Delaware Mortgage Rates Weekly Market Update for April 22, 2013

Delaware mortgage rate weekly mortgage market update for the week of April 22, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan.

Delaware mortgage rates remained at all-time record lows last week as mortgage bonds traded in a tight trading range near all-time record highs for the bond. We are recommending LOCKING your Delaware mortgage rate if closing in the next 30 days to start the week as rates are at record lows but bonds could sell off and move rates higher. If closing more than 30 days you can start the week cautiously FLOATING your interest rate but would quickly switch to a locking stance if bond breaks below the 200 days moving average. If you look at the bond chart below you can see that bonds traded in a narrow range and ended the week almost where they started. As long as the bond stays above the 200 day moving average rates will stay where they are but if breaks below the 200 days moving average could have sell off and rates could move higher fast. If you have been waiting to refinance your Delaware mortgage loan, now is the time to do it before rates move higher.

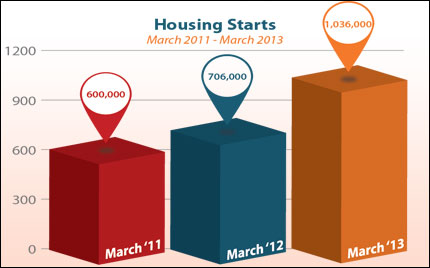

The US Housing Market continues to make a comeback. Housing Starts for March 2013 jumped 7% higher to 1.036 Million units which were way above the expected amount of 930,000. March 2013 Housing Starts were 47% higher than March 2012 and this is the largest rate of housing starts since June 2008. Housing Starts are the number of homes that builders have started building. Building Permits did decline by 4 percent to 902,000 but this was still a good number and overall these reports show the housing market is making a comeback as New Construction is taking off.

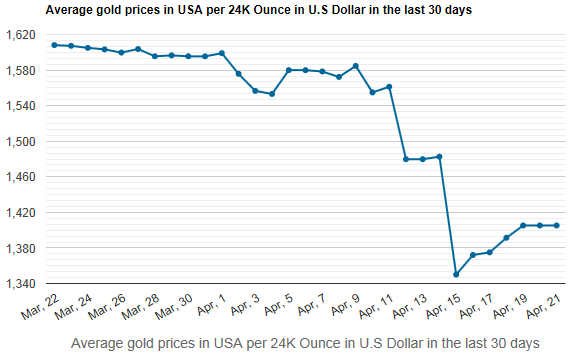

We saw a report from the US Labor Department on inflation from the Consumer Price Index that showed a decline of 0.2% for March 2013 which shows inflation remains very tame and the threat of hyperinflation is at bay. This continued tame readings on inflation may explain why Gold had a huge sell-off on Friday, April 12, 2013, and then another big sell-off on Monday, April 15, 2013. Gold dropped about 13% in two days. The drop in Gold caused Oil prices to drop as well so consumers should be seeing a drop in gas prices at the pump.

Thursday we saw the Weekly Initial Jobless Claims Report show claims increased by 4,000 to 352,000 claims for the week of April 15, 2013. This again shows the US Labor Market is not improving as the jobless claims remain stubbornly high.

U.S. Senators sponsor a bill that will allow the 900 communities that currently qualify for USDA Rural Housing Loans but would not under the 2010 census data to be grandfathered in and still qualify until the 2020 census data is implemented. Since the 2010 census was supposed to take effect, Congress has passed temporary measures to extend the eligible areas, most recently till October 1, 2013. The current guidelines are for communities outside of metropolitan statistical areas with populations below 10,000 are eligible for USDA rural housing loans. Delaware USDA Rural Housing Loans would then be eligible for Middletown and Smyrna until at least 2020.

I am recommending LOCKING your Delaware Mortgage Rate as mortgage bonds are trading at the best levels of the year to take advantage of all time historic low rates. Call 302-703-0727 to schedule a free mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Free Delaware First Time Home Buyer Seminar is Saturday, May 11, 2013, in Newark, Delaware and Tuesday, April 23, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Free Maryland First Time Home Buyer Seminar is Saturday, May 11, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713