Fannie Mae 97% Conventional Mortgage Loan is Back

Fannie Mae 97% Conventional Mortgage Loan is back for qualified first time home buyers as announced by Fannie Mae on December 8, 2014. This new loan option for qualified first-time homebuyers that will allow for a down payment as low as three percent or for limited cash-out refinance of homeowners who currently have a Fannie Mae loan. The lower down payment is to help qualified borrowers to access credit that may not have the resources for a larger down payment.

These 97% Conventional loans do require mortgage insurance as the borrower is financing more than 80% of the value of the home. The mortgage insurance can be paid on a monthly basis or paid as a one-time single premium at closing.

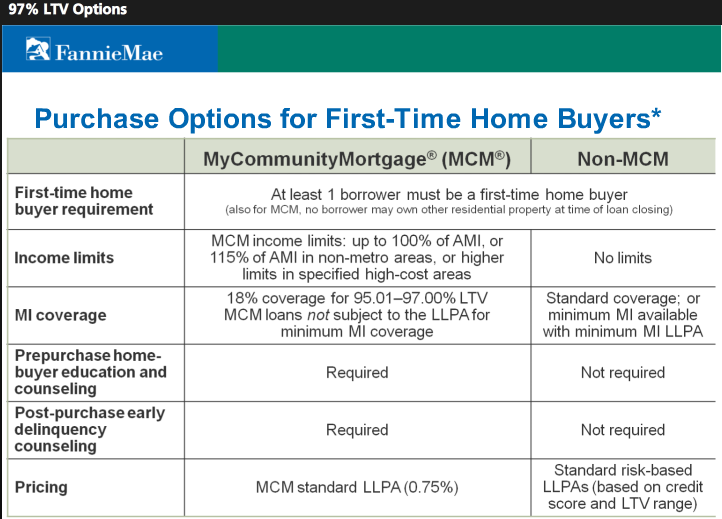

The 97% mortgage loan program is available through the My Community Mortgage Product from Fannie Mae and for a standard non-MCM Conventional Loan Product. The highlights of the program for both programs are as follows:

- Maximum loan to value (LTV), Combined Loan to Value (CLTV), and High or Home Equity Combined Loan to Value (HCLTV) is 97%.

- DU Underwriting required

- 1 Unit Principle Residence Only (Including Condos & PUDs)

- Manufactured Homes are Not Eligible for 97% LTV Loans

- Must be a Fixed Rate Mortgage (No ARMS)

- Gifts may be used for down payment and for Reserves

A First Time Home Buyer is defined by Fannie Mae as a person who has NOT owned ANY residential property in the last 3 years which includes primary residence, second home, and or investment properties.

In order to be eligible to Refinance using the 97% LTV mortgage loan program the current mortgage being refinanced must be owned by Fannie.

So commonly asked questions about the Fannie Mae 97% Conventional Mortgage Loan are as follows:

What are the down payment requirements on a 97% Conventional Loan?

The down payment requirement is 3% of the purchase price. For example, if purchasing a home for $200,000, then the 3% down payment from the borrower is $6,000. Compared to the previous 5% down the program at $10,000, this is a much cheaper option for potential first time home buyers.

What is the maximum loan size for Fannie Mae 97% Conventional Loan?

The maximum loan amount for Delaware is $417,000 for a 97% Conventional Mortgage Loan. This would mean that the maximum purchase price at 3% down is $430,000.

If you would like to apply for a 97% Conventional Mortgage Loan to purchase or refinance a home in Delaware, please call 302-703-0727 or APPLY ONLINE

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713