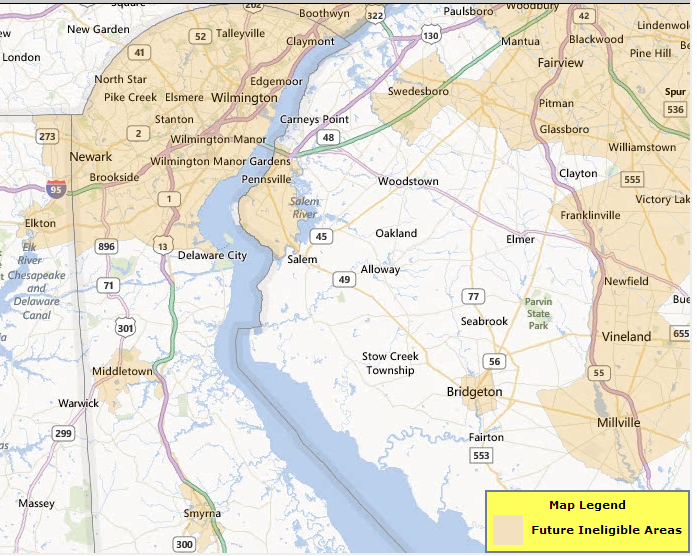

Delaware USDA Rural Housing Loan Income Limits for 2014 remained the same as 2013 for each county in Delaware. The income limits are based on the household income for the total number of people living in the home. If you have questions about USDA Loans for the purchase or refinance of a home, please call 302-703-0727 or you can

APPLY ONLINE.

The income limits for New Castle County, Kent County, and Sussex County are displayed below:

New Castle County Delaware Income Limits for USDA Rural Housing Loans for 2014:

1-4 Person 5-8 Person

Household Household

$0 – $93,450 $0 – $123,354

Kent County Delaware Income Limits for USDA Rural Housing Loans for 2014:

1-4 Person 5-8 Person

Household Household

$0 – $78,200 $0 – $103,224

Sussex County Delaware Income Limits for USDA Rural Housing Loans for 2014:

1-4 Person 5-8 Person

Household Household

$0 – $78,200 $0 – $103,224

Add 8% to the 1-4 person limit for each person above the 8 person limit to get the income limit for households bigger than 8 people. Moderate income is defined as the greater of 115% of the U.S. Median family income or 115% of the average of the state-wide and state non-metro median family incomes or 115/80ths of the area low-income limit.

If you have questions on Delaware USDA Rural Housing Loans or would like to apply for a USDA loan, please call 302-703-0727 or you can APPLY ONLINE.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713