Delaware Mortgage Rates Weekly Mortgage Market Update for May 13, 2013

Delaware mortgage rate weekly mortgage market update for the week of May 13, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware mortgage rates continued to move higher last week following through on the jump higher on May 3rd after April 2013 Jobs Report was released. Mortgage bonds dropped below the 200-day moving average and then sold off to end the week causing home loan rates to move higher. With no clear level of support for mortgage bonds, we can see them sell off, even more, this week and move home loan rates even higher so we are recommending LOCKING your Delaware mortgage rate. PIMCO’s Gross says the bull run in Bonds is over which means mortgage rates will be slowly moving up as mortgage bonds continue to sell off a move lower. We also saw Warren Buffet mention he likes owning stock right now and not bonds as he feels bonds are overbought supported by the Federal Reserve bond buying program which again supports the view that mortgage rates will rise from here as mortgage bonds move lower.

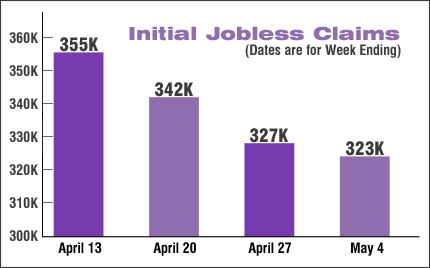

Last week we saw the initial jobless claims released on Thursday, May 9, 2013, which showed that only 323,000 claims were filed which was below expectations and the lowest level since January 2008. This trend of lower jobless claims shows the labor market is improving but there is still room for concern as the Labor Force Participation Rate still remains at 63.3% which measures how many eligible workers 16 years and older are actually working full time.

In housing news, CoreLogic reported that home prices rose 10.5 percent in March 2013 from March 2012. This was the biggest annual increase since March 2006 and the 13th consecutive increase in home prices. There was also a 1.9 percent gain from February 2013 to March 2013 and prices increased in all states except four. However, average home prices remain 25 percent lower than the peak of April 2006.

Freddie Mac and Fannie Mac both reported record profits last week which shows the two mortgage giants have recovered and are now profitable which is great news for the mortgage and housing industry.

Call 302-703-0727 to schedule a free mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Free Delaware First Time Home Buyer Seminar is Saturday, June 22, 2013, in Newark, Delaware and Tuesday, May 21, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Free Maryland First Time Home Buyer Seminar is Saturday, June 15, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713