PRMI Home Sense Buy Before Your Sell Program

Buy Before You Sell: How the PRMI Home Sense Program Lets You Buy a New Home Without Carrying Two Mortgages

PRMI Home Sense Buy Before Your Sell Program allows home buyers that have a home to sell to purchase BEFORE they sell their current home WITHOUT having to qualify to carry both mortgages. Home Sense allows you to buy before you sell with greater certainty, competitiveness, and convenience throughout the home buying and selling journey. The program has two parts; a Guaranteed Offer to purchase your current home and a Bridge Loan to access your equity to purchase your new home. Get the convenience to move on your schedule, streamlining the transition between homes without slowing you down. Get started today by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

What are the Guidelines for the PRMI Home Sense Program?

The PRMI Home Sense Program will provide a guaranteed purchase offer on your current home to close within 6 months which meets Conventional Loan Guidelines for excluding your current mortgage payment when qualifying for purchasing a new home. The second part of the program provides a Bridge Loan to pay off your existing loan and to tap the equity in your current home to put down on the purchase of your new home. Below are the guidelines:

- Making a Non-Contingent Offer to purchase a new home

- Remove the Home Sale Contingency with PRMI Home Sense Purchase Guarantee

- Down Payment up to 100% of the purchase price of your new home from Bridge Loan

- Can Cover Closing Costs on the new purchase home loan

- Up to $35,000 for home prep to get the most out of your listing

- 6 months (interest-free) mortgage payments on existing home

- Can use Bridge Loan to pay moving expenses up to $5,000.

- Home Sense Contract Fee is 2.25% of the departing property’s estimated value

- Work with your preferred Agent to Sell your Current home and to purchase your new home

If you don’t qualify for the Buy Before Your Sell Program or don’t want to pay the fee, are there other options for a bridge loan? Yes you can look into our Bridge Loan HELOC as alternate option but you will have to qualify carrying both mortgages.

What are the Departing Property Eligibility Requirements?

The following is a list of the requirements for the property you are selling to qualify for the Buy Before Your Seller Program and allow you to remove a home sale contingency on any offers you make to purchase a new home:

- Single Family Residence, Town home or Condo

- Home Conditioned Verified

- Listed within 45 Days of Closing on the New Purchase

- Property cannot be part of an active bankruptcy filing

- Fair Market Value of Property < $1,5000,000

- Departing Home Value at least $150,000

What are the Ineligible Property Types?

The following departing residence property types are NOT eligible for the Home Sense Buy Before Your Sell Program:

- Mobile Homes

- Land Only

- Manufactured Homes

- Multi-Family Residences

- 10+ Acres

- Commercial Property

- Occupied Rental Properties

- Deed Restricted Properties (ex. 55+ Communities)

What is the Cost of the Home Sense Buy Before You Sell Program?

There is a cost to using the PRMI Home Sense Buy Before Your Sell Program. The cost of the program is a 2.25% Contract Fee that is paid out of the bridge loan funds at closing on the new home. Below is an example calculation of the Contract Fee to use the Home Sense Program:

Estimated List Price of Current Home – $500,000

Contract Fee 2.25% – $11,250

That is the only fees to use the program but there are some closing costs on the Bridge Loan. The Bridge Loan is 0% interest and estimated closing costs on Bridge Loan is about $1,850 but varies by state.

How is Guaranteed Purchase Offer Amount Determined?

The Guaranteed Purchase Offer will be 80% of the estimated sale price. So if List price is $500,000 then the maximum guaranteed offer will be $400,000. The home seller has 6 months to list and the sell the home before would be required to execute on the guaranteed offer. Most customer’s homes are on the the market in less than 90 days and the average sale to list price ratio over the last 3 years is >100%.

The Purchase Guarantee “untethers” buyers from their current home and mortgage, but unlike the industry norm, our shared goal is to help get the highest price on the open market.

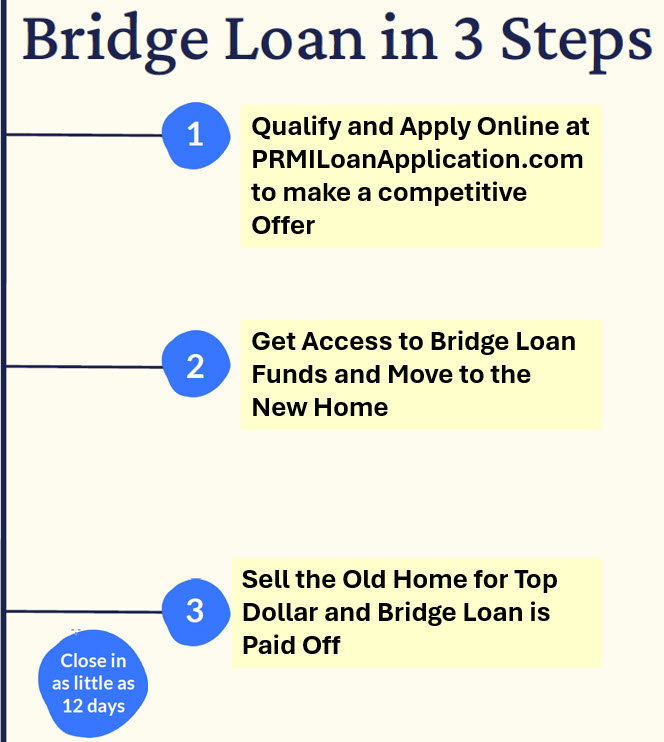

How Does the Home Sense Bridge Loan Work?

