Mortgage Rates Weekly Update January 23, 2017

Mortgage Rates Weekly Update for January 23, 2017

Mortgage Rates Weekly Update for January 23, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

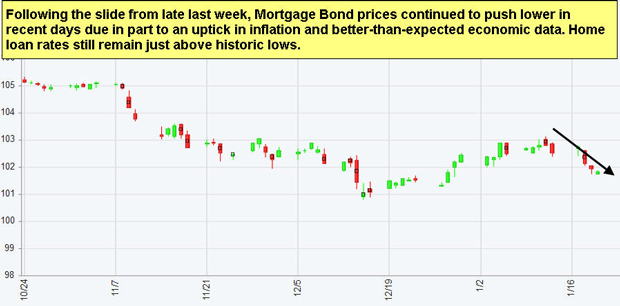

Mortgage Rates Moved Higher Last week as mortgage bonds sold off after reports of higher inflation. If you look at the mortgage bond chart below you can see mortgage bonds were turned lower last Monday with the red candle following the previous Friday’s attempt to move higher. Mortgage bonds then sold off the rest of the week until finding a bottom on Thursday and moving higher on Friday with a Green Candle. We are recommending FLOATING Your mortgage rate to start the week to see if bonds can recover from the sell off and move back higher which would move mortgage rates lower.

In Economic News

The Consumer Producer Price Index (CPI) for December 2016 was released last week which measures inflation at the consumer level. The CPI was at 2.1% year over year and was the fastest pace of inflationary growth since June 2014. Inflation is the enemy of bonds so that is one of the reasons mortgage bonds sold off last week and moved interest rates higher.

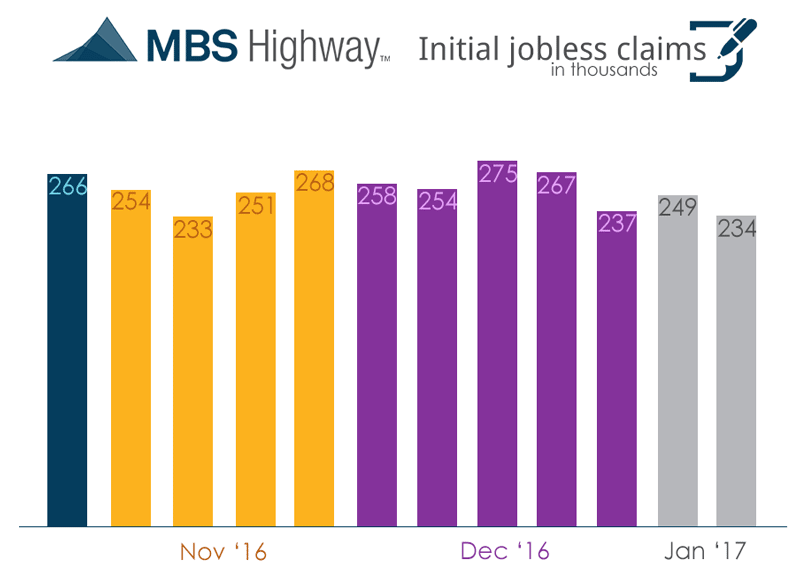

Weekly Initial Jobless Claims were released on Thursday and they dropped 15,000 from previous week at 234,000 claims. This was also the sample week to be used in the January 2017 Jobs Report. This report points to a very strong jobs report for January and a very good sign for the labor market.

In Housing News

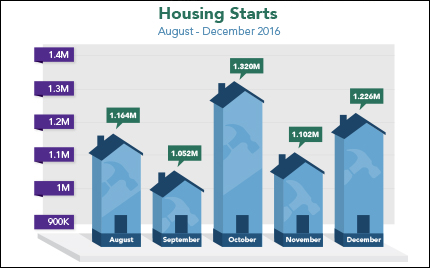

Housing Starts for December 2016 were released last week and jumped higher by 11.3 percent from November 2016 to 1.226 Million units on an annualized basis. The housing starts is a measure of how many new homes that home builders have started construction on for that month. Housing Starts have been very volatile in the last 3 months which a 27% rise in October, a 11% pull back in November and a 11.3 percent gain in December. If you average out the last 3 months we have a 15% average monthly gain which points to a very good new construction home market and supports home prices continuing to rise.

FHA Mortgage Insurance Premium Cut has been put on Hold by the Trump Administration for them to review. HUD had released a mortgagee letter to reduce the FHA MIP effective January 27, 2017 but that is now on hold indefinitely till Trump Administration can review the impact of the change.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday February 18, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday March 25 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate