Delaware Mortgage Rates Weekly Mortgage Market Update for January 6, 2014

Delaware Mortgage Rates weekly rate update for the Week of January 6, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates traded in a tight range for the last week and ended the week about where they started as you can see from the mortgage bond chart below. We are going to recommend FLOATING your Delaware Mortgage Rate to start the week to see if bonds can improve but again be on guard if bonds break below the level of support they have been trading at all week, rates will move higher fast so will quickly switch to a locking stance.

How will 2014 look for Delaware mortgage interest rates?

Mortgage interest rates have been on the rise since May 2013 where they were about 3.25% till now about 4.75%. Mortgage Rates will continue to rise as we move into January 2014 for Two reasons;

- Improving Economy – Pulling Money out of Bond Market into Stock Market which means high-interest rates

- Federal Reserve reducing their asset purchase program QE3 to end it by December 2014

This means the mortgage rates we have now may be the best interest rates all year for 2014 as most predictions see rates in the 5% range. So if you are interested in purchasing a home then now is the time to get out looking and get under contract because as the year moves on your buying power goes down for two reasons:

- Mortgage interest rates moving higher make your mortgage payment higher for the same purchase price

- Home Prices are increasing and expected to increase another 6% in 2014 – high sales price means a higher payment

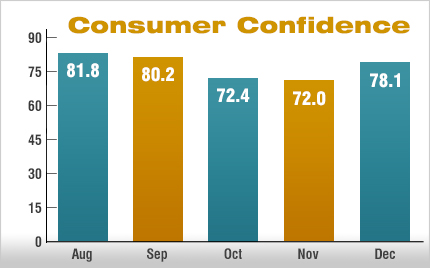

In Economic News, the Consumer Confidence for December 2013 increased to 78.1 from the lows of October and November which were caused by the U.S. Government shut down.

Thursday we saw the release of the Weekly Initial Jobless Claims which came in at 339,000 claims slightly lower than last week’s number which was 341,000 claims. Last week was actually revised higher from 338,000 claims to 341,000 claims. Jobless claims still remain high in the 300s which will make for a slow labor market recovery if the number doesn’t come down. The big report next Friday is the December Jobs Report which is expecting 197k jobs created. If this number hits or come out higher we could see mortgage rates spike higher on the continued good economic news because that will give the Feds reason to taper even more at the next meeting.

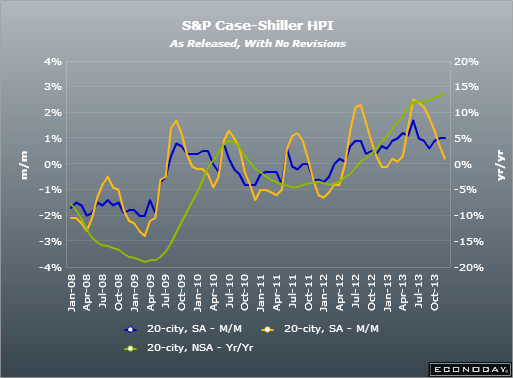

In Housing News, the Case-Schiller Home Price Index for October 2013 was up 13.6% year over year from October 2012. This was a very good number but it is a bit dated as it is from October. The housing market has been slowing a bit since October with increased home prices and with mortgage interest rates rising. Looking forward to 2014 we see home prices continuing to increase but only in the single digits consistent with historical averages.

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, January 18, 2013, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, January 25, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713