Understanding Seller Paid Closing Costs

Understanding Seller Paid Closing Costs

Seller Paid Closing Costs are negotiated between a home buyer and home seller during the initial offer process and are written into the sales agreement. Seller Paid Closing Costs are also called Seller’s Assistance. If the Seller Paid Closing Costs are not written into the contract then they don’t exist and will not be credited to the buyer at the settlement. Call 302-703-0727 to get pre-approved today and find out how much seller paid closing costs you will need or APPLY ONLINE

It is very important to understand that when you ask for the seller to pay money toward your closing costs that the seller is taking this money off the purchase price to give to the buyer at closing. For Example if you offer the seller $200,000 for their home and ask for $10,000 in seller paid closing costs, you are really only offering the seller $190,000 for their home.

Who Negotiates the Seller Paid Closing Costs?

The seller paid closing costs are negotiated by your Buyer’s Agent when the offer is submitted with the Seller’s Agent. It is very important that you, your agent and your lender are all on the same page when submitting an offer. For example if the lender pre-approves you for $200,000 with $10,000 in seller paid closing costs but you only submit your offer for $200,000 with 3% seller paid closing costs, you are only asking for $6,000 in seller paid closing costs! You will need $4,000 more than you thought when the numbers were run at $10,000 in seller paid closing costs.

This is why it is very important to make sure you have your lender run the numbers on your offer and any counter offers you get before you accept the contract. This will keep you from having “Sticker Shock” if you find out after the contract is negotiated that you didn’t get the seller paid closing costs that you need because it will be very hard to get the seller to now agree to different terms.

How Much Seller Paid Closing Costs Can I Get?

The amount of seller assistance that you can negotiate with the seller of the property depends on the type of mortgage loan that you are using to finance the purchase. The amount of seller paid closing costs is summarized below by loan type:

FHA Loans & FHA 203k Loans – Seller can pay up to 6% of the purchase price

VA Loans – Seller can pay all customary closing costs and up to 4% for discount points and buyer debt

USDA Loans – Seller can pay up to 6% purchase price

Conventional Loan Seller Paid Closing Costs – Depends on the down payment:

- Less than 10% down payment – Seller can pay up to 3% of purchase price

- 10% to 25% down payment – Seller can pay up to 6% of purchase price

- 25% or more down payment – Seller can pay up to 9% of purchase price

When Do I Get the Closing Costs Paid by the Seller?

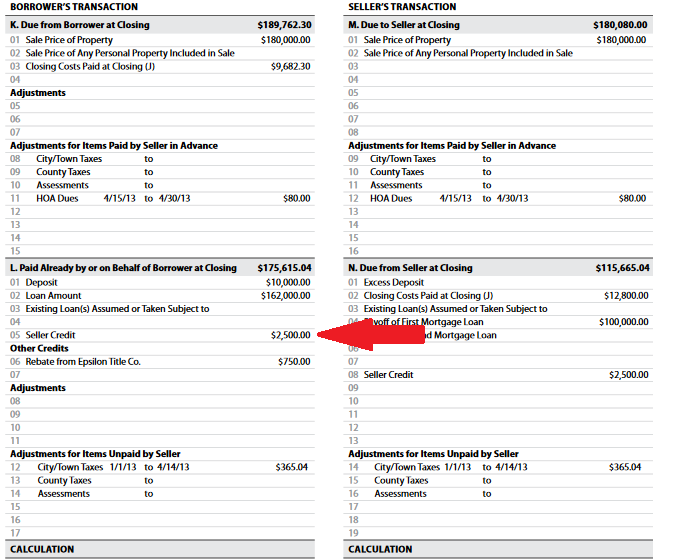

The Seller Assistance that is negotiated in the Sales Contract is never given directly to the buyer, it can only be a credit at closing on the Closing Disclosure (CD). The money from the seller is typically a line item credit on the buyer side of Page 3 of the CD and a line item debit from the seller side of Page 3 of the Closing Disclosure. See example below:

The money from the seller that is paid toward buyer’s closing costs can also show up on the CD by actually moving buyer fees to the seller side of Page 2 of the Closing Disclosure instead of a doing a lump sum line item credit on Page 3 of the CD.

Does the Seller Pay Closing Costs Out of Pocket?

The home Seller does NOT pay the closing costs out of pocket for the home Buyer. Any closing cost assistance negotiated from the seller will be a credit at closing on the Closing Disclosure (CD) form. The seller will not be bringing a check to pay the buyer’s closing costs instead it is a line item debit from the seller to the buyer on the CD. The buyer receives a line item credit as shown in the picture above. The seller credit just ends up being a reduction in the seller proceeds at closing. So the seller will not be writing the buyer a check at closing for the buyer’s closing costs. The Seller Paid closing costs will appear on page 3 of the closing disclosure as a line item credit or will be on page 2 of the closing disclosure as buyer fees that get moved to the seller side of the CD for the seller to pay at closing from seller proceeds.

The home Seller does NOT pay the closing costs out of pocket for the home Buyer. Any closing cost assistance negotiated from the seller will be a credit at closing on the Closing Disclosure (CD) form. The seller will not be bringing a check to pay the buyer’s closing costs instead it is a line item debit from the seller to the buyer on the CD. The buyer receives a line item credit as shown in the picture above. The seller credit just ends up being a reduction in the seller proceeds at closing. So the seller will not be writing the buyer a check at closing for the buyer’s closing costs. The Seller Paid closing costs will appear on page 3 of the closing disclosure as a line item credit or will be on page 2 of the closing disclosure as buyer fees that get moved to the seller side of the CD for the seller to pay at closing from seller proceeds.

What Happens If There Are Not Enough Closing Costs to Use the Seller Assistance?

If you negotiate more closing costs paid by the seller than there are actually costs for them to pay then the seller gets to keep the difference. For example, if you negotiate $10,000 in seller paid closing costs and the actual closing costs are only $8,500 then the remaining $1,500 will be kept by the seller and go to their bottom line on the closing disclosure.

One tactic to use any extra seller paid closing costs is to add a home warranty that is paid by the seller . For example if you add a two year home warranty at a cost of $500 per year for a total of $1,000 then the extra $1,500 above, only $500 would be kept by the seller and the buyer gets two years of a home warranty.

Can I finance my closing costs into my mortgage loan on a purchase?

A frequent misunderstanding among home buyers is that they think they can roll the closing costs into the loan. The loan programs will NOT let you “roll” the closing costs into the loan as the amount you can borrower is based on the purchase price. For example, a FHA loan will allow you to borrower 96.5% of the purchase price so on a $100,000 purchase you would be able to borrower $96,500 so you would need to put down $3,500 as your minimum investment for FHA loan. If you closing costs are $6,500 then you would need your down payment of $3,500 plus your closing costs of $6,500 for a total of $10,000. Now if you negotiated the maximum seller assistance of 6% which is $6,000 then you would only need $4,000.

There is one way to include the closing costs into the loan which is to increase the sales price by the amount of closing costs and have the seller agree to pay back this amount in seller paid closing costs. So on the FHA loan above you would increase the purchase price to $106,000 and have the seller agree to pay $6,000 toward closing costs and you have in a sense now “rolled” the closing costs into the loan. The IMPORTANT thing to remember is the home must appraise for $106,000 in order for this to work.

If you would like to apply for a mortgage pre-approval to purchase a home, please call the John Thomas Team at 302-703-0727 or you can APPLY ONLINE.