Mortgage Interest Rates Update January 18 2016

Mortgage Interest Rates Weekly Update January 18 2016

Mortgage Interest Rates weekly update for the Week of January 18, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

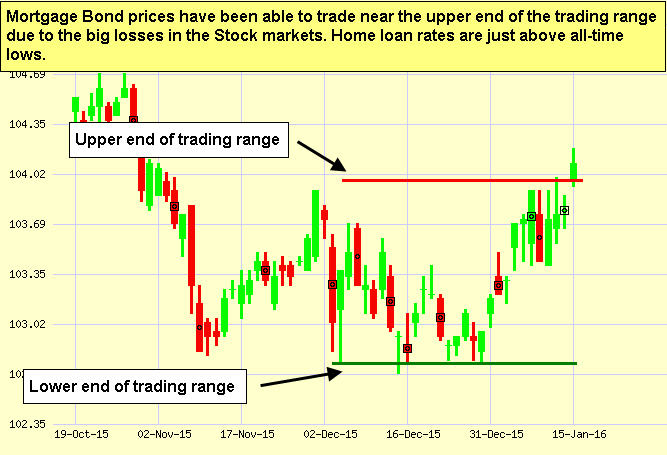

Mortgage Interest Rates were able to move lower last week after a big sell off in Global Stock Markets. If you look at the mortgage bond chart below you can see that mortgage bonds have been able to trade to the upper end of the trading range which has helped improve mortgage rates. But with mortgage bonds not able to mount more than a 19 bps rally in the face of the DOW Stock Index dropping 390 points to end the day, we are recommending LOCKING your mortgage rate to start the week. If stocks reverse, we will see the mortgage bonds sell off and move mortgage interest rates higher.

In Economic News, the US Stock Market plunged last week as the price of Oil continues to drop and Economic Troubles continue to slow China’s economy. Economic conditions here in the US are not as promising as the media would like us to believe as proof in a falling stock market. The New York Manufacturing data released on Friday was dismal, Empire Manufacturing came in at Negative 19.1 versus expectations of -3.5. Manufacturing data is a leading indicator of production so that does not bode well for the US Economy. We also saw that WalMart released a report that they are closing 269 Stores and 16,000 employees will be losing their jobs. 10,000 of the jobs lost will be in the United States.

Another big road sign that the US Economy is faltering is the drop in Gross Domestic Product (GDP) from 3.9% in the 3rd quarter of 2015 to only 2% in the 4th quarter of 2015.

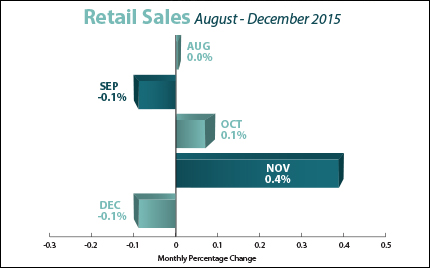

Retail Sales for December 2015 ended the year the worst since 2009, retail sales dropped by 0.1% versus expectations of an increase of 0.1%. Retail Sales for all of 2015 rose only 2.1% which is the smallest in all of this current economic recovery. The numbers point to more Americans saving money versus spending on holiday sales even in the face of lower gasoline prices at the pump.

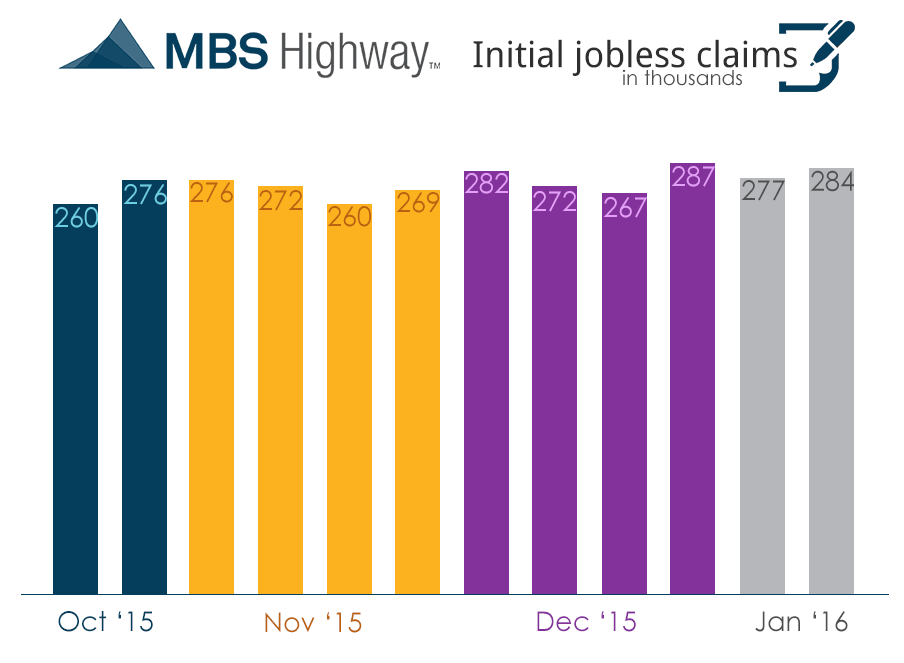

Weekly Initial Jobless Claims were released on Thursday and were up 7,000 claims from previous week to 284,000 claims. It was the worst level since July but it is still relatively a good number as it was the 45th consecutive week of claims below 300,000. We will have to watch this number and see how corporate lay offs like Walmart effect the reporting.

In Housing News, CoreLogic released their National Foreclosure Report for November 2015 which showed foreclosures dropped 21% from a year ago, down from 573,000 to only 448,000 homes in some kind of foreclosure this year. Only 3% of all homes are seriously delinquent, which is the lowest level in 8 years.

Housing Outlook for 2016:

2016 should be another good year for housing with home prices continuing to rise by a national average of about 5%. The economic problems won’t have big impact on housing as we still have a shortage of inventory of homes for sale which will cause an upward price pressure. Mortgage Interest rates will benefit from the Stock Market Sell off and economic troubles that will probably plague the world and the US in 2016 so we should continue to see record low mortgage interest rates in 2016.

First Time Home Buyer Seminars Coming Up:

The next Dover Delaware Home Buyer Seminar is Saturday January 30, 2016 in Dover, Delaware

The next Delaware First Time Home Buyer Seminar is Saturday February 20, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com