Conventional Loan Limits 2025

Conventional Loan Limits have increased for 2025 from $766,550 for a 1 Unit Property up to $806,500. This new maximum baseline conforming loan limit is effective January 1, 2025. Conventional Loans are backed by Fannie Mae and Freddie Mac. The announcement was made November 26, 2024 by the Federal Housing Finance Agency (FHFA). Primary Residential Mortgage is taking applications as of 11/26/2024 at the new higher loan limits on conventional loans and not waiting until January 1, 2025. If you would like to apply for a Conventional Loan, give the John Thomas Team a call at 302-703-0727 or APPLY ONLINE.

What are the Conventional Loan Limits 2025?

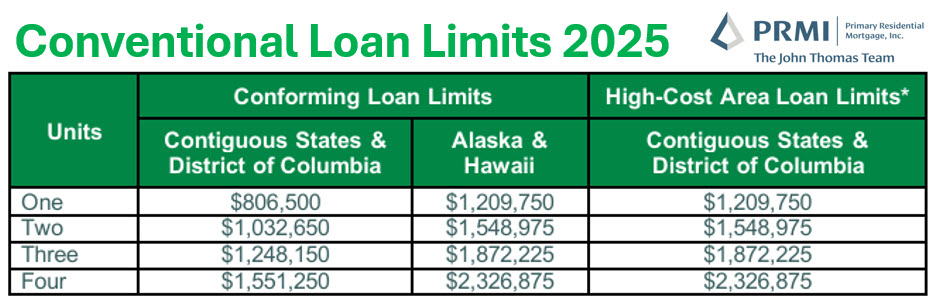

The Conforming Loan Limit for 2025 has increased for all properties in all states. Some counties are located in High Cost Areas which have an even higher loan limit. The Conventional Loan Limit increased 5.2% from 2024. Below is the chart for the Conventional Loan Limits 2025 for one to four units for all areas:

Conforming Loan Limits are adjusted each by the FHFA using a formula that is based on 3rd Quarter Home Price Data for the current year. The 2008 Housing and Economic Recovery Act mandated that the conforming baseline loan limit could only rise after home prices returned to pre-recession levels which they did in 2016. Since 2016, the FHFA has raised the baseline loan limit each year. It is important to note that even if home prices were to fall, the baseline loan limit will not decrease.

Below are the Conventional Loan Limit increases in FHFA’s conforming loan limit for one-unit loans for the lower 48 states since 2016.

- 2016: $417,000

- 2017: $424,100 — 1.7% increase

- 2018: $453,100 — 6.8% increase

- 2019: $484,350 — 6.8% increase

- 2020: $510,400 — 5.3% increase

- 2021: $548,250 — 7.4% increase

- 2022: $647,200 — 18% increase

- 2023: $726,200 — 12.2% increase

- 2024: $766,550 — 5.5% increase

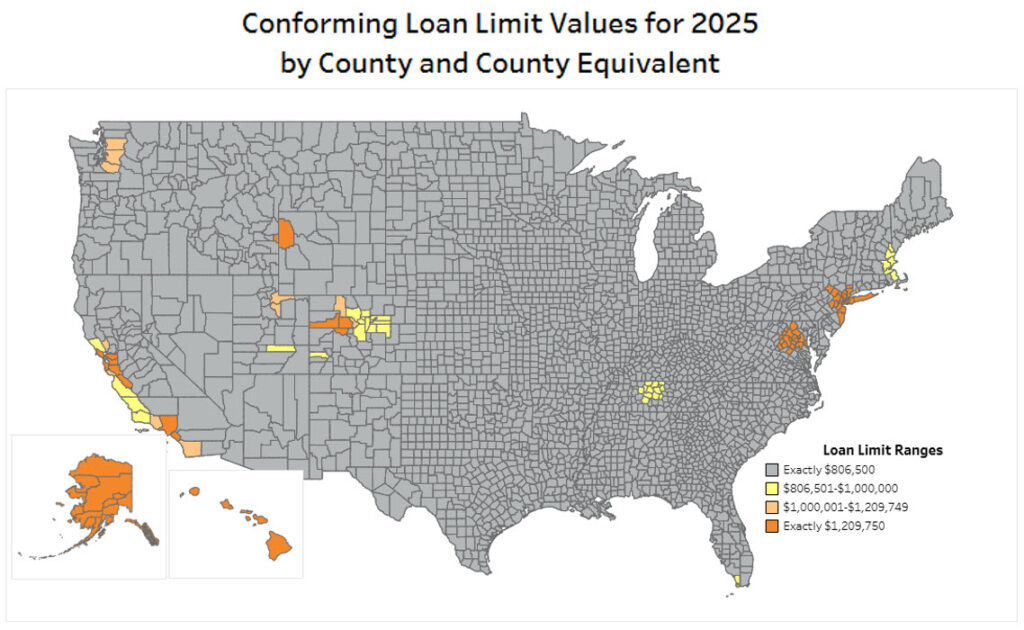

What is a High Cost Area for a Conventional Loan?

High Cost Areas for Conventional Loans are counties in which 115 percent of the local median home value exceeds the baseline conforming loan limit for that given year. The Conforming Loan Limits 2025 will be higher than the conforming baseline loan limit. The Housing and Economic Recovery Act (HERA) requires FHFA to adjust the baseline conforming loan limits each year to reflect the changes in the housing market based on home price appreciation. HERA establishes the high cost area loan limits and sets a ceiling at 150 percent of the baseline loan limit. The new High Cost Area Conventional Loan Limit for 2025 is $1,209,750 which is 150 percent of $806,500 for a 1 Unit Property.

What if You Need a Loan Amount Above the Conventional Loan Limits 2025?

If you are needing a loan for purchase or refinance that exceeds the Conventional Loan Limits 2025 then you would need to get what is termed a Jumbo Loan. Jumbo loans are available when you need to exceed the conforming loan limit with one loan. The other option for financing more than the conventional loan limit is using two mortgages. The first mortgage would be for the conventional loan limit and then you would also get a second mortgage loan for the amount above the conforming loan limit.

Below is an example of when it would be appropriate to use with a jumbo loan or a 1st and 2nd combination:

Purchase Price – $1,200,000

Money for Down Payment – $240,000 (20%)

Total Loan Amount Needed – $960,000

Conventional Loan Limit for County – $806,500

In this scenario your total loan amount needed exceeds the conventional loan limit so you will need to either finance with a Jumbo Loan for $960,000 or you would get a Conventional Mortgage for $806,500 and a second mortgage loan for $153,500.

How Do I Apply for a Conventional Loan?

If you would like to apply for a Conventional Loan to purchase or refinance a home then give the John Thomas Team of Primary Residential Mortgage a call at 302-703-0727 or APPLY ONLINE.