Delaware VA Loan Limits 2020

Delaware VA Loan Limits for 2020 depend on whether a qualified Delaware Veteran has full entitlement or not. Veterans with full entitlement have no loan limits in Delaware or any other state for a Delaware VA Loan. The maximum VA loan limit was eliminated with the Blue Water Navy Vietnam Veterans Act of 2019. If a Veteran has reduced entitlement then the VA Loan Limit will be the same as the Federal Housing Finance Agency (FHFA) conforming loan limit for the county. If you are a Delaware Veteran and want to find out the maximum VA loan you qualify for, give us a call at 302-703-0727 or get started online at APPLY ONLINE

What are Delaware VA Loan Limits 2020 for Reduced Entitlement?

Delaware Veterans who have a reduced entitlement will have a maximum loan limit for 100% financing of $510,400 in all three counties of Delaware.

New Castle County – $510,400

Kent County – $510,400

Sussex County – $510,400

Veterans with reduced entitlement because of an existing VA Loan must use the VA remaining entitlement calculation to determine the maximum loan amount for 100% financing. Veterans with reduced entitlement can purchase a home in Delaware for more than $510,400. The Veteran must just put down 25% of the difference between their maximum loan amount and the purchase price.

How much Does a Veteran Have to Put Down Above Maximum Loan Limit?

A Delaware Veteran with reduced entitlement can purchase a home for more than the 2020 VA Loan Limit for Reduced entitlement of $510,400. The veteran must just put down 25% of the difference. Below is example calculation:

Purchase Price – $550,000

Maximum Loan Amount for 100% – $510,400

Difference – $39,600

Required Down Payment – $9,900

Delaware VA Loan Amount – $540,100

In this same scenario a Delaware Veteran that has full entitlement would have no loan limit for 100% financing so would be able to have the following:

Purchase Price – $550,000

Delaware VA Loan Amount – $550,000

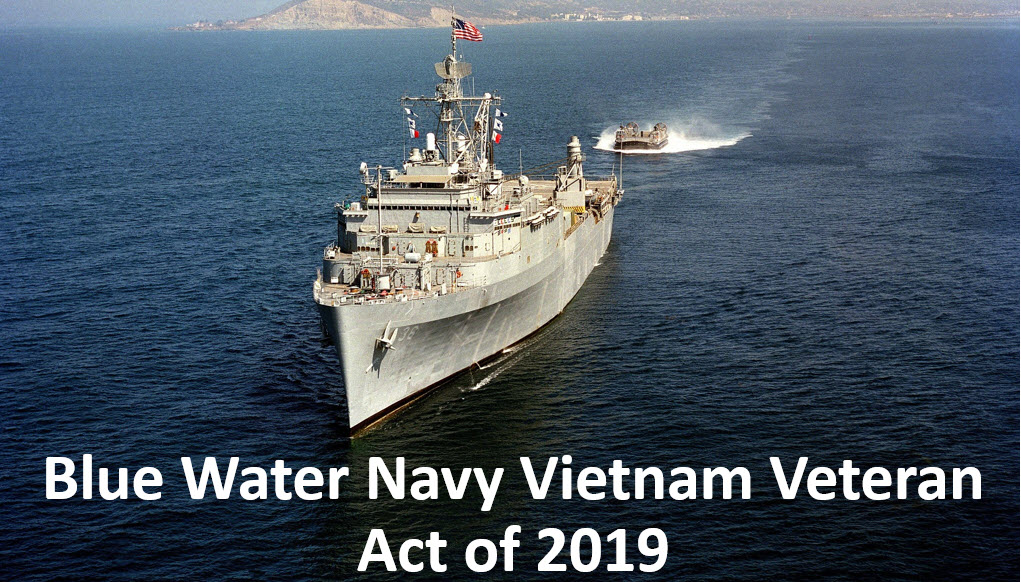

What is the Blue Water Navy Vietnam Veterans Act of 2019?

The Blue Water Navy (BWN) Vietnam Veterans Act of 2019 extended the presumption of herbicide exposure, such as Agent Orange, to Veterans who served in the offshore waters of the Republic of Vietnam between Jan. 9, 1962 and May 7, 1975.

The BWN took effect January 1, 2020. The Act also included a change in the maximum VA Loan Limit and the VA Funding Fee. The BWN also made several changes to the VA home loan program. The changes are as follows:

- VA-guaranteed home loans will no longer be limited to the Federal Housing Finance Agency (Federally-established) Confirming Loan Limits. Veterans will now be able to obtain a no-down payment home loan in all areas, regardless of loan amount.

- VA removed the loan limit for Native American Veterans seeking to build or purchase a home on Federal Trust Land.

- The law exempts Purple Heart recipients currently serving on active duty from the VA Home Loan funding fee.

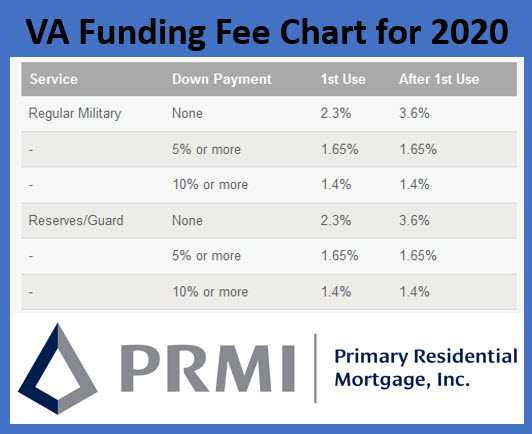

- At this time, there is a temporary change to the VA Funding Fee. Veterans and service members will see a slight increase of 0.15 to 0.30% in their funding fee (currently for two years), while National Guard and Reserve members will see a slight decrease in their fee to align with the fee paid by ‘Regular Military’ borrowers (permanent). Veterans with service-connected disabilities, some surviving spouses, and other potential borrowers are exempt from the VA loan funding fee and will not be impacted by this change.

How Do You Apply for a Delaware VA Loan?

If you are a veteran looking to purchase or a refinance a home in Delaware, the first step is to get your Certificate of Eligibility (COE) from the Department of Veteran Affairs. The COE determines whether a veteran has full entitlement or partial entitlement which allows the VA Lender to calculate the maximum Delaware VA loan amount.

You can apply for a Delaware VA Home Loan by calling John Thomas at 302-703-0727 or APPLY ONLINE