Delaware Mortgage Rates Weekly Mortgage Market Update for July 1, 2013

Delaware mortgage rates weekly market update for the week of July 1, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates Finally improved for the first time since the big sell-off in mortgage back securities after Bernanke’s statements on Wednesday, June 19, 2013. Mortgage rates were able to improve after members of the Federal Reserve started backtracking on statements made by Bernanke about tapering QE3 this year. If you look at the mortgage bond chart below you can see the big red candle on June 19th which was the sell-off after Bernanke’s comments. The bond was able to stabilize on Monday and Tuesday and then jumped higher on Wednesday and Thursday after lower than expected first quarter 2013 GDP reading at 1.8%, the expectation was for GDP of 2.4%.

The Federal Reserve talk of tapering its asset purchase program called QE3 has definitely scared the markets but the reality is that tapering the program will take time and there is more to it than just tapering the 85 Billion a month of bond purchases. The Fed is also re-investing another 20 Billion a month from principal payments from its current holdings of agency debt and mortgage-backed securities back into new bond purchases. So it will be years before Feds can stop their accommodative policies because the following has to happen:

- $85 Billion in monthly purchases being wound down to zero

- Fed stops reinvesting the principle from the portfolio

- Fed starts raising the Fed Fund Rate

- Fed Actually starts selling holdings (Fed has already said could never sell and hold to maturity)

In housing News, NAR (National Association of Realtors) stated pending home sales were up 6.7% in May of 2013 and were up 12.1% from a year ago. The Case-Shiller home price index was also up 12.1% from a year ago. We also saw home prices increase by 2.5% from March 2013 to April 2013. Home prices going up is going to create an affordability problem as incomes are only going up 2% while home prices are going up 12%. So with interest rates and home prices going up, affordability goes down. So if you are thinking of purchasing a home, now is the time to do it.

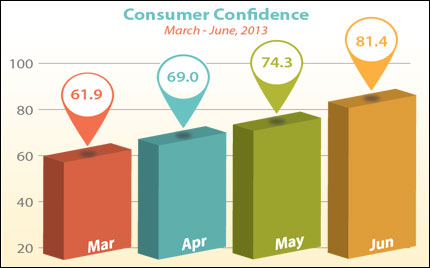

In economic news, we saw the release of Consumer Confidence reading for June 2013 and it came in better than expected at 81.4 which is the highest level since January 2008. Consumer confidence measures how optimistic or pessimistic consumers are about the economy.

Thursday we saw weekly initial jobless claims come in lower by 9k at 346,000 which is close to the 350,000 claim range the weekly reports have been stuck at. The markets didn’t react to the report.

Call 302-703-0727 to schedule a free mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Free Delaware First Time Home Buyer Seminar is Saturday, July 20, 2013, in Newark, Delaware, and Tuesday, July 27, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Free Maryland First Time Home Buyer Seminar is Saturday, July 20, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713