Delaware Conventional Loans

Delaware Conventional Loans Overview:

A Delaware Conventional Loan is a loan that is not guaranteed or insured by government agencies and is fixed in terms and rate. Agencies like FHA, VA, and USDA do not back Conventional Loans, meaning Conventional Loans are backed by either Fannie Mae or Freddie Mac and must meet guidelines set for a Qualified Mortgage. A Conventional Loan is also known as a Conforming Loan. Delaware Conventional Loans can be used to purchase a primary residence, a second home, or an investment property. It can also be used to purchase a residential property with between 1-4 units. Call 302-703-0727 to apply for a Delaware Conventional Loan or APPLY ONLINE

Since these loans aren’t government-insured, lenders risk losing money if the borrower defaults. To combat this, they impose stricter requirements on borrowers than FHA Loan or VA Loan lenders do and typically charge higher interest rates with bigger down payments and credit scores required.

Conventional Loans can be for 10 year, 15 year, 20 year, 25 year, and 30 year terms and can be either fixed for the entire term or can be an adjustable rate mortgage (ARM).

Am I Eligible for a Conventional Loan in Delaware?

Delaware Conventional Loans must follow the terms and conditions set forth by government-sponsored enterprises such as Fannie Mae or Freddie Mac. To be eligible, you’ll need to meet certain criteria – things like your credit background, monthly housing costs, and monthly debt will be closely considered.

A FICO credit score of 620 or above is required to obtain an approved Delaware Conventional Loan. Monthly housing costs (including things like property taxes, mortgage principal and interest, and insurance) must meet a pre-defined percentage of your gross monthly income. Your credit background (ways you’ve spent money, paid bills, and interacted with creditors) will be considered. You must also have enough income to both pay your housing costs and all additional monthly debt.

How Much Will I Need for The Down Payment and Closing Costs?

Delaware Conventional Home Loans require an investment from the homeowner of between 3% and 20% of the sales price towards the down payment and closing costs. For example, a $100,000 price tag will mean the mortgage applicant must invest at least $3,000 – $20,000 to meet Delaware Conventional Loan down payment requirements, depending on the program. If you are putting down less than 20% of the purchase price then you will be required to pay for a Private Mortgage Insurance (PMI) to protect the lender in case you default on the loan. The PMI rate depends on the credit score and the down payment. So higher credit scores equal lower PMI and higher down payments equal lower PMI.

If you are a first time home buyer then there are programs that can help you with the down payment and/or closing costs. A few examples of programs to help with down payment and/or closing costs on a Delaware Conventional Loan are as follows:

- New Castle County DPS Program

- New Castle County Revamp Program

- DSHA SMAL Loan Program

- DSHA Advantage 4 Grant Program

You can also try to negotiate for the home seller to pay some or all of your closing costs as long as it meets the guidelines for the conventional loan that you are applying for. For example if you are doing a conventional loan with only 5% down payment then you are capped at a maximum of 3% of the purchase price in seller paid closing costs but if you put down 10% or more then you can negotiate up to 6% seller paid closing costs. You can more information and compare at the following link: Understanding Seller Paid Closing Costs

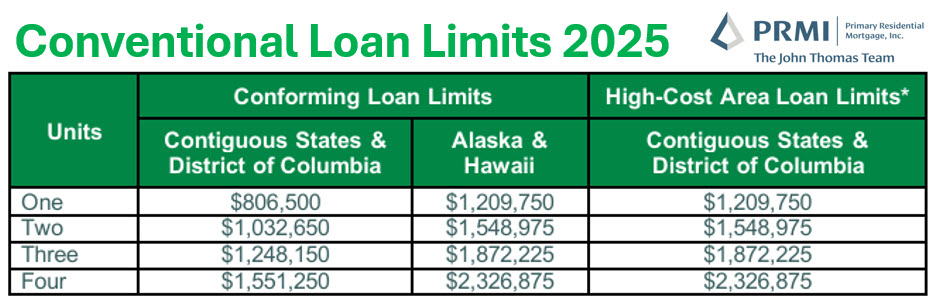

Delaware Conventional Loan Limits for 2025

Most US counties have a maximum loan limit of $806,500 for a single-family residence, $1,032,650 for two units, $1,248,150 for three units & $1,551,250 for four units. These limits are applicable to purchase and refinance mortgages and is the same in all three counties of Delaware which are New Castle County, Kent County, and Sussex County. If you want to get a mortgage for more than the conventional loan limit then you will need to explore one of two options. Option 1 is a Jumbo Loan and Option 2 is getting a conventional first mortgage loan with a 2nd mortgage for the amount above $806,500.

If you are looking to purchase in another state such as Maryland, they have high cost areas where the conventional loan limit is above the $806,500 loan limit. These loans are called high balance conventional loans and act the same way except there is typically an adjustment to the interest rate so rates can be slightly higher on a high balance conventional loan.

Fannie Mae 97% Conventional Mortgage Loan

Fannie Mae offers a 97% Conventional Mortgage loan for first time home buyers called HomeReady and Freddie Mac offers a 97% Conventional loan called Home Possible. A First Time Home Buyer is defined by Fannie Mae as a person who has NOT owned ANY residential property in the last 3 years which includes primary residence, second home, and or investment properties.

In order to be eligible to Refinance using the 97% LTV mortgage loan program the current mortgage being refinanced must be owned by Fannie.

Some commonly asked questions about the Fannie Mae 97% Conventional Mortgage Loan are as follows:

What are the down payment requirements on a 97% Conventional Loan?

The minimum down payment requirement is 3% of the purchase price. For example, if purchasing a home for $200,000, then the 3% down payment from the borrower is $6,000. Compared to previous 5% down program at $10,000, this is a much cheaper option for potential first time home buyers.

What is the maximum amount that I can borrow?

The maximum loan amount for Delaware is $806,500 for a 97% Conventional Mortgage Loan. This would mean that the maximum purchase price at 3% down is $831,443.

Can I buy a home that requires repairs with a Conventional Loan?

You can purchase homes that require repairs or renovations in order to meet minimum property eligibility guidelines using a renovation loan program. There conventional loan option for purchasing homes that needs repairs in Delaware is a Conventional HomeStyle Renovation Loan. This loan program will lend you the money to purchase the home and to fix it up all in one mortgage loan. There is still a required down payment on but down payment is based on purchase price plus the rehab amount not just the purchase price. The minimum down payment on a primary residence is 5% with the HomeStyle Renovation Loan.

How do I apply for a Conventional Mortgage Loan?

If you would like to apply for a Conventional Mortgage Loan to purchase or refinance a home in Delaware, please call 302-703-0727 or APPLY ONLINE

John R. Thomas

Branch Manager / Certified Mortgage Planner – NMLS 38783

Primary Residential Mortgage, Inc.

248 E Chestnut Hill Rd

Newark, DE 19713

302-703-0727 DE Office

410-412-3319 MD Office

610-906-3109 PA Office