Mortgage Rates Weekly Update [July 10 2017]

Mortgage Rates Weekly Update for July 10, 2017

Mortgage Rates Weekly Update for July 10, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates continued to move higher last week as mortgage bonds continued the downward trend that we discussed in last week’s update. If you look at the mortgage bond chart below you can the downward trend in mortgage rates over the last couple weeks with the blue arrow. Mortgage bonds are now testing an important floor of support shown with the blue horizontal line. If mortgage bonds continue lower and break through this floor bonds have a long way to fall before hitting the next floor of resistance which means the risk of higher rates out weighs any potential reward of waiting to see if mortgage bonds could rally higher. We are recommending LOCKING your mortgage rate as the risk is for bonds to move higher and the under lying technicals are not strong for the bond market right now.

In Economic News

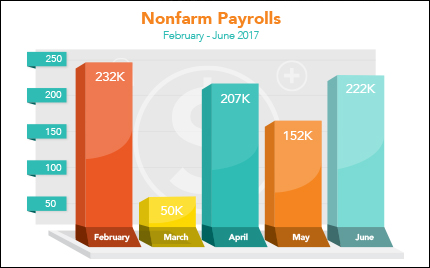

The June 2017 Jobs Report was released by the Labor Department on Friday and showed 222,000 jobs created in June which was well above expectations of 170,000. April Jobs Report was revised higher from 174,000 to 207,000 and May Jobs Report was also revised higher from 138,000 to 152,000 jobs. The Unemployment Rate increased from 4.3% to 4.4% because the household survey showed 245,000 jobs created but 361,000 people entered the work force so that pushed the unemployment rate up.

The Labor Force Participation Rate ticked up to 62.8% which is a step in the right direction as it measures the number of people 16 years and older that are able to work that are actually working. The jobs report overall was a good number with unemployment low and jobs created above expectations but mortgage bonds did not sell off because wage growth continues to be stagnant at only 0.2% growth in June and only 2.5% year over year. We need wage growth at least 3.0% to have some inflation which would allow the Feds to continue to hike short term rates.

Bond Yields in Europe have moved higher which has put upward pressure on mortgage rates in the United States as the outlook for the European economy has improved. The German Bund has moved significantly higher from 0.22% a couple of weeks ago to 0.58% presently which is the highest since December 2015. If the German Bund continues to move higher it will make it difficult for mortgage rates in the US to move lower. The German Bund was -0.20% last year which means people were paying to park their money in the German Bund. This is a HUGE turn around and will be a big head wind for our mortgage rates. This is making the long term outlook for interest rates is to continue to move higher.

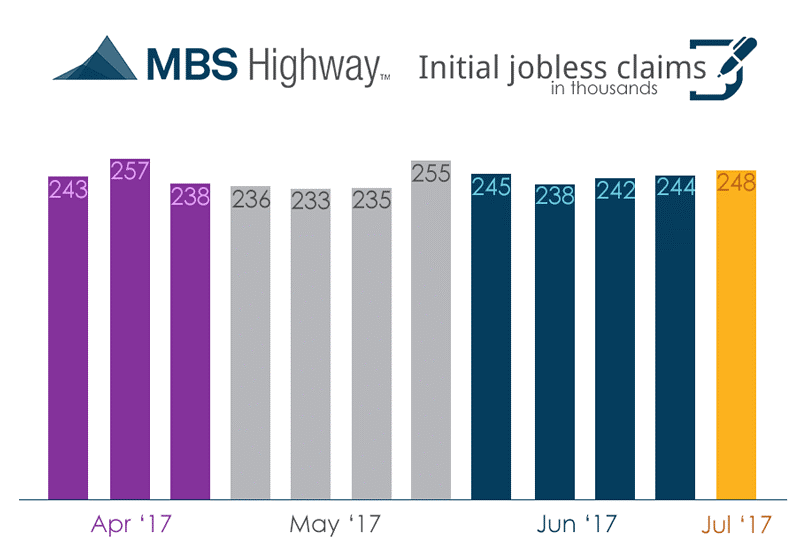

Weekly Initial Jobless Claims were released on Thursday and showed 248,000 jobless claims for the week which was up 4,000 claim from the previous week but still a very strong number. This was the 122nd consecutive weeks jobless claims have remained below 300,000 and is the longest stretch in 47 years.

In Housing News

CoreLogic Released its Home Price Index for May 2017 which showed home prices were up 1.2% from April and were up 6.6% from May 2016. This was a slight decline from last month’s year over year appreciation of 6.9% but still very solid home price appreciation. CoreLogic is predicting a 5.3% home price appreciation from May 2017 to May 2018 which means still a great time to purchase a home. Just a few months ago price appreciation prediction was only 4.7% so housing continues to improve.

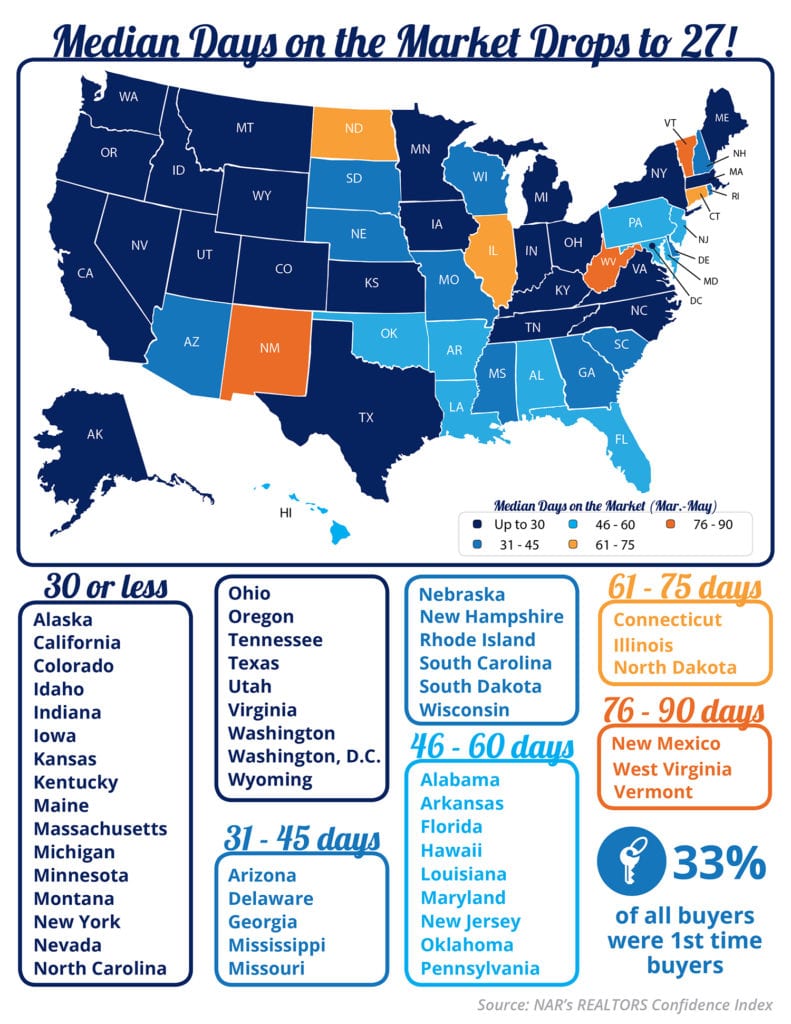

The Median Days on Market for Homes for Sale has continued to drop across the United States and the average has dropped to 27 days! First Time Home Buyers have accounted for 33% of home sales nationwide. If you look at the info graphic below you can see over half the country is at less than 30 days on the market for home sales. In the local market, Delaware is at 31-45 days, Maryland is 45-60 days, New Jersey is 45-60 days, and Pennsylvania is at 45-60 days.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday July 22, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate