DSHA Home Sweet Home DPA Program

DSHA Home Sweet Home Down Payment Assistance Program provides $12,000 toward down payment and closing costs to eligible home buyers purchasing in Delaware and was just refunded January 30, 2024. If you are a Delaware home buyer then you don’t want to miss out on your chance to get from the State of Delaware to help you purchase your home. You don’t even have to be a Delaware First Time Home Buyer, you can be a repeat home buyer. Find out if you qualify by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

What are the Guidelines for the DSHA Home Sweet Home Program?

This Delaware down payment assistance program requires home buyers to meet certain eligibility requirements. You must be purchasing a home in Delaware and MUST use an DSHA approved Mortgage Lender for your first mortgage. The first mortgage loan MUST be the DSHA Smart Start Mortgage Loan which is either a FHA Loan, VA Loan, USDA Loan, or Conventional Loan. Below are the Guidelines for being eligible for the DSHA Home Sweet Home DPA:

- Can Be a Delaware First Time Home Buyer or Repeat Home Buyer

- Must purchase the property as your Primary Residence

- All Borrowers MUST have a Minimum 620 or Higher Middle Credit Score

- Maximum Purchase Price is $285,000 or Less

- $12,000 Forgivable Second Mortgage Loan at 0% Interest

- Second Mortgage is Forgiven after 10 years.

- Must Use DSHA Smart Start Home Loan Program as First Mortgage from DSHA Approved Lender

- Available in New Castle County, Kent County & Sussex County

- Must be under the Household Income Limit Based on County & Household Size

- Must Take 8 Hours of HUD Approved Home Buyer Counseling If Credit Score Less than 660

- Can be Combined with the Delaware Mortgage Credit Certificate Program

What are the Eligible Property Types for the Program?

The DSHA Home Sweet Home DPA Program allows borrowers to purchase properties that are on the eligible list. The following are eligible property types for the program:

- Single Family Residence

- Townhomes / Row Homes

- Warrantable Condos

- Planned Unit Developments (PUDs)

- Manufactured Homes that Meet guidelines (660 Minimum Credit Score)

- 1-4 Unit Properties as Long as will live in 1 Unit

Properties that are NOT eligible for the DSHA down payment assistance program:

- Rental Properties

- Second Homes

- Coops

- Non-Warrantable Condos

- Investment Properties

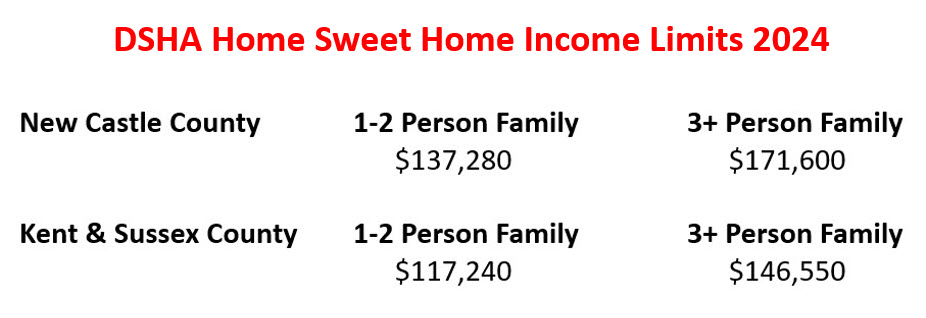

What are the Income Restrictions for the Home Sweet Home DPA?

In order to be eligible for the DSHA Home Sweet Home Down Payment Assistance, you must be under the Income Limits based on which county your are purchasing a home and the number of people in your household. The Income Restrictions for 2024 are as follows:

How is the $12,000 Forgivable Mortgage Loan Paid Back?

The Home Sweet Home Forgivable Second Mortgage Loan is only forgiven if you occupy the property as your primary residence for at least 10 years. Each year you live in the property the amount owed goes down by 10%. Below is chart to showing how much still owed after each year:

If you refinance or sell the property in less than 10 years then you must pay back the amount still owed. For example if you want to refinance after 2 years then you would have to pay off $9,600 in order to refinance. After 10 Years borrower will be required to show proof have lived in the property in order for the loan to be forgiven. Must provide Driver’s License or Utility Bill with the address to show proof of residency.

How do I Apply for the DSHA Home Sweet Home DPA Program?

Applying for the Down Payment Payment Assistance Program must be done through a DSHA approved Lender such as the John Thomas Team with Primary Residential Mortgage. You can give us a call at 302-703-0727 or you can APPLY ONLINE.