Delaware FHA Loans

Delaware FHA Home Loans are mortgages insured by the Federal Housing Administration – they are easier to qualify for than Conventional Loans with lower rates and underwriting standards. FHA Loans also have lower minimum down payments at 3.5%. While they are much more accessible loans, FHA borrowers must pay for mortgage insurance (MIP) to protect the lender in the event of a default.

Delaware FHA Loans offer 30 year Fixed Rate mortgages which present Delaware first time home buyers and repeat home buyers with affordable low down payment and flexible qualifying options when purchasing a primary residence in Delaware. This is a great loan for borrowers who are working on their credit – Delaware home seekers can qualify with credit scores as low as 500. FHA loans offer great low rates and very flexible qualifying guidelines such as higher debt to income ratios and less restrictive credit guidelines than conventional mortgage loans. Call 302-703-0737 to apply for a Delaware FHA Loan or APPLY ONLINE

Delaware FHA Loans – Overview

FHA is the Federal Housing Administration which is governed by HUD (United States Department of Housing & Urban Development).

It is rare that a home buyer will put down 20% on a home these days. First Time Home Buyers are more likely to go for more affordable low or no down payment mortgages; these mortgages are also popular with repeat buyers. One of the biggest low-down payment mortgage program in Delaware is the FHA loan from the Federal Housing Administration.

In fact, FHA Loans are so popular that around 1 in 5 U.S. buyers uses it to finance a home purchase. Delaware home buyers can make down payments of just 3.5 percent with an FHA Loan. The more relaxed underwriting standards and low mortgage rates (compared to conventional loan rates) make it a great choice. With rates rising, the FHA continues to gain popularity.

Download the PDF Flyer: Delaware_FHA_Loans

What Types of Properties Does The Delaware FHA Loan Allow?

Delaware FHA home buyers are able to purchase almost any home type. FHA will insure the following property types:

- Single Family Residence

- Town House

- 2-4 Unit Properties

- FHA Approved Condos

- Mobile Homes

- Manufactured Homes

This gives you a great variety in your choice of homes when using an FHA Home Loan.

Delaware FHA Loan Rates

There are few mortgage options that allow down payments of 5% or less – the FHA Loan is one of them. Delaware FHA Loans require borrowers to put a minimum of 3.5% down toward the purchase price of the home. This is perfect for borrowers who need to save the funds for emergencies, home repairs, moving costs, and other financial obligations. Borrowers can meet their minimum 3.5% down payment requirement by using grant programs, gift funds, or community second mortgage loans. Delaware FHA Rate-Term Refinance Loans, Delaware FHA Cash-Out Loans, and Delaware FHA Streamline Refinance Loans are available. FHA also offers a special Delaware FHA 203k Rehab Loan for purchasing properties that need repairs and/or upgrades.

Call 302-703-0727 to apply for a FHA Loan or APPLY ONLINE

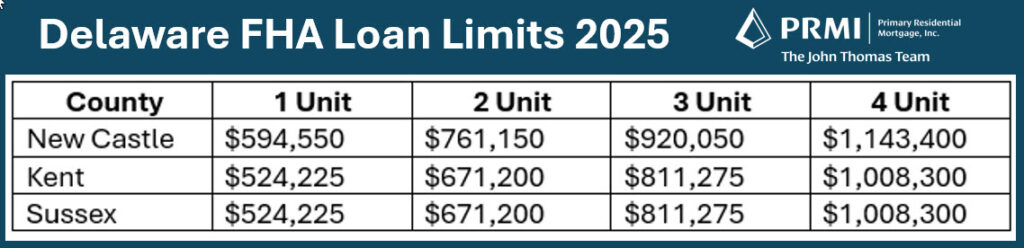

Delaware FHA Loan Limits 2025

FHA Loan Limits for Delaware for 2025

The 2025 loan limits for FHA Loans have been released and are calculated based off the median home price for the county. Each county has a different loan limit based on the median home price for that county. 2025 FHA Loan Limits are as follows;

The loan limits do not include the financing of the upfront mortgage insurance premium. So for someone buying a home in New Castle County, Delaware they could get a maximum loan amount of $556,750 plus the upfront mortgage insurance premium. Look up the FHA Loan Limit for any county or state at the following website: https://entp.hud.gov/idapp/html/hicostlook.cfm

Who Can Qualify for a FHA Home Loan?

Eligible home buyers that can qualify for a FHA Loan recently changed when HUD issued an update.

The U.S. Department of Housing and Urban Development (HUD) has issued Mortgagee Letter 2025-09, revising residency requirements for FHA-insured financing. These changes take effect for FHA case numbers assigned on or after May 25, 2025.

Key Updates:

- Non-Permanent Residents No Longer Eligible: FHA will no longer insure loans for non-permanent residents.

- Permanent Residents: Borrowers must provide documentation proving lawful permanent resident status.

- Citizens of the Federated States of Micronesia, Republic of the Marshall Islands, and Republic of Palau remain eligible under existing guidelines.

Delaware FHA Loans Income Limits for 2025

There are no income limits for FHA loans, you can make as little or as much as you want as long as you meet the Debt-to-income ratios allowable by FHA. The ratios are 31% of your gross income can be used toward your housing expense and 43% of your gross income can be used for your housing plus all your other expenses listed on your credit report. You can push the ratios higher if you have some compensating factors such as good credit or reserve money. The highest housing expense ratio is 46.9% and the highest total debt to income ratio allowed on a FHA loan is 56.9%

Delaware FHA Loans Down Payment Requirements for 2025

FHA loans require you to invest 3.5% in the transaction as of January 1, 2009. This 3.5% must be used toward down payment and not closing costs or pre-paid items. The maximum loan to value for an FHA loan for a purchase in Delaware is 96.50%. If you are using an FHA loan to refinance for a change in rate and term then you can go up to a maximum of 97.75%. If you already have an FHA loan and want to do an FHA Streamline Refinance to change your rate and term, then you don’t need an appraisal but you can’t take any cash out. If you wish to do a cash-out refinance then you are limited to a 85% loan to value. If your credit score is below 580 then FHA requires a 10% down payment on purchase transactions for maximum LTV is 90% on Delaware FHA Loans.

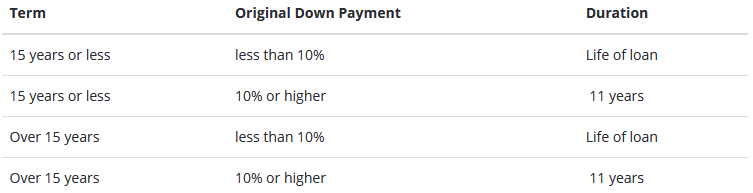

Delaware FHA Loans Mortgage Insurance for 2025

FHA Loans require that the borrower pay an upfront mortgage insurance premium that may be financed into the loan and FHA loans also require a monthly mortgage insurance premium that is part of the monthly mortgage payment. As of March 2023 the upfront mortgage insurance premium on Delaware FHA Loans is 1.75% and the monthly mortgage insurance premium is calculated using a yearly premium amount of 0.55% for loans with 95% or higher loan to value for 30 year FHA mortgages. It is 0.50% on 30 year mortgages with 5% or more down payment.

FHA Mortgage insurance is required to part of the monthly mortgage payment for the full 30 years of a Delaware FHA Loan if less than 10% is put down. If you put at least 10% down on a FHA Loan then you are only required to have the mortgage insurance for 11 years. A unique feature of FHA mortgage insurance is that it does get re-calculated every 12 payments so will go down every year.

For FHA Loans with FHA Case Numbers Assigned on or after June 3, 2013

Borrowers will have to pay FHA mortgage insurance for the entire loan term if the LTV is greater than 90% at the time the loan was originated. If your LTV was 90% or less, the borrower will pay mortgage insurance for the mortgage term or 11 years, whichever occurs first.

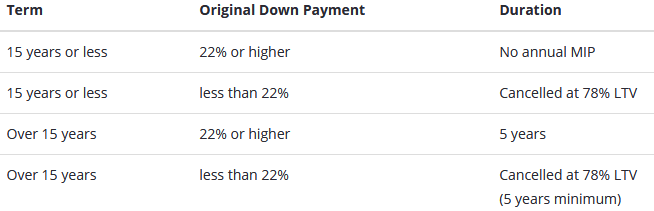

For FHA Loans with FHA Case Numbers Assigned Prior to June 3, 2013

Can I get an FHA Loan with a Credit Score below 620?

While they technically accept credit scores as low as 620, the majority of Fannie Mae and Freddie Mac home loan approvals go to applicants with FICO scores in the 700-749 group. This makes those loans inaccessible and impractical to most First Time Home Buyers and even many repeat home buyers. In fact, the average credit score for completed Fannie Mae and Freddie Mac home purchase loans was 754 according to a recent report.

FHA loans are a better option for borrowers with lower scores. FHA loan requirements allow for very low credit scores. About 37 percent of FHA approvals fell into the 650-699 credit score range according to Ellie Mae. Another 24 percent of applicants had a score between 600 and 649. Credit scores below 620 are eligible with the Delaware FHA Choice Loan. Borrowers who have FICO credit scores between 500 and 620 are traditionally denied for a mortgage loan by most mortgage lenders as these credit scores are below their risk tolerance. The FHA Choice loan is the perfect solution for qualified buyers who may just be suffering from a low credit score.

Officially, the following are credit score minimums for FHA

- 580 or higher for 3.5% down

- 500-579 for 10% down

High credit scores are ideal if you have them. But you don’t have to hold off on homeownership because of bruised credit. applicants with credit mistakes in their past can often purchase a home before they have fully restored their credit. Applicants with no credit scores can also qualify for an FHA loan by building non-traditional credit.

Can I Get an FHA Loan With a High Debt-to-Income Ratio?

FHA loans allow for higher debt-to-income ratios (DTI). Your DTI is calculated by comparing your debt payments and your before-tax income. Fannie Mae and Freddie Mac Conventional mortgage programs allow debt-to-income ratios between 36 and 49 percent.

FHA maximum DTIs are:

- Up to 46.9% of gross income for housing costs

- Up to 56.9% of gross income for housing costs plus other monthly obligations

Delaware FHA Lender

The John Thomas Team with Primary Residential Mortgage is one of the leading Delaware FHA Lenders. John Thomas has been recognized as a Top FHA Mortgage Loan Originator from 2016 through 2022 by the Scotsman Guide. So whether you are looking to purchase or refinance with a FHA Loan in Delaware, John Thomas should be your go to FHA Loan Originator.

If you have questions on FHA Loans or a need a FHA Mortgage Lender, give us a call at 302-703-0727 or you can APPLY ONLINE for Delaware FHA Loan

John R. Thomas

Certified Mortgage Planner – NMLS – 38783

Primary Residential Mortgage, Inc.

248 E Chestnut Hill Rd

Newark, DE 19713

302-703-0727 Office

#DelawareFHALoans

#FHALoans

#DelawareFHALenders

ga(‘create’, ‘UA-17103540-1’, ‘auto’);

ga(‘send’, ‘pageview’);