DE Mortgage Rates Weekly Update October 31 2016

DE Mortgage Rates Weekly Update October 31, 2016

DE Mortgage Rates weekly update for the Week of October 31, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates Moved Higher Last week as mortgage bonds continued to sell off. If you look at the mortgage bond chart below you can see mortgage bonds sold off last week and broke through the floor of support and finally stopped at the 200 day moving average. We are recommending carefully FLOATING your DE Mortgage rate to start the week as mortgage bonds have held the 200 day moving average so we are looking for bonds to move higher and move mortgage interest rates lower.

In Economic News

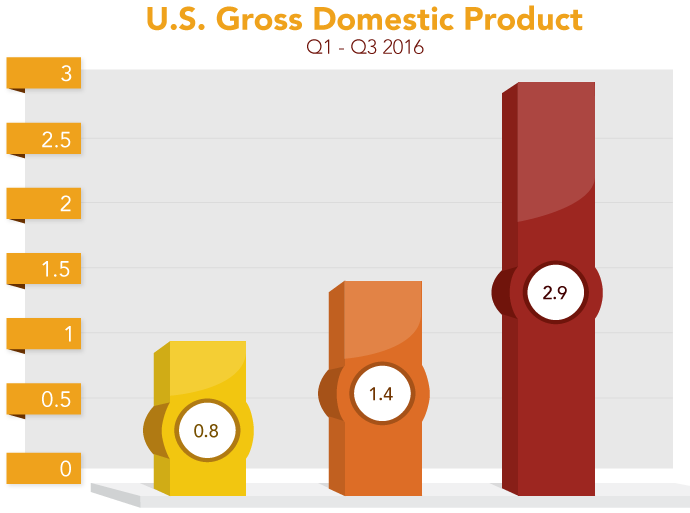

Gross Domestic Product GDP for 3rd Quarter 2016 was reported last week and the first readying came in at a surprising 2.9% which was above expectations of 2.5%. GDP measures the total dollar value of goods and services produced over a specific time period so it essentially shows the pace of economic activity. A GDP reading between 2.5% to 3% is optimal for a healthy economic.

When you dig into the GDP report, all was not well as consumer spending grew by only 2.1% which is the major factor to drive a health economy. Consumer spending dropped from 4.3.% in the second quarter of 2016. The GDP spiked up because of a 10% rise in exports which will not be sustainable so predicts for 4th quarter GDP are for about 2.1%.

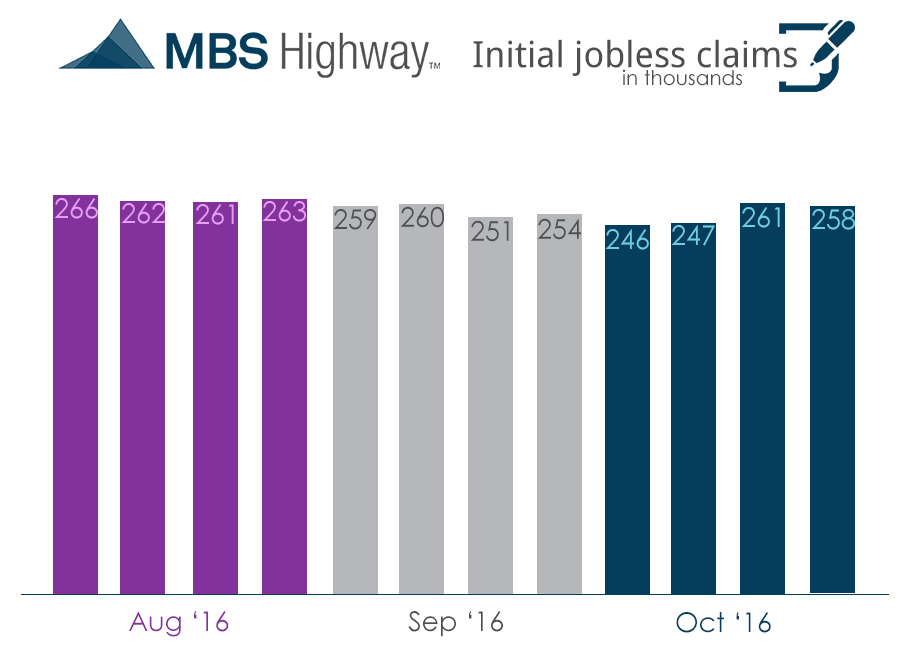

Weekly Initial Jobless Claims were released on Thursday and came in at 258,000 claims which was a drop of 3,000 claims from the previous week and marked the 86th consecutive week of claims below 300,000. Weekly claims support a very good October Jobs report which will be reported on November 4th.

In Housing News

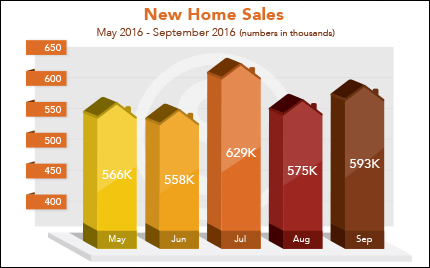

New Home Sales for September 2016 rose 3.1% from August 2016 to 593,000 units on an annualized basis. This was below expectations of 610,000 and August new home sales were revised lower from 609,000 to only 575,000. But the report was not really bad because new home sales are up 30% from September 2015.

Pending Homes Sales for September 2016 rose 1.5% and are up 2.4% year over year. This was better than expectations of 1.0% and a good number. Pending Home Sales measures signed contracts on existing homes. NAR reported that buyer demand is holding up impressively and Realtors are reporting much stronger foot traffic than last year.

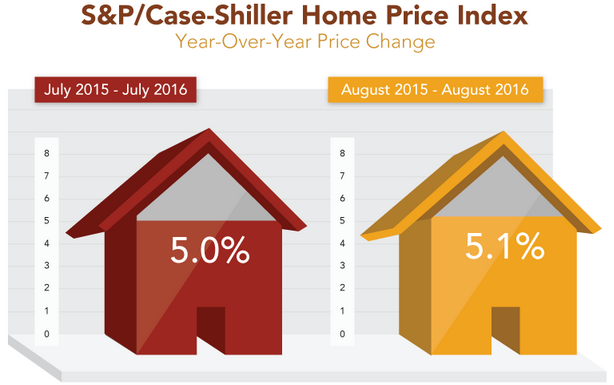

The Case-Shiller Home Price Index for August 2016 showed home prices increased 5.1% from a year ago and were up 0.2% from July 2016. This report supports a stable housing market and appreciation rates around 5% are very sustainable.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday November 19, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate

#DEMortgageRates