The Home Sense Bridge Loan are provided at the closing on the New Home Purchase. The money from the Bridge Loan Can Be Used for the Following:

- Access Up to $1,000,000 in Equity

- Can Be Used for Down Payment & Closing Costs

- Secured & Unsecured Debt Payoff

- Home Prep Up to $35,000 on Current Home

- Moving Expenses Up to $5,000

- Payment of Departing Residence Mortgage Payment for up to 6 Month at 0% Interest

The Bridge Loan Qualifications are as follows:

- Credit Score 620+

- Down Payment up to 100% of the purchase price of the new home

- Primary Residence to Primary Residence Purchase Only

- Maximum List Price $1.5 Million in Most Markets

Bridge Loan Pays Off Existing Mortgage – Eliminates the Payment

Departing Property Mortgage Payoff

PRMI HomeSense will now pay off the existing mortgage, allowing you to eliminate PITI from DTI calculations. This update makes the process faster, easier, and eligible for more programs.

What this means for you:

- Save more with no double payments – clients save months of mortgage payments and interest

- Qualify for your next home with more purchasing power and a stronger, non-contingent offer

- Currently, there are no additional fees for this benefit – still the same fair, fixed costs

Give yourself the freedom, confidence, and ease to move forward now instead of waiting.

What Type of Mortgage Loans Can You Use for the Purchase of Your New Home?

Most Buy Before Your Sell Programs limit you to only a Conventional Loan for the purchase of your new home because they only provide a guarantee offer to purchase your current home. Conventional is the only loan type that will allow you to exclude the current mortgage payment with a Guarantee Offer. The PRMI Home Sense Buy Before Your Sell, you can use any loan program to purchase your new home because our Bridge Loan pays off your existing mortgage and has no payments and no interest so the mortgage payment no longer exists.

We only have to count the following in your debt to income ratios for qualifying for the new loan to purchase the new home for all loan types except conventional:

- Property Taxes

- Homeowners insurance

- HOA Fees

PRMI will provide the following loans types for the purchase of the new home with their Home Sense Buy Before Your Sell Program:

- Conventional Loans

- FHA Loans

- VA Loans

- Renovation Loans

- Non-QM Loans

How Do You Apply for the PRMI Home Sense Program?

If you are interested in removing your home sale contingency and accessing the equity in your current home with a Bridge Loan, then the PRMI Home Sense Buy Before You Sell Program is the perfect solution. You can get started by calling the John Thomas Team with Primary Residential Mortgage at 302-703-0727 or APPLY ONLINE.

Frequently Asked Questions: PRMI Home Sense Buy Before You Sell Program

1) What is the PRMI Home Sense Buy Before You Sell Program?

It lets qualified homeowners purchase their next home before selling their current one. Through a guaranteed purchase offer and a zero-interest bridge loan, you can unlock equity from your current home for the down payment and closing costs—without carrying two mortgages.

2) How does the guaranteed purchase offer work?

You receive a written offer to purchase your current home—typically up to 80% of its estimated market value—so you can close on the new home without a sale contingency. You’ll have up to six months to list and sell on the open market. If it sells for more, you keep the difference; if it doesn’t sell, PRMI’s partner purchases it at the guaranteed amount.

3) Who qualifies for this program?

- Minimum credit score generally 620+ (some loan types may require 660)

- Primary residence purchase only

- Departing home listed within 45 days of closing on the new home

- Sufficient equity (often ~20%+)

Your PRMI loan officer John Thomas will confirm eligibility during pre-approval.

4) What are the costs or fees?

There’s typically a 2.25% contract fee based on your current home’s value, plus normal bridge-loan closing costs. The bridge loan carries no monthly interest payment. Fees are collected at settlement. Terms can vary; your loan officer John Thomas will review specifics.

5) How is the guaranteed offer amount determined?

An independent evaluator estimates market value using recent comparable sales and local trends. The guaranteed purchase offer is then based on up to 80% of that estimate.

6) What if my home doesn’t sell within six months?

If the home hasn’t sold by the end of the window, PRMI’s partner purchases it for the guaranteed amount—so you’re not stuck paying two mortgages.

7) Can I still make improvements or list higher?

Yes. You control your listing strategy and agent choice. You can make updates and list at any price. If it sells for more than the guaranteed amount, you keep the upside (minus program fees and normal selling costs).

8) Does the bridge loan affect qualifying for the new mortgage?

For many loan types, the bridge-loan balance and existing mortgage payoff are excluded from your debt-to-income ratio for the new purchase. Typically, only taxes, insurance, and HOA dues on the departing home are counted. Your loan officer John Thomas will calculate this during pre-approval.

9) What if I decide not to move forward?

Before you sign the program agreement, you can walk away with no penalty. After you sign, the contract fee becomes binding and the evaluation process begins. Review all terms with your loan officer before proceeding.

10) Is the program available outside Delaware?

Availability varies by state and market. The John Thomas Team primarily offers the program in Delaware and nearby areas. Ask your loan officer to confirm eligibility for your location.