Mortgage Rates Weekly Update for March 20 2017

Mortgage Rates Weekly Update for March 20, 2017

Mortgage Rates Weekly Update for March 20, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved lower as mortgage bonds were able to rebound last week after the Federal Reserve raised their Fed Funds Rate. If you look at the mortgage bond chart below you can see mortgage bonds were able to bounce off multi-year lows after Fed Hike and now have hit a tough ceiling of resistance. We are looking to see if we can repeat the trend from the December Rate Hike where bonds rallied higher so we recommend FLOATING Your mortgage rate to start the week to see if mortgage bonds can rally and break above resistance.

In Economic News

Federal Reserve Raised their Fed Funds Rate by 0.25% at their March 15th meeting as expected. Fed Chairwoman Janet Yellen stated “The simple message is the economy is doing well.”

The Consumer Price Index (CPI) was released on Wednesday and rose 0.1% moving up from 2.5% to 2.6% which was the hottest reading in 5 years. In the report it showed rents rose 4% on average nationally.

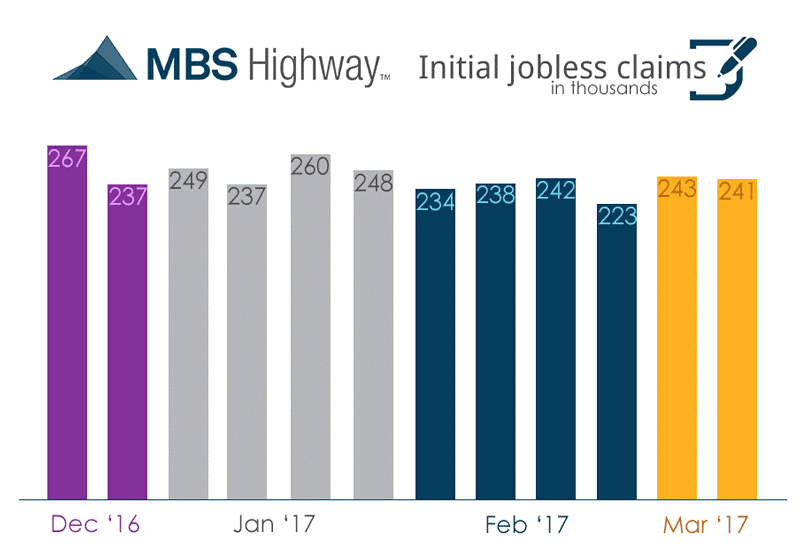

Weekly Initial Jobless Claims were released on Thursday and dropped 2,000 claims to 241,000 claims which was in line with expectations and continues to support a strong labor market. This week’s will be the sample week used in the March job report.

In Housing News

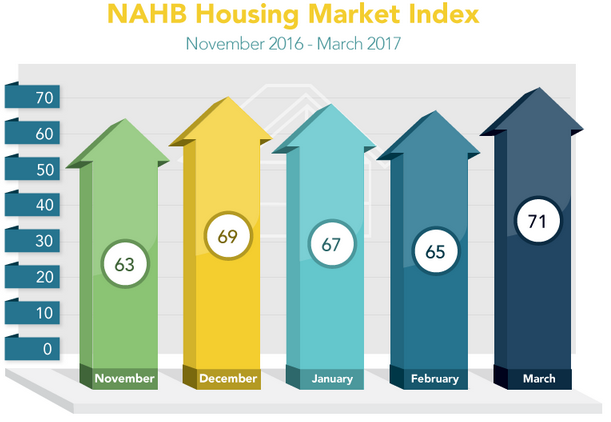

The National Association of Home Builders released its Housing Market Index for March 2017 which jumped 6 points to 71 which is the highest in 12 years. The index measures home builders confidence in the new home construction market.

Housing Starts for February 2017 rose 3% from January to 1.288 million units which is a four month high for housing starts. Housing Starts measures the number of new construction homes that home builders started constructing. Housing starts are up 6.2% from February 2016 to February 2017.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday April 15, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday March 25 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate