Delaware USDA Rural Housing Loans

100% Financing – No Down Payment Loans!

Delaware USDA Guaranteed Rural Development Home Mortgage Loan is a flexible no down payment government insured mortgage loan program that is growing in popularity for rural areas of Delaware. The USDA Loan is designed to promote home ownership for borrowers with low to moderate incomes and who have limited savings for a down payment. Call 302-703-0727 to Apply for a Delaware USDA Rural Housing Loans or APPLY ONLINE

Delaware USDA Rural Housing loans will allow the mortgage lender to lend up to the home’s appraised value and even allow the home buyer to include closing costs in the actual loan if the home appraises for more than the purchase price. A common misconception about the USDA home loan program is that it’s for farmers, but this mortgage loan is for those who want to purchase a primary residence outside the urban areas. In Delaware you will find that many suburban areas qualify for this program as well such as Smyrna, Delaware.

Benefits of USDA Home Loan 100% Financing:

- 100% Financing

- Do NOT have to be a First Time Home Buyer

- No Down Payment *Closing Costs and fees may apply.

- 30 year low fixed rate loans

- No Prepayment Penalty

- Great Low FIXED Interest Rates

- No Loan Limits

- Possible to Roll Closing Costs into Loan if Appraises Higher

- No Cash Reserves Required

- Up to 6% Seller Contribution toward Closing Costs

- 100% Gifted Closing Costs allowed

- Primary Residents only (no rentals/investment properties)

- Only Need a 620 Credit Score to Apply

- Bankruptcy wait period is 3 years from Discharge date

- Can Use Delaware First Time Home Buyer Tax Credit Program

What are the USDA Loan Requirements and Guidelines for Delaware?

Below are some of the requirements to qualify for a Delaware USDA Loan:

- Monthly housing expense (mortgage principal and interest, property taxes and homeowners insurance) must meet a specified percentage of your gross monthly income (29% ratio is the guideline).

- Credit history & background will be fairly considered. At least a 620 FICO credit score is required to obtain a USDA approval through a Delaware USDA Lender.

- Borrower must have enough income to pay housing costs plus all additional monthly debt (41% ratio is guideline).

- Household income can be up to 115% of the median income for the county.

- Bankruptcy: Have been discharged from a Chapter 7 bankruptcy for three years or more (if applicable).

- Delaware property must be considered rural, which is generally defined as open country with fewer than 10,000 people.

Delaware home buyers must be able to afford the mortgage payments, including taxes and insurance.

How do Delaware USDA Loans Work?

The process for Delaware USDA Rural Housing Loans is very similar to getting a Delaware FHA loan or a conventional mortgage.

Like the FHA, there is a government agency that sponsors the loan program, but we would handle 100% of the transaction. That means that the John Thomas Team does everything from taking your application to issuing the final approval for your loan. After that point, the USDA puts a final stamp of approval on the loan. Here’s a better breakdown of how the Delaware USDA Rural Housing Loan process looks:

Apply for Your Loan ? Pre-approval ? Find Your Delaware House ? Get Approval From the John Thomas Team ? Final Sign-off by USDA ? Close the Loan ? Moving Day

Apply for Your Loan: We will walk you through the process and give you all the information you need to get started.

Pre-approval: We will consider information like your income, credit, and employment information. If you meet USDA home loan requirements, we’ll provide you with a pre-approval letter.

Find Your Delaware Home: Use your pre-approval letter to make an offer on a USDA-eligible home. The house MUST be in a designated USDA area before putting in an offer.

Approval: We will add property information to your loan file, and perform any last checks needed.

Final Sign-off by USDA: We submit your full loan file to USDA for final approval.

Close the loan: At this point, you’ll sign the final paperwork. A few days later, the house is all yours!

Move in: The process is over! You get to move in and enjoy your home.

Delaware USDA Rural Housing Loans Guidelines

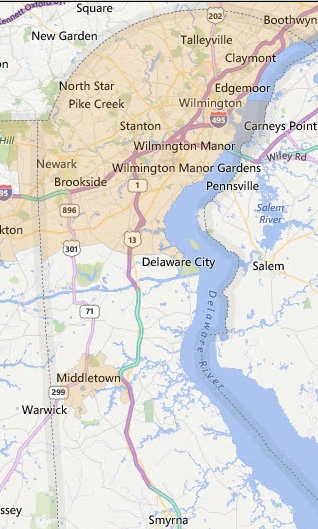

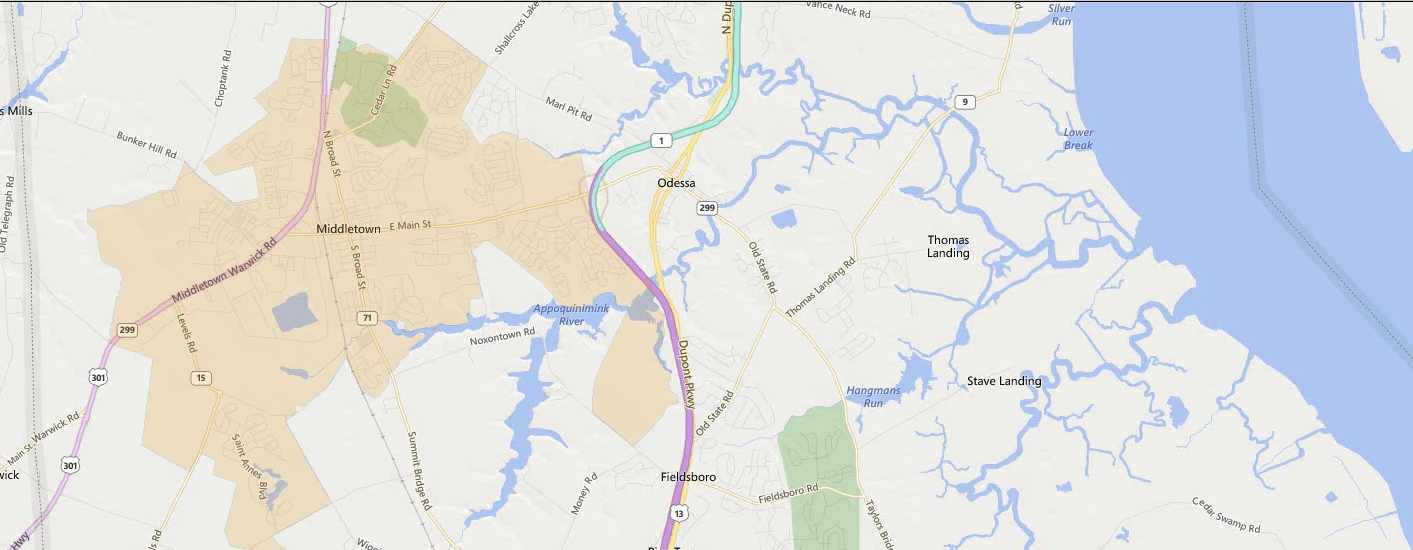

Delaware USDA Rural Housing Loans have two restrictions; income and geographical. The geographical restrictions are based on the U.S. census population data for each area of a particular county. Below is a diagram showing the eligible areas of New Castle County. The areas in ORANGE are NOT Eligible

What are the USDA Eligible Property Areas in Delaware?

New Castle County USDA Eligible Areas are shown below.

