Cost of Waiting to Purchase a Home

Cost of Waiting to Purchase a Home

If you are thinking of waiting to purchase a home, think again! There is a definite cost of waiting to purchase a home. Home ownership has significant financial benefits but there is still a significant number of renters and people living with family that are delaying investing in one of the biggest sources of long term wealth. With mortgage interest rates and home prices expected to continue to increase, waiting to purchase a home is definitely going to cost more money and even more than most would think. If you are interested in getting started right away on getting pre-approved for a mortgage, call us at 302-703-0727 or APPLY ONLINE

How Much is the Cost of Waiting to Purchase a Home?

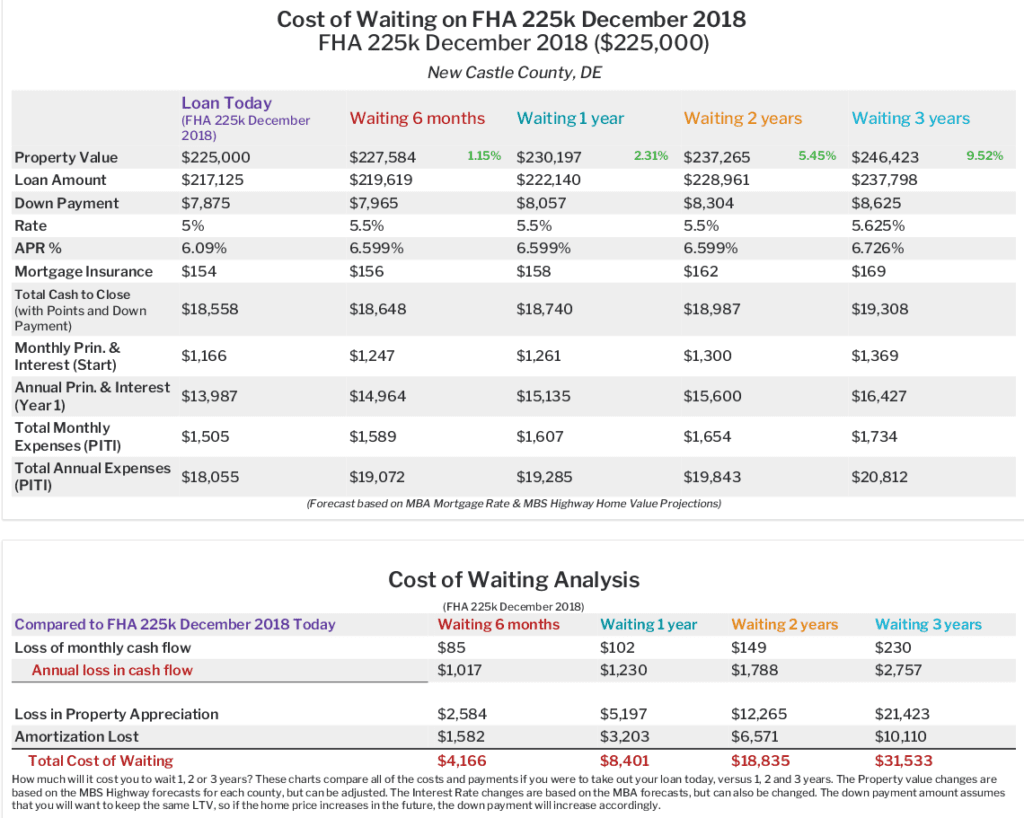

In order to calculate how much the cost of waiting is to purchase a home, we need to look at an example. Below is an example of someone who could theoretically purchase a home today using a FHA loan for the following information:

Purchase Price – $225,000

Loan Type – FHA 30 Year Fixed

Required Down Payment – 3.5% = $7,875

Interest Rate – 5.0% (APR – 6.09%)

Annual Appreciation Rate – 2.31% project for 1st year

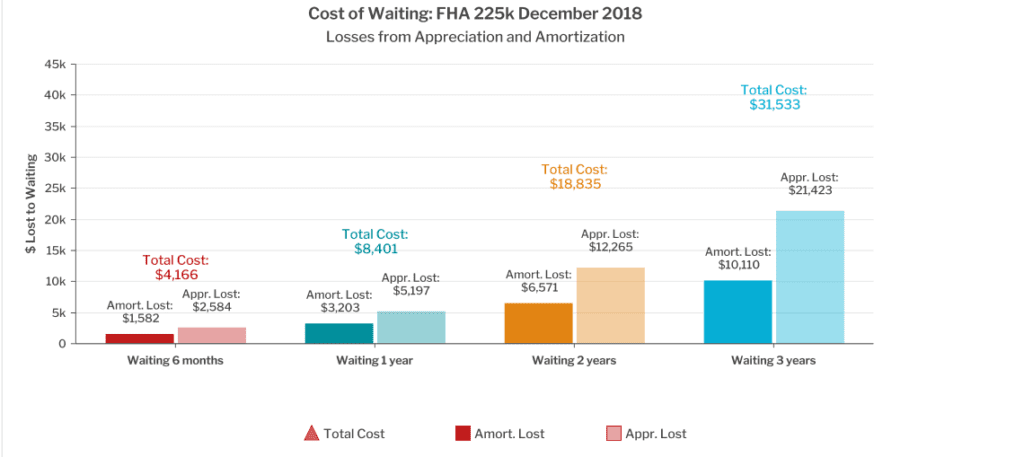

If they wait just 6 months there is a cost of waiting of $4,166 between the increase in mortgage payment and home price appreciation of the home. The chart below demonstrates the cost of waiting to purchase for 6 months, 1 year, 2 years, and 3 years based on an annual appreciation rate for New Castle County, Delaware.

