Delaware Mortgage Rates Weekly Update for February 25, 2013

Delaware mortgage rate weekly mortgage market update for the week of February 25, 2013, by John Thomas with Primary Residential Mortgage in Newark, Delaware. John is the Newark, DE Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan.

Delaware mortgage rates appeared to stabilize last week as the mortgage bonds tried to hammer out a bottom of the support. We are recommending FLOATING your Delaware mortgage rate to see if mortgage bonds can move higher from recent lows which would allow interest rates to move lower. If you look at the bond chart below you can see mortgage bonds traded in a tight range last week and stopped the drop lower that has happened every week since the beginning of the year.

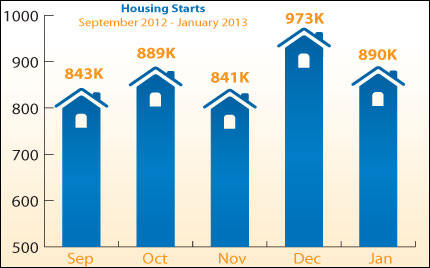

In the housing news, we saw that housing starts for January 2013 came in at 890,000 which was a decline from December but the decline was from multi-family units starts declining. Single Family Housing Starts actually increased and was at the highest rate since July 2008. We also saw building permits come in above expectations. Housing starts are how many new homes builders have started construction on and building permits is a measure of how many homes builders are anticipating building. So this is showing that builders are coming back into the market.

Last week we saw the read on inflation from the Consumer Price Index (CPI) & Producer Price Index (PPI) which both reports showed inflation remains tame. Inflation is the enemy of bonds so as long as inflation remains tame, mortgage rates should stay low. We also saw the Labor Department release the weekly initial jobless claims which showed claims rising by 20,000 to 362,000. This is bad news for the labor market which could help mortgage bonds if initial jobless claims continue to rise.

The next Free Delaware First Time Home Buyer Seminar is Saturday, March 16, 2013, in Newark, Delaware and Tuesday, March 19, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Free Maryland First Time Home Buyer Seminar is Saturday, March 23, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713