Delaware Mortgage Rates Weekly Mortgage Update for July 29, 2013

Delaware mortgage rates weekly market update for the week of July 29, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware mortgage rates ended the week about where they started as the mortgage bond was stopped from moving higher by the long term downward trend line. If you look at the mortgage bond chart below, you can see mortgage bonds still have not been able to break above the falling blue trend line that is moving mortgage bonds lower and Delaware mortgage interest rates higher. The mortgage bond was able to close above the 25 days moving average for 2 days in a row which is great news and hasn’t happened since April 2013. We are recommending FLOATING your Delaware mortgage rate to start the week to see if mortgage bonds can build on the momentum of closing above the 25 days moving average.

Next week brings some very important events that can move the mortgage market. The first big event is the 2 Day Federal Open Market Committee Meeting which starts on Tuesday and will release a monetary statement on Wednesday. The whole world will be watching on Wednesday to see if the statement mentions tapering bond buying program (QE3) or it will remain unchanged into 2014. If tapering is mentioned it could cause bonds to sell off and mortgage interest rates could jump higher, if Feds state QE3 will continue into 2014 unchanged then bonds could jump higher and move home loan interest rates lower. We can float into Wednesday but if you have a good interest rate on Tuesday, you may want to consider locking in your Delaware mortgage rate by end of the day on Tuesday to avoid the chance that home loan rates spike higher on Wednesday after the release of the Fed’s monetary statement. Next week we see some key readings on the US Economy which is the release of the GDP and on Friday the Jobs Report. We think the numbers will not be that good so this could start the Summer Rally in mortgage bonds and we could see interest rates move lower, but if readings are good then bonds will certainly sell off and mortgage rates will jump higher.

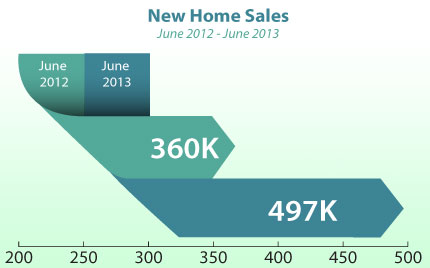

In Housing News, New Home Sales for June 2013 which reported new homes sales surged by 8.3 percent in June 2013 to 497,000 sales. New Home Sales are up a tremendous 38 percent from June 2012! This is the largest annual increase since 1992. This shows New Construction is really taking off as can be seen by the huge increase in the number of new home builder sites in Delaware. Not all the housing news was good as Existing Home Sales came in lower than expected, down 1.2 percent from May to June of 2013

In Economic News, the Weekly Initial Jobless Claims jumped higher by 7,000 claims on Thursday to 343,000 which was also higher than expected. This shows the labor market just keeps see-sawing back and forth week to week and can’t make any meaningful move to better employment. But we did see some good news last week, Consumer Sentiment came in higher than expected at 85.1 which shows consumers are still feeling pretty good about the economy as this is a 6 year high. The Stock Market also set another record high last week so you should see an improvement in the value of your 401k.

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, August 17, 2013, in Newark, Delaware and Tuesday, July 27, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Maryland First Time Home Buyer Seminar is Saturday August 17, 2013 in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713