Delaware Mortgage Rates Weekly Update for April 7, 2014

Delaware Mortgage Rates weekly market update for the Week of April 7, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates moved lower last week after the Jobs Report was released on Friday. Looking at the mortgage bond chart below you can see bonds rallied on Friday with the big upward candle. Now that the Jobs Report is behind us and stocks sold off, bonds were able to rally. We are recommending FLOATING your Delaware Mortgage Rate to see the bond rally can continue but be careful as there is a tough overhead resistance to the bond so it could be turned lower and move interest rates higher.

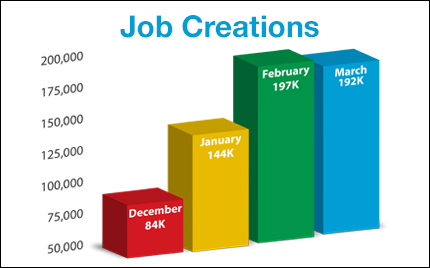

The Jobs Report for March 2014 was released on Friday and showed that 192,000 jobs were created in March. The unemployment rate ticked up from 6.6% to 6.7%. The Labor Force Participation Rate (LFPR) ticked up slightly from 63% to 63.2%. The LFPR measures the number of people 16 years and older that are working so this number moving up is a good sign.

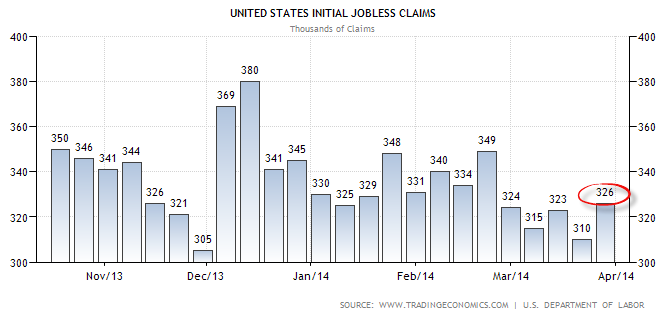

Weekly Initial Jobless Claims came out on Thursday and ticked up 16,000 claims to 323,000 claims. Jobless Claims had been trending lower and now reversed, we will need to see if this is an anomaly or if the trend is starting to move upward again.

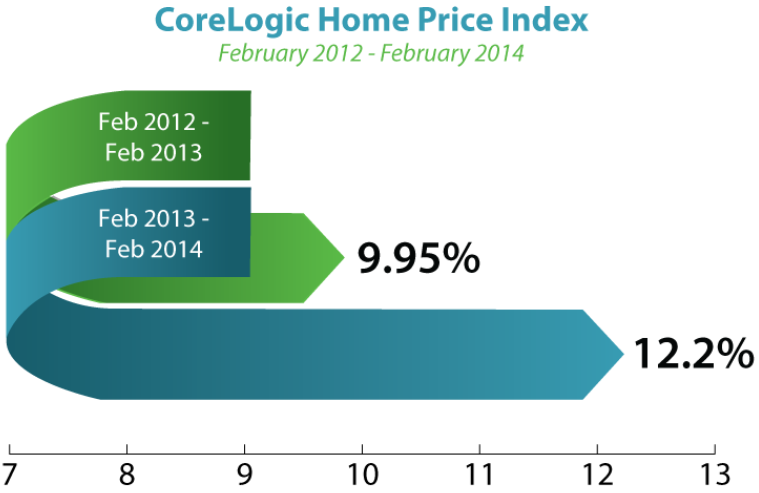

In Housing News, CoreLogic reported that home prices rose by 12.2% from February 2013 to February 2014. This increase in home prices represents 24 months of the year on year increase. However, home prices still remain about 17 percent below the peak in 2006. So still a great time to purchase a home as still a lot of upside to the market.

CoreLogic Reported Foreclosure Inventory is down 35% from a year ago and only 4.9% of mortgages are seriously delinquent. Fewer mortgages in delinquency mean fewer homes will be headed to foreclosure so that is a good sign for the economy and housing.

The Senate is set to hear a bill that would reinstate the Mortgage Debt Forgiveness Act which expired 12/31/2013. The Debt Forgiveness Act helps underwater homeowners when they sell their home or get foreclosed on by allowing the debt to be forgiven and not count as taxable income.

The next Delaware First Time Home Buyer Seminar is Saturday, April 19, 2014, in Newark, Delaware or Dover Delaware Home Buyer Seminar Saturday, April 12, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, April 26, 2014, in Towson, Maryland or Maryland First Time Home Buyer Seminar Saturday, April 12, 2014, in Rockville, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713