Asset Qualifier Loan Program

Do you have assets but are unable to provide sufficient income to qualify for a mortgage loan? Our Asset Qualifier Loan program also know as Asset Depletion Loan or Asset Utilization Loan, allows borrowers to use their liquid assets to be used as income to qualify for a mortgage loan. This program does NOT require employment or income to justify your ability to repay. We qualify based on required assets that meet the seasoning requirements. This is a great program for retirees, undeserved self employed, divorced borrowers with no income, and other borrowers with large assets but no income. You can get started today by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

What are the Guidelines for Asset Qualifier Loan Program?

- No Employment and No Income Required

- Up to 90% LTV – Purchase

- Up to 80% LTV – Rate/Term Refinance

- Up to 75% Cash-Out Refinance

- Loan Amounts up to $4 Million

- Assets Seasoned for minimum of 3 Months

- Minimum FICO Score 600

- Owner Occupier, 2nd Home, or Investment Property

- Qualify with

- Just Assets OR

- Blended with One or Two Yr. Full Doc, Bank Statements, WVOE, 1099 or P&L

- Liquid Assets Can be:

- Savings and Checking

- Stocks, Bonds, or Mutual Funds

- Vested amount of retirement and money market account

- No Tax Returns or Tax Transcripts

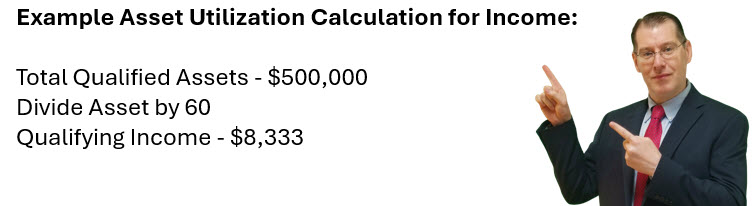

How to Calculate Asset Utilization for Income

The assets are generally given 100% of the value of the account unless un-vested retirement accounts. The Income Amount used is the qualified assets divided by 60 months. Below is example:

What is Considered a Qualified Asset?

The assets that can be used for an Asset Qualifier Loan Program typically must be seasoned assets for 3-6 months depending on credit score and LTV. Most account types are given 100% of their value for qualified assets but retirement accounts could be reduced to 70% of value. The following are list of qualified Assets that can be used:

- Bank Accounts (Checking or Savings

- Certificate of Deposit (CD)

- Money Market Accounts

- Mutual Funds

- Stocks & Bonds

- Retirement Accounts

How Do You Apply for an Asset Qualifier Loan Program?

If you want to take advantage of the Asset Qualifier Loan Program you can get started by contacting the John Thomas Team at 302-703-0727 or you can APPLY ONLINE.