Why A Delaware VA Loan?

WHY A DELAWARE VA LOAN?

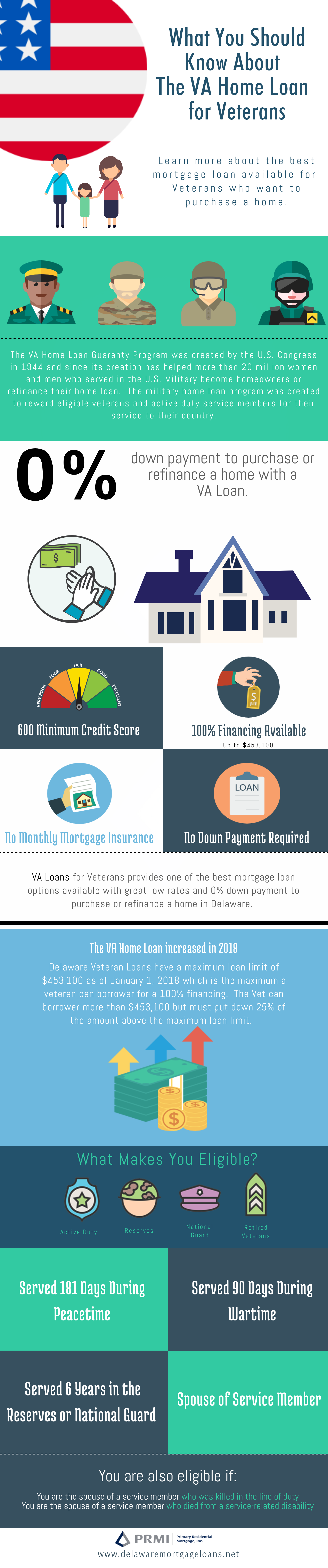

The more you know about our Delaware home loan program for Veterans, the more you will realize how little “red tape” there really is in getting a Delaware VA loan. These loans are often made without any down payment at all which means a veteran can get 100% financing. Aside from the veteran’s certificate of eligibility and the fact that the appraiser is assigned by VA, the application process is not much different than any other type of Delaware mortgage loan. And if the lender is approved for automatic processing and the Lender Appraisal Processing Program (LAPP), as more and more lenders are now, a buyer’s loan can be processed and closed by the lender without waiting for VA’s approval of the credit application or for VA to review the appraisal.Lenders are also able to use VA recognized automated underwriting systems, such as Loan Prospector and Desktop Underwriter, to facilitate the underwriting process. This makes the VA Loan a great program for Delaware First Time Home Buyers who meet the eligibility requirements.

Helping Spouses and Qualifying Family Members Find a Delaware Home

A great aspect of the Delaware VA Loan is the availability for qualifying spouses of Delaware military members who died during active duty or as a result of a service-connected disability. This makes it an invaluable program for the families of fallen military members. To qualify, you must be:

- An un-remarried spouse of a Delaware Veteran who died while in military service or from a service-connected disability

- A spouse of a Service member who is missing in action or a prisoner of war

- A surviving spouse in receipt of Dependency and Indemnity Compensation (DIC) benefits in cases where the Veteran’s death was not service-connected

- Surviving Spouses of certain totally disabled veterans whose disability may not have been the cause of death

If you are a surviving spouse who remarried on or after December 16th, 2003, or who remarried on or after the age of 57, you may still be eligible for the Delaware VA Loan.

(Note: a surviving spouse who remarried before December 16, 2003, and on or after attaining age 57, must have applied no later than December 15, 2004, to establish home loan eligibility. VA must deny applications from surviving spouses who remarried before December 6, 2003, that are received after December 15, 2004.)

Delaware VA Loan Offers Zero Down Payment Option

Delaware VA Loans cater to Veterans who want to purchase a home, first or otherwise, in Delaware. To make the process even easier, Delaware Veterans can qualify for their dream home with 100% financing. This option makes this an even easier process to overcome struggles many home owners face when trying to get together a suitable down payment. This also counts for refinancing your mortgage and can go up to $453,100.

Here’s a quick infographic explaining the most important information on Delaware VA Loans:

How Do I Apply for a Delaware VA Loan?

If you would like to obtain a VA loan in Delaware, Maryland, New Jersey, Virginia or Pennsylvania please feel free to give The John Thomas Team a call at 302-703-0727 and we can walk you thru the whole process.

If you would like to apply for a Delaware Home Loan, you can APPLY ONLINE HERE, or give us a call.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713