Mortgage Rates Weekly Update October 24 2016

Mortgage Rates Weekly Update October 17, 2016

Mortgage Rates weekly update for the Week of October 24, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were finally able to move slightly lower last week as mortgage bonds were able to rebound off support. If you look at the mortgage bond chart below, you can see mortgage bonds had been trading lower for last couple of weeks but were finally able to find a floor of support last week and move higher but have hit a tough ceiling of resistance that will be very difficult to break above so we are recommending LOCKING Your Mortgage Rate to start the week to lock in the slightly better rates we saw at the end of last week.

In Economic News

Consumer inflation edged slightly higher as the Consumer Price Index (CPI) for September 2016 came in at 1.5% which was up from 1.1% in August 2016. Inflation is one of the key indicators the Federal Reserve is watching to help determine if they should raise short term interest rates. The Feds target for inflation is 2.0%, so getting closer to this target gives them more incentive to raise rates.

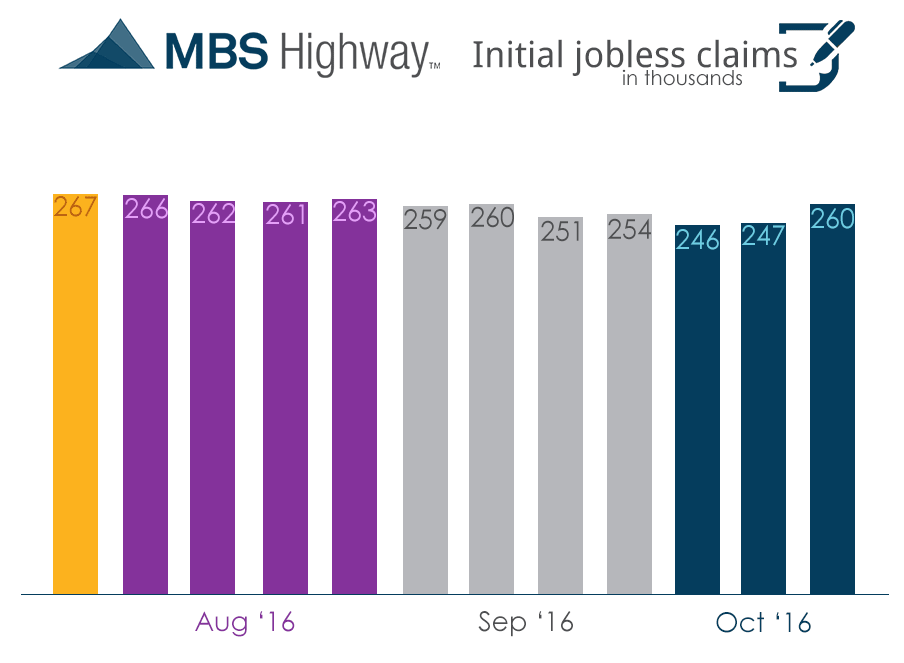

Weekly Initial Jobless Claims were released on Thursday and jumped higher to 260,000 claims for the week. Even though weekly claims moved up, it is still the 85th consecutive week of claims below 300,000. This is also the sample week to be used in the October Jobs Report so points to a strong jobs report for October 2016.

In Housing News

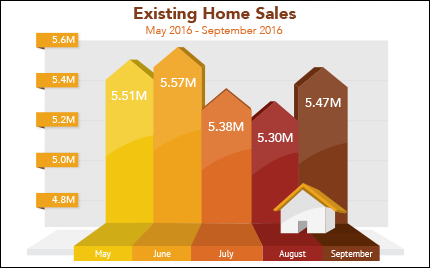

Existing Home Sales for September 2016 jumped 3.2% to 5.47 Million after two straight months of declining existing home sales. This was a good number for housing and shows that the housing market remains strong. We are looking for homes to continue to appreciate throughout the end of the year and again next year.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 29, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate

#DEMortgageRates