortgage rates move higher in response.

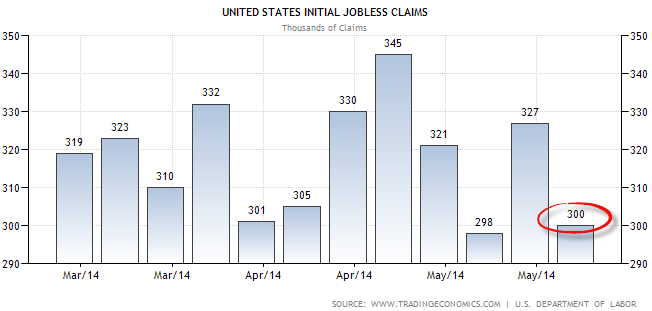

Thursday we saw the release of the Weekly Initial Jobless Claims which came in at 300,000 claims. This was a drop of 27k claims from the previous week and was a good rebound from last week’s higher claims.

In Housing News, CoreLogic released their National Foreclosure Report which shows foreclosure inventory is down 35% from a year ago and that only 4.5% of mortgages are now seriously delinquent for the first time in 6 years.

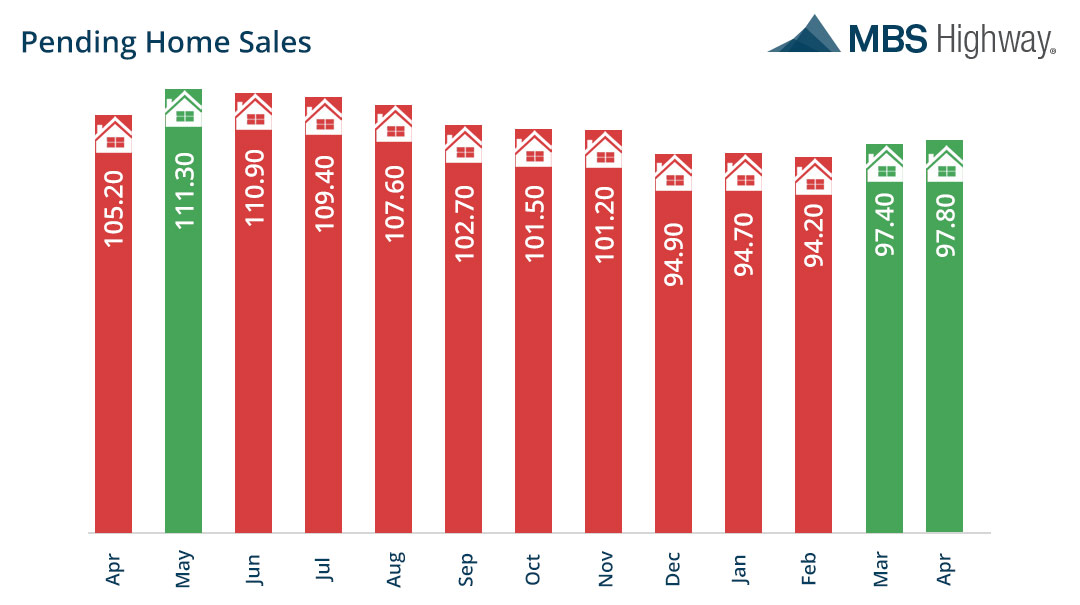

Pending homes Sales Index for April 2014 were up 0.4% from March at 97.8. A reading of a 100 corresponds to the average level of contract activity in 2011 which is “historically healthy” home-buying traffic according to NAR.

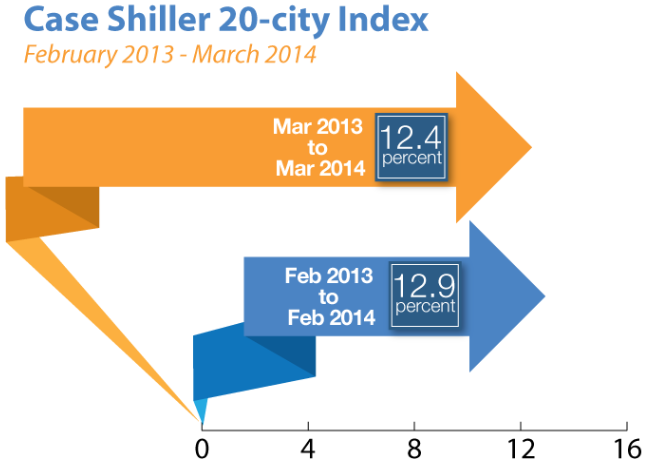

The Case-Schiller Home Price Index for March 2014 was released last week and it came in up 12.4% year over year from March 2013 to March 2014. Of the 20 cities in the index, only New York saw a decline in home prices. Appreciation is slowing a bit but this was still a very strong report for housing.

The next Delaware First Time Home Buyer Seminar is Saturday, June 21, 2014, n Newark, Delaware and the Dover Delaware Home Buyer Seminar is Saturday, June 14, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, June 28, 2014, in Towson, Maryland and Maryland First Time Home Buyer Seminar June 7, 2014, in Clinton, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713