Student Loan Cash Out Refinance

Student Loan Cash Out Refinance, Let your home pay off your student loans. The money you need to graduate from the student debt is right inside of your front door with better rates than a traditional cash-out refinance! You may already know that refinancing your home loan can help net you a lower mortgage interest rate, but what you may not know is it can also get you cash to pay off the balance of your student loans. PRMI’s Student Loan Cash Out Refinance can put an end to your student loan payments and get you better terms for your mortgage payments, all in one easy transaction. Get started today by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

What are the Program Guidelines for a Student Loan Cash Out Refinance?

The Program is available with a Fannie Mae Conventional Loan on your current primary residence. In order to qualify you must meet the following guidelines:

- Must have minimum 620 Credit Score

- Primary Residence Refinance Only

- Maximum Loan to Value is 80% LTV

- Must have owned your home for at least 12 months

- Must pay off at least one student loan in full

- Max cash to borrower at closing is $2,000 or 2% of the loan balance, whichever is less

- Cannot Pay Off any other debt

- Only Available with a Fannie Mae Conventional Loan

By meeting these requirements, you can take advantage of a more affordable way to consolidate your student loans with your mortgage, potentially saving thousands over the life of your loan.

What are the Benefits of the Fannie Mae Student Loan Cash-Out Refinance?

Combining student loans and other debts with your mortgage isn’t a new concept—people have been doing it for years. What’s changed, though, is the cost of doing so when you want to pay off student loan debt.

In the past, debt consolidation through a cash-out refinance often came with high interest rates through what are called loan level price adjustments (LLPAs). However, Fannie Mae has introduced an option that could significantly lower your costs when you use a cash-out refinance specifically to pay off student loan debt. This option allows you to access rates comparable to those offered on no-cash-out refinances.

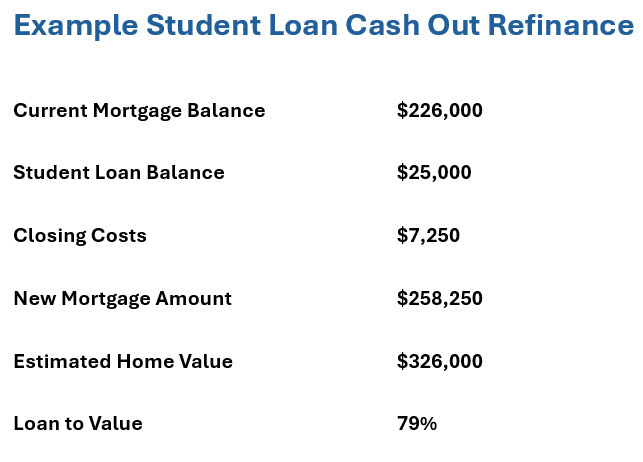

Example Student Loan Cash Out Refinance

Below is an example of how a Cash Out Refinance to pay off student loans might work:

In this example, the borrower would qualify because the Loan to Value (LTV) is less than 80% when combining the existing mortgage, closing costs and the student loan.

However, if the client’s student loan was $50,000 instead then the refinance wouldn’t work because the new loan amount would exceed the limit of the 80% maximum LTV.

If the client had two student loans at $25,000 each for a total of $50,000 then the refinance could still work with just paying off one of the student loans for $25,000.

Comparing Standard Cash-Out and Student Loan Cash-Out Refinances: How Much Can You Save?

Fannie Mae’s guidelines include risk-based fees known as Loan Level Price Adjustments (LLPAs). These fees are typically steep for standard cash-out refinances, leading lenders to increase interest rates to cover the costs.

However, when you use the special Fannie Mae cash-out refinance to pay off student loans, the fees are considerably lower. For example, if you have a 700 credit score and an 80% loan-to-value ratio, you could save around $1,375 per $100,000 borrowed compared to a standard cash-out refinance. This difference could lower your interest rate by approximately 0.5% to 1%.

The savings are even more significant for borrowers with lower credit scores. If you have a credit score of 660, you could save up to $2,250 per $100,000 borrowed, resulting in a rate that’s 1% to 1.5% lower than a standard cash-out refinance.

How do Your Apply for the Student Loan Refinance?

If you are interested in finding out more information or to apply for this Fannie Mae Student Loan Cash Out Refinance then give the John Thomas Team with Primary Residential Mortgage a call at 302-703-0727 or APPLY ONLINE.