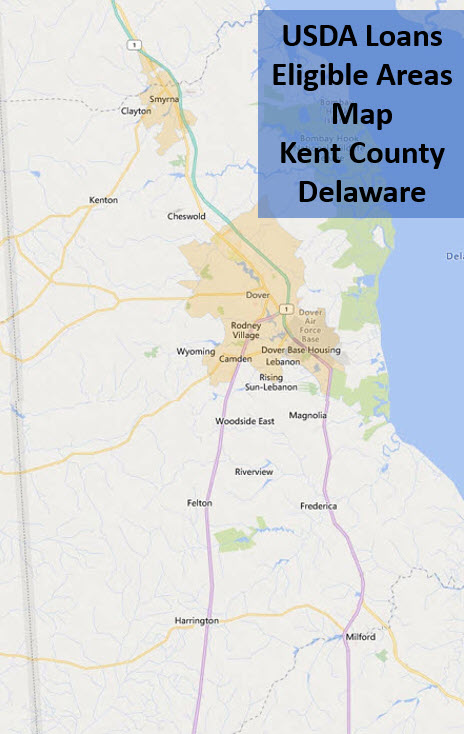

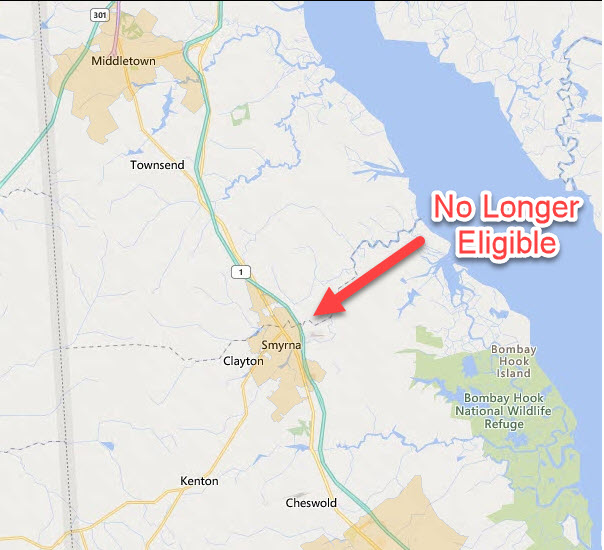

Kent County USDA Eligible Areas are shown below.

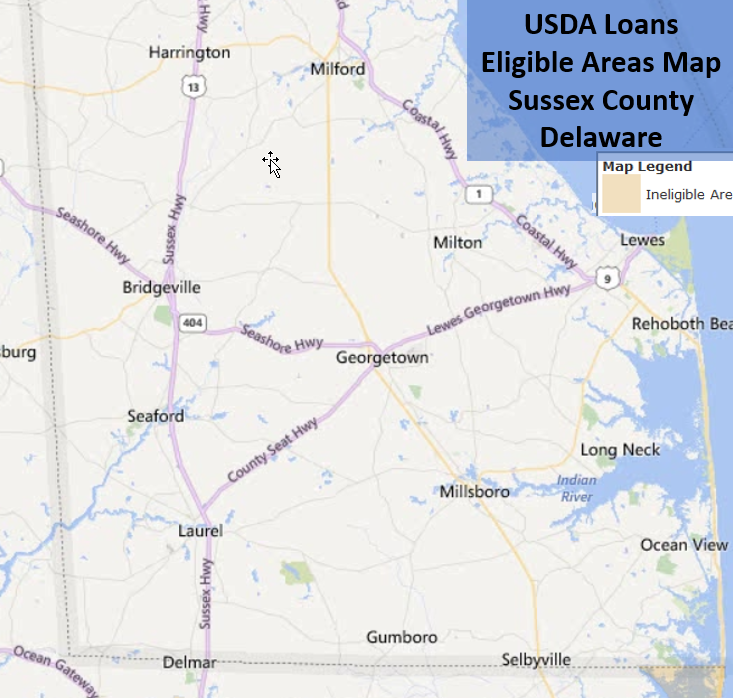

Sussex County USDA Eligible areas are shown below

How Can You Determine if a Property is Eligible for USDA Loan?

You can determine if a property in Delaware is eligible for financing through the USDA Rural Housing Loan program by entering the property address at the following website https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=sfp

The Eligible areas for USDA Rural Housing Loans were suppose to change on January 15, 2014 but the changed was delayed indefinitely until Congress passes legislation updating the Census data used for calculating the eligible areas from 2000 Census to the 2010 Census. When the 2010 Census Data is used the city of Middletown, Delaware and the city of Smyrna, Delaware will no longer be eligible for USDA financing but until further notice both cities are still eligible for 2014.

