Renovation HELOC Loan Program

If you have limited equity in your home and want to renovate, you are forced to either tap into your savings or simply wait. Not Anymore! The John Thomas Team with Primary Residential Mortgage is happy to announce our new Renovation HELOC Loan Program. You can now get a second mortgage to tap into your equity without refinancing your first mortgage. Get started Today! Call us at 302-703-0727 or APPLY ONLINE.

What is a Renovation HELOC Loan?

A Renovation HELOC Loan will boost your borrowing power by calculating the after renovation value (ARV) of our home to determine how much you can borrow. Unlike typical home improvement loans, our Renovation Home Equity Loan is a line of credit that you can borrower against for up to 10 years that does not require refinancing.

Unlike traditional first mortgage renovation loans like a FHA 203k Rehab Loan, the Renovation HELOC Loan does NOT require you to pay off your current first mortgage. So if you have low interest, you can keep it!

What are the Guidelines for the Renovation HELOC Loan Program?

The Renovation HELOC Loan is a home equity line of credit for renovating your property and has the following guidelines:

- Only Eligible for Primary Residence or Second home

- NOT Eligible for Investment Property

- 10 Year Draw Period

- 20 Year Repayment Period

- Minimum Credit Score – 640

- Minimum Loan Amount – $50,000

- Maximum Loan Amount – $500,000

- Up to 150% LTV/CLTV (as is value)

- Up to 95% LTV/CLTV (After Renovation Value)

- No Pre-payment Penalties

- No Early Termination Fees

What Type of Properties are Eligible

The eligible property types for the Renovation HELOC are as follows:

- 1-2 Unit Properties

- ADUs

- PUDs & Townhomes

- Warrantable Condos

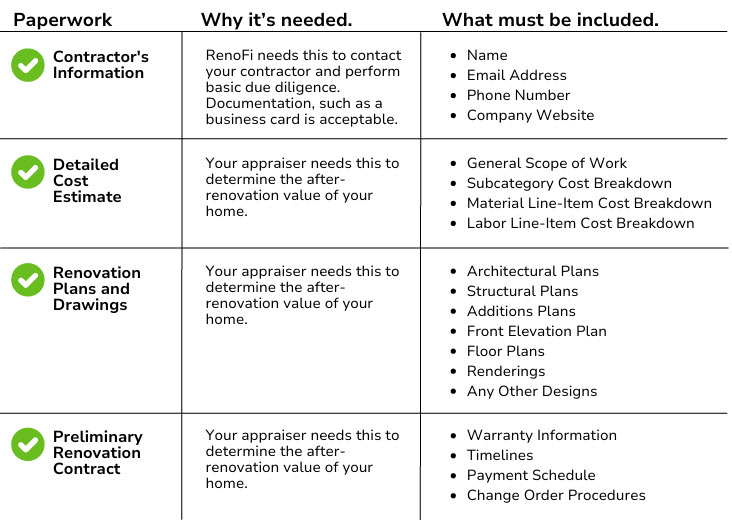

What Paperwork is Required to Get Started Renovating?

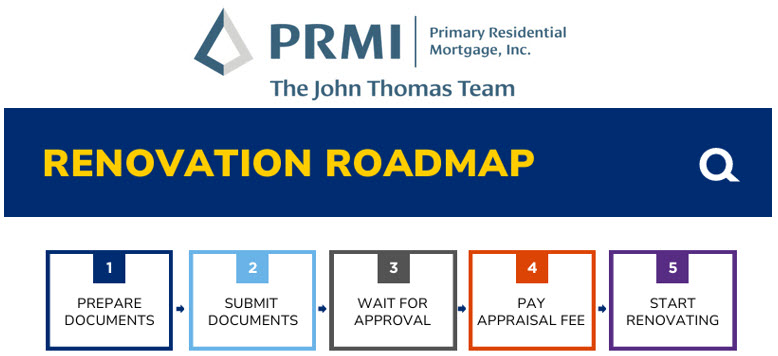

How Do You Apply for a Renovation HELOC Loan?

You can get started today! Give the John Thomas Team a Call at 302-703-0727 or APPLY ONLINE

There are other options to obtain funds to renvote your home. Below are the first mortgage programs available if the HELOC isn’t your best option:

- FHA 203k Rehab Loan

- VA Renovation Loan

- USDA Renovation Loan

- Conventional Renovation Loan