Delaware Mortgage Rates Weekly Update for June 24, 2013

Delaware mortgage rates weekly market update for the week of June 24, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware mortgage rates once again jumped higher last week which marks the eighth straight week mortgage rates have moved higher since May 1st. If you look at the mortgage bond chart below you can see that mortgage bonds sold off on Wednesday after Ben Bernanke made comments after the Federal Open Market Committee released their meeting minutes. Bernanke’s comments caused stock, bonds, and oil to sell off as he stated the economy was doing better so the Federal Asset purchase program would begin tapering purchasing this year and end it by mid-2014. This was in contrast to what the Federal Reserve has been saying so markets went crazy. Bonds sold off again on Thursday and then again on Friday which moved mortgage rates back to where they were in October 2011. We are recommending cautiously FLOATING your Delaware mortgage rate to start the week as mortgage bonds may seem cheap here and we may get buyers coming back into the market.

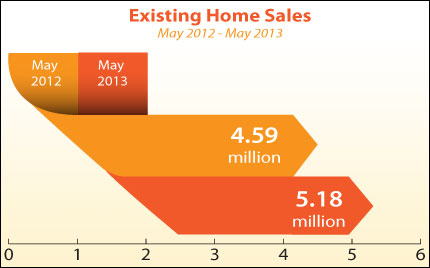

In Housing News we had some more good news as Existing Home Sales rose by 5.18 Million Units for May 2013 which is 12.9% higher than May of 2012 which was 4.59 Million units. We also saw the Housing Starts for May 2013 rose by 7 percent which is up by 28 percent from May of 2012. Housing Starts is a measure of how many new construction builds were started for the month so New Construction is still going strong as the housing market deals with a shortage of inventory of homes for sale.

Thursday we saw the release of weekly initial jobless claims which came in higher at 354,000 which was an increase of 18,000 claims from last week and even higher than expected of 340,000 claims. This again shows that the labor market is limping along and there is no clear trend of improving the labor market. We also saw a report on inflation from the Consumer Price Index which came in at 0.1%, this shows inflation remains tame and the Federal Reserve’s prediction for inflation for 2013 is between 0.8% and 1.2%. This is good news for bonds as high inflation forces bond rates to increase.

Call 302-703-0727 to schedule a free mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Free Delaware First Time Home Buyer Seminar is Saturday, July 20, 2013, in Newark, Delaware and Tuesday, July 27, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Free Maryland First Time Home Buyer Seminar is Saturday, July 20, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713