Property Eligibility Update for June 4, 2018

USDA updated its eligible property areas for a Delaware USDA loan and Middletown, Delaware is no longer eligible as of June 4, 2018. Below is map showing the Middletown Delaware area with the new updated areas. The areas in Orange is no longer eligible for a USDA financing as of June 4, 2018.

Property Eligibility Update for October 1, 2023

USDA updated its eligible property areas and Smyrna, Delaware is no longer eligible effective for closing on and after October 1, 2023. Below is map showing the Smyrna Area that is no longer eligible in the Orange Color.

What are the Delaware USDA Rural Housing Income Guidelines for 2023?

The income limits for Delaware USDA Rural Housing loans are based on the number of people in the house and the county that the property is located. The Delaware USDA Loans Income Limits for 2023 are as follows:

New Castle County Maximum Income Limits for 2023

1 -4 Person 5-8 Person

$0 – $128,350 $0 – $169,400

Kent County & Sussex County Maximum Income Limits for 2023

1 – 4 Person 5 – 8 Person

$0 – $110,650 $0 – $146,050

Is There a Minimum USDA Home Loan Down Payment Required?

There’s no down payment required for the Delaware USDA loan. This is why it’s such an attractive loan for Delaware home seekers. The only other widely known and used zero-down payment loan is the Delaware VA Loan.

For Delaware residents who are not in the military, USDA loans are usually the only no down payment mortgage option. The minimum down payment for the most popular loans are:

- Conventional loans: 3%

- FHA: 3.5%

- VA: 0%

- USDA: 0%

What are the Credit Score Requirements?

Another plus for the USDA Rural Loan is that you don’t need a super impressive FICO score to be approved. Borrowers will need to have a 620 minimum credit score to apply for a USDA Guaranteed loan.

Borrowers with an average to high credit score (640 and higher) can receive a more streamlined approval. Those with no credit score or scores below 640 will require extra documentation. We may ask for things like:

- Rental and housing history

- Insurance payments

- Utility and bill payment history

- Childcare payment history

- Tuition and loan payments

Good payment history can lead to a score being provided to us, allowing for a more streamlined approval. Bankruptcy requires a 3 year wait period from the discharge date.

Financial hardships like bankruptcies, credit dings, and collections may require extra documentation even if you have a score above 640.

What is the USDA Guarantee Fee?

USDA Rural Housing Loans require that borrowers pay a upfront mortgage guarantee fee that as of June 2017 is 1% of the loan amount but USDA lets you finance this upfront fee into the loan. For example if you are purchasing a home for $200,000 and want to borrower 100% which is $200,000, USDA requires the borrower to pay a 1% guarantee fee which would be $2,000. This $2,000 fee can be financed into the loan so your total USDA loan would be $202,000.

USDA Rural Loans also require a monthly fee of 0.35% of the loan amount on an annual basis. This monthly fee is much lower than a comparable FHA Loan at 0.85% or a conventional loan with less than 20% down.

What is the USDA Direct Loan Program?

The USDA Direct Loan Program is a program administered by RHS directly to home buyers who income is below 80% of the median income limit and cannot obtain credit otherwise. 40% of the loans under the direct program must be made each year to people under 60% of median income limit. You must apply directly with the RHS to obtain this program as it is not available from a private lender.

Need a USDA Mortgage Lender Delaware – Call the John Thomas Team at 302-703-0727 to apply for a Delaware USDA Rural Housing Loan or send an e-mail to johnthomasteam@primeres.com or APPLY ONLINE NOW!!

Primary Residential Mortgage, Inc.

248 E Chestnut Hill Rd, Newark, DE 19713

#DelawareUSDARuralHousingLoans

#USDALoans

#DelawareUSDALoans

#USDAHomeLoans