You can clearly see that waiting 3 years could cost you $31,533 between increased mortgage payment and lost appreciation on the home. Waiting even longer only costs you more and more each year that you wait. So stop renting and start owning today. If you need a plan, then sign up for the next Home Buyer Seminar

Whose Mortgage Do You Want to Pay?

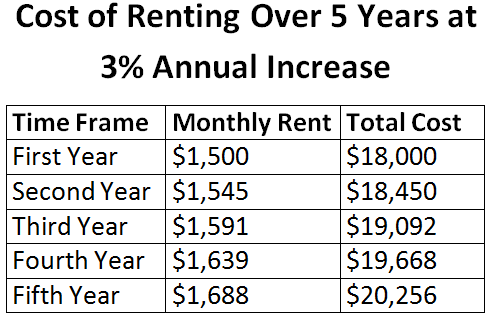

The real question is not whether you want to make a mortgage payment or not, it is Whose mortgage payment do you want to make, yours or your landlord’s mortgage payment? There is another cost to waiting to purchase the home, it is the amount of rent you are paying until your purchase the home which is essentially how many checks do you want to write toward your landlord’s mortgage before you pay your own mortgage. Lets assume you are currently renting a home for $1,500 per month in Rent. If you wait 6 months to purchase a home, you will have spent $9000 on rent that didn’t go toward your own mortgage payment or your own equity on your home. The table below shows you what it costs you to wait in the rent you pay each year:

Renting for five years costs you a total of $95,466!! You have nothing to show for this as you don’t own anything, you received no asset appreciation, no tax deductions, basically nothing to show for spending almost $100,000.

What Would Be My Total Cost of Waiting Over 3 Years?

If we continue to use our example above of a $200,000 purchase in New Castle County Delaware with a FHA loan, we can show everything that it costs you if you wait. The first tabled showed us there is a cost of $35,912 in lost appreciation and increased mortgage rate. If we add the money spent on rent over three years from the 2nd table above that is $55,542 spent on rent instead of your own mortgage payment. If you were to consider that if you were a first time home buyer and were eligible for the first time home buyer tax credit which would provide $2,000 a year as a federal tax credit then over three years there is a $6,000 tax credit benefit that is lost. There is an initial cost to enroll of about $2,000 so essentially losing $4,000 of tax credit. If we add them all up below you can see the total cost to wait for just 3 years:

Lost Appreciation & Amortization – $31,533

Money Lost on Rent – $55,542

Lost Tax Credit – $4,000

Total Cost of Waiting 3 Years – $91,075

Cost of Waiting – Lost Rate of Return on Your Money

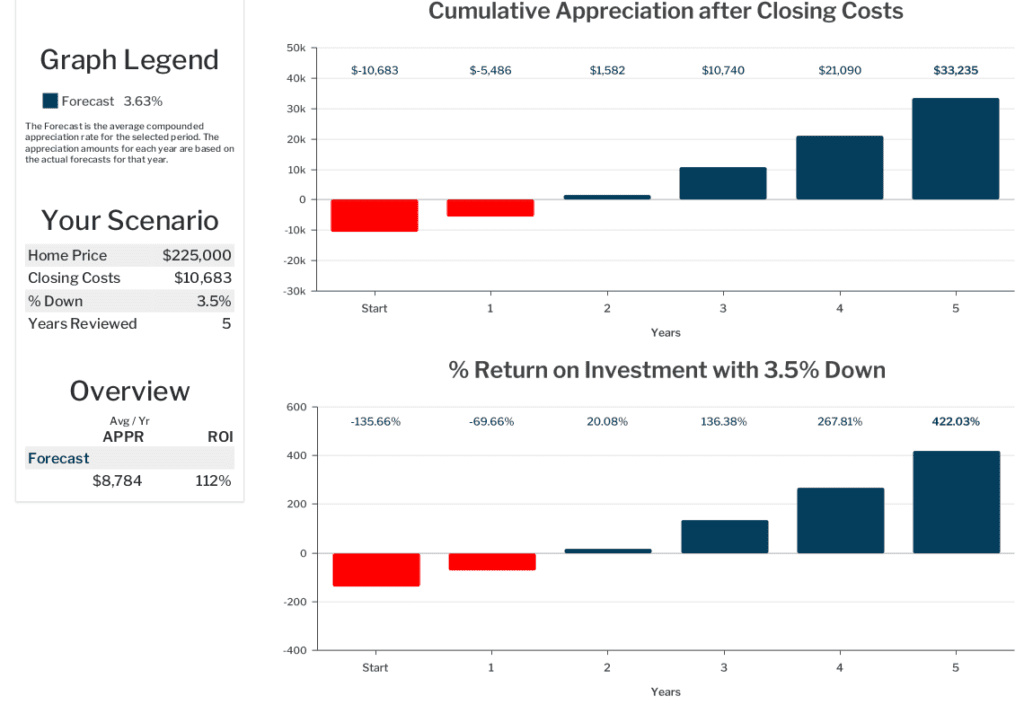

If you wait to invest in purchasing a home you will lose out on the rate of return (ROI) that the money could be returning. When you put as little as 3.5% down plus closing costs on a home you can see below that your rate of return can be enormous just over a 5 year period. Your appreciation minus your closing costs shows that after paying back your closing costs in appreciation, you are still ahead $33,235 after 5 years which is a rate of return of 422%!

Don’t Wait Get Pre-approved for a Mortgage Today and Start Shopping!

Take action and start building long term wealth by investing in your future. Call the John Thomas Team with Primary Residential Mortgage at 302-703-0727 to speak to one of our licensed team members who can get you started on a mortgage pre-approval. You can also get started online at http://www.PRMILoanApplication.com