Conventional Loan Limits 2024

Conventional Loan Limits 2024 have increased to $766,550 for a 1 Unit Property. This is a 5.56% increase when compared to the Conventional loan Limit for 2023 of only $726,200. The Conventional High Balance Loan Limit for 2024 also increased and is now $1,149,825. The conventional loan limit is the limit for the maximum amount you can borrower before it becomes a Jumbo Loan. Take advantage of these higher loan limits today by giving the John Thomas Team with Primary Residential Mortgage at 302-703-0727 or APPLY ONLINE.

What are the Conventional Loan Limits 2024?

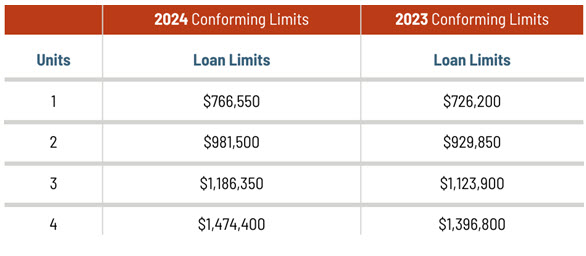

The Federal Housing Finance Agency (FHFA) announced the new Conventional Loan Limits for 2024 have increased for all properties. The Conforming loan limit is the maximum loan amount for a mortgage that Fannie Mae or Freddie Mac will guarantee. The loan limit is adjusted every year by FHFA to reflect changes in the average price of a home in the U.S. Below is a comparison of the new Conforming Loan Limits for 2024 compared to the Conforming Loan Limits for 2023:

What is a High Cost Area for Conventional Loans?

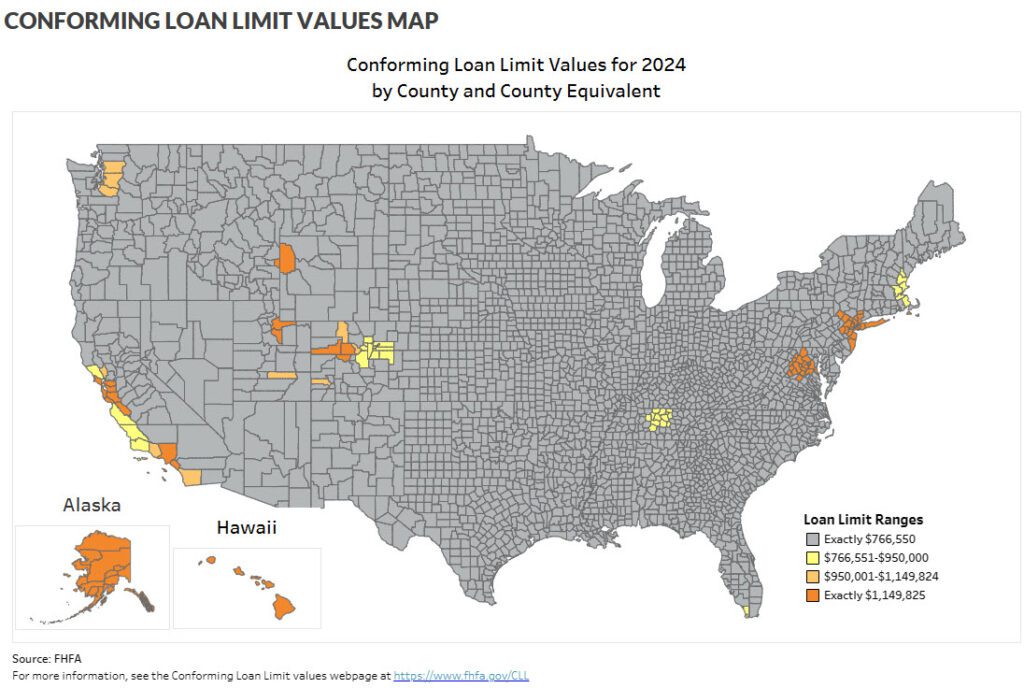

High Cost Areas for Conventional Loans are places in which 115 percent of the local median home value exceeds the baseline conforming loan limit for that given year. The Conventional Loan Limit 2024 will be higher than the conventional baseline loan limit. The Housing and Economic Recovery Act (HERA) requires FHFA to adjust the baseline conforming loan limits each year to reflect the changes in the housing market. HERA establishes the high cost area loan limits and sets a ceiling at 150 percent of the baseline limit. The new High Cost Area Conventional Loan Limit is $1,149,825 which is 150 percent of $766,550.

How Do I Apply for a Conventional Loan?

If you are interested in finding out if you qualify for a Conventional Loan, then get started today by contacting the John Thomas Team at 302-703-0727 or APPLY ONLINE.