What Repairs Can I NOT Do With a FHA 203k Loan?

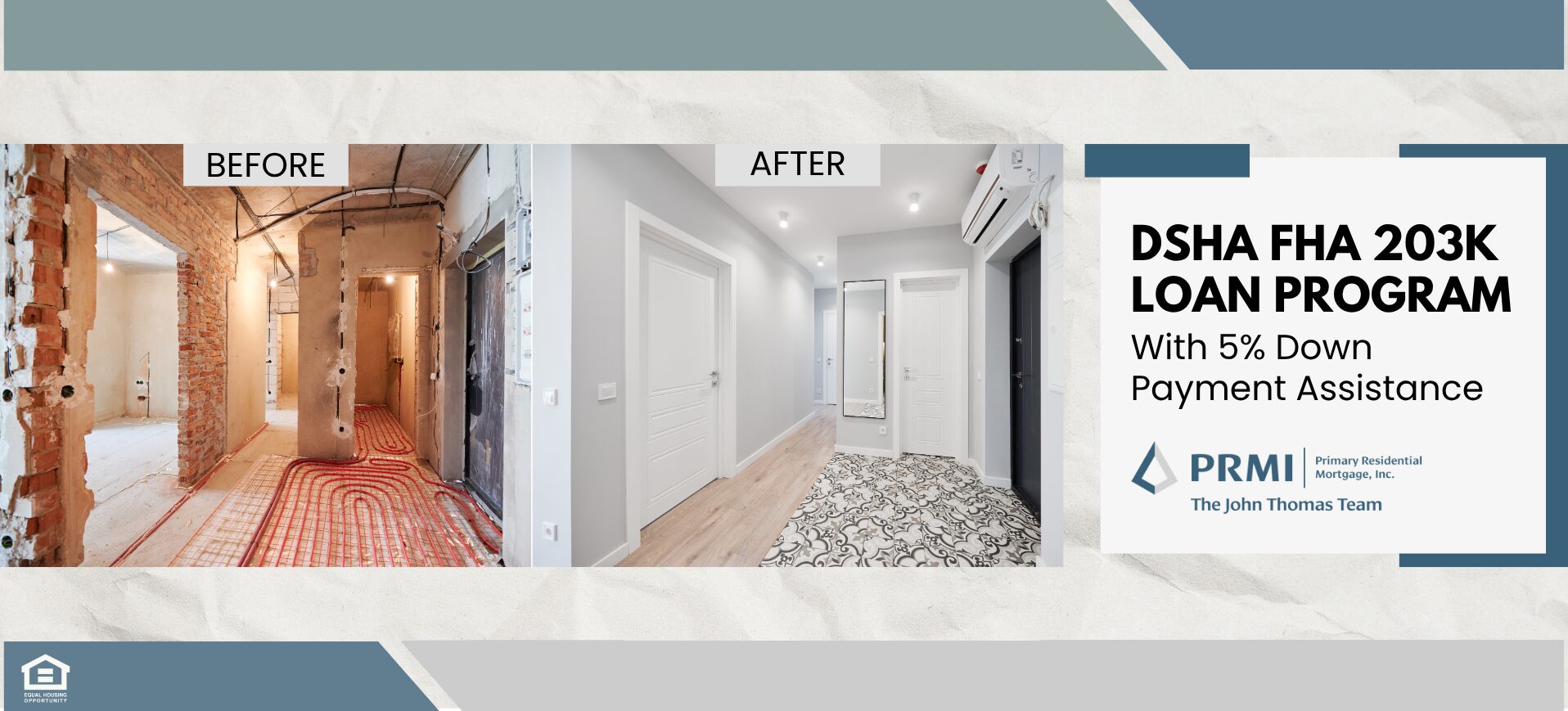

FHA 203k program is flexible and allows a lot of leeway when it comes to the property you can buy and the repairs, renovations and upgrades you can complete as part of the loan.

You can finance everything from second story additions, to finished basements, new kitchens or that large master suite you always wanted.

There are, however, some repairs that you can not do as part of the 203k process. So, what are the improvements you absolutely can’t do with a 203k?

Outbuildings | Guesthouses | Non-Attached Structures

The property you want to purchase has a second structure; a rental cottage, pool house, guest house, detached converted garage, workshop or superlative storage shed. That structure is not in good condition and needs some work.

Sorry, but FHA 203k guidelines will not allow you to include any repairs to that structure as part of the loan.

You cannot renovate anything other than the primary structure on a FHA 203k loan, PERIOD. All the renovations must be permanently affixed to the primary structure – the main house.

This FHA 203k guideline can sometimes be a problem for approval. Especially if the outbuilding is in excessive disrepair.

There problem for many comes with the fact that, despite our inability to renovate, the secondary structure still needs to meet FHA collateral guidelines.

In other words, it can’t be a hazard or deemed a health and safety issue by the appraiser during his valuation process.

Depending on what state you dwell this can really be a deal killer as many homes in certain areas have a detached structure.

The kicker is we ARE allowed to do one thing IF the structure is deemed a “health and safety” issue – we can demolish it!

Swimming Pools | Hot Tubs | Spas

This one can also cause some consternation for buyers, especially those looking at foreclosures with a swimming pool. In all likelihood, that swimming pool is a mess. They tend to get that way with no upkeep.

Technically, FHA 203k guidelines allow for $1500 in pool repair on the standard 203k and NONE on the streamline K, but as of September 2015 the pool requirement has changed. You can now repair a pool on both the Limited 203k and the Consultant 203k.

That said, many lenders still don’t allow ANY pool repair at all even though FHA 203k guidelines now allow it.

Talk to a Renovation Loan Specialist

Cosmetic Landscaping

FHA 203k guidelines do not allow for cosmetic landscaping.

They will allow you to protect the collateral (the house) and address erosion or water drainage issues. A lot of the ability to do this type of repair is in the verbiage used in the contractor bid.

It can be a fine line between cosmetic landscaping and drainage/erosion issues in some cases. if worded correctly on the contractor bid and / or HUD consultant work write up, can encompass a LOT of potential repairs.

Furniture | Accessories | TV

It would be nice if you could finance that new living room set, California king bedroom suite, dining table or big screen tv right into your 203k loan. But you can’t, sorry. Same goes for those window blinds, not allowed either.

Kitchen appliances – stove, range, refrigerator, built-in microwave oven – those can be included in the loan. In some cases, like that of a stove/range, it may even be required to be included. FHA guidelines dictate that a home must have those built-in appliances to qualify.

Make sure your lender offers BOTH the =&0=&and the =&1=& (also known as the standard or full ) products as there are plenty of issues that can flip a streamline to a full 203K. There are also multiple repairs that are allowed on the standard 203k loan that are not on the streamline 203k.

Good renovation loan officers know what you can and can’t do. Be prepared, use a mortgage lender with knowledge of both products and give yourself the best chance for 203k success.

Call 302-703-0727 for questions about FHA 230k loans or to apply to be pre-approved. You can also apply online at www.PRMILoanApplication.com