MacGray Matter – Financial News Update – July 5, 2010

MacGray Matter – July 5, 2010

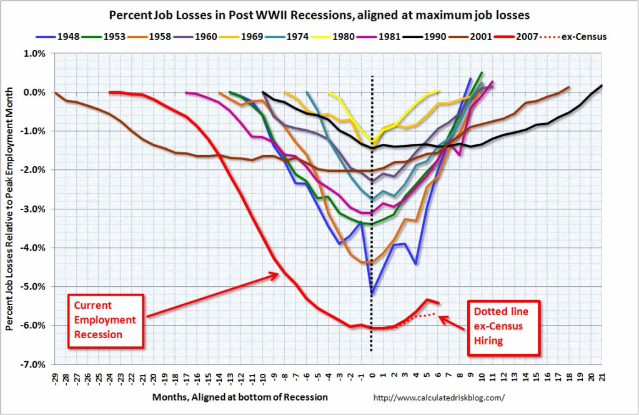

UNEMPLOYMENT NUMBERS ADD TO A NEGATIVE WEEK: On Friday, the Department of Labor reported that non-farm payrolls dropped by 125,000 jobs due largely to the Census Bureau laying off 225,000 temporary workers.

Private sector job growth was positive by 83,000 jobs, but that was less than “expected” and not near enough to make up for the loss of government jobs. Manufacturing jobs fell by 8,000 after a three-month positive streak. I continue to find this particular graph found on calculatedrisk.com (and used with permission) to be a key one to follow: