Mortgage Rate Weekly Update [July 17 2017]

Mortgage Rate Weekly Update for July 17, 2017

Mortgage Rate Weekly Update for July 17, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

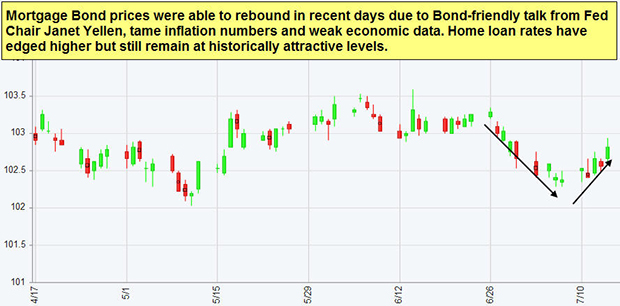

Mortgage Rates were able to once again move lower last week after moving higher for several weeks in a row. If you look at the mortgage bond chart below you can see mortgage bonds were able to rebound higher last week after bouncing off a floor of support. Mortgage bonds failed to break above a tough ceiling of resistance on Friday after a strong rally and fell back down to end the day so we are recommending LOCKING your mortgage rate to take advantage of the move lower in interest rates as mortgage bonds will continue to face a very touch ceiling of resistance.

In Economic News

The Consumer Price Index (CPI) for June 2017 fell to 1.6% from 1.9% in June 2016 on annualized basis. The CPI measures inflation at the consumer level which is remaining very tame. Low inflation is good for bonds so that can help boost the price of mortgage bonds which moves mortgage interest rates lower. This was the lowest year over year CPI reading since October 2016.

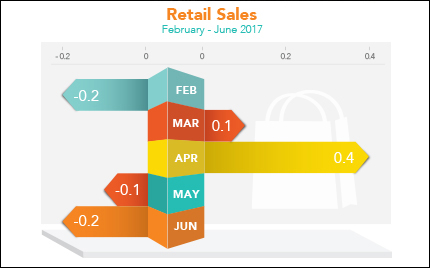

Retail Sales for June 2017 fell 0.2% from May’s Retail Sales which makes the 2nd month in a row of declining retail sales. Some good news is that Retail Sales for June 2017 are up 2.8% from June of 2016. The Commerce Department reported that sales were down at department stores, food stores, and gas stations.

Weekly Initial Jobless Claims were released on Thursday and showed 247,000 initial claims for the week. This was a drop of 3,000 claims from the previous week and marks the 123rd consecutive week of jobless claims below the 300,000 level which is the longest streak in 47 years. The weekly initial jobless claims continues to show that the labor market is strong.

In Housing News

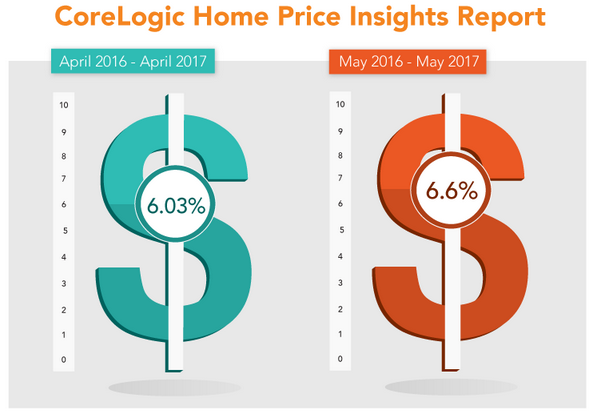

CoreLogic released its Home Price Index for May 2017 which showed home prices were up 6.6% from May 2016 and home prices were up 1.2% from April 2017 to May 2017. Tight inventories of homes for sale nationwide continue to push home prices upward. CoreLogic is predicting home prices will rise 5.3% from May 2017 to May 2018 which still makes it a great time to purchase a home.

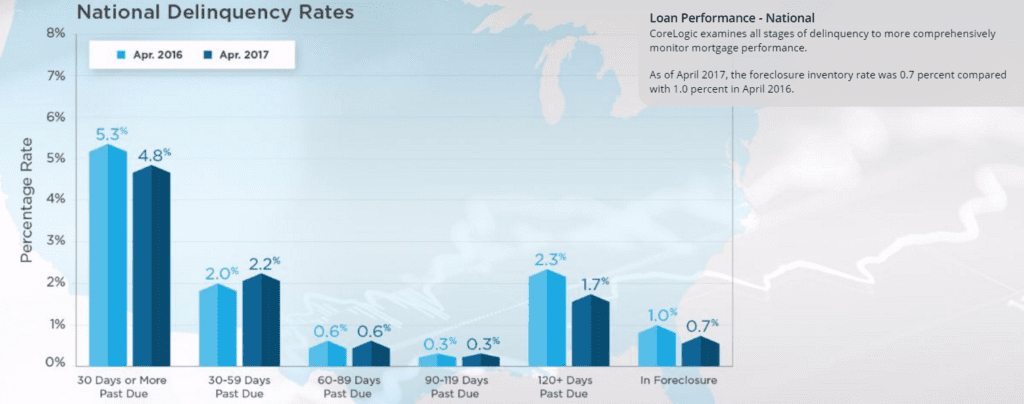

CoreLogic released their Loan Performance Insights for April 2017 and it showed that loans that are 30 days or more past due dropped from 5.3% in April 2016 to only 4.8% in April 2017. Seriously delinquent loans that are in foreclosure dropped from 1.0% last year to only 0.7% this year and are also down 0.1% from March which was 0.8%. The report shows that the housing market and mortgage loan performance are all doing much better.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday July 22, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate