Mortgage Rates Weekly Update for January 12, 2014

Mortgage Rates weekly market update for the Week of January 12, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware.

Mortgage Rates moved to record lows last week as mortgage bonds hit a record high for the past 2 years. If you look at the mortgage bond chart below you can see that mortgage bonds hit record high and were stopped at the line of resistance shown in blue. Bonds were then turned lower after hitting the ceiling of resistance so with this in mind, we are recommending LOCKING your Mortgage Interest Rate to start the week as mortgage rates sit at multi-year lows.

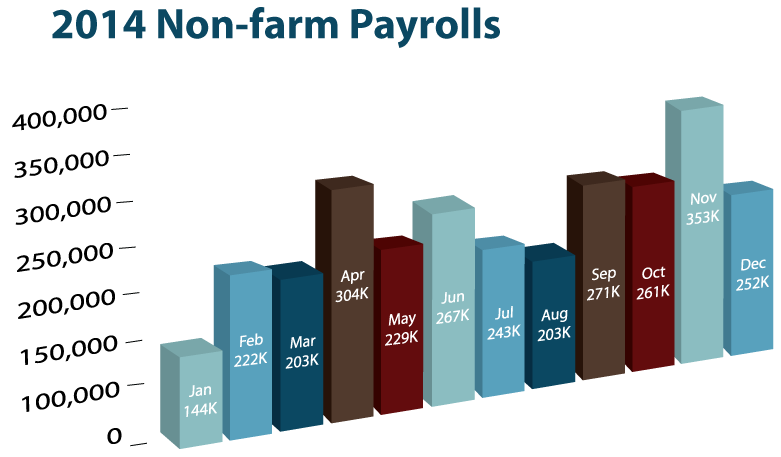

In Economic News, the Jobs Report for December 2014 was released on Friday by the Bureau of Labor Statistics and it showed 252,000 jobs were created in December. Employers added 2.95 Million Jobs in 2014 which was above the 1.95 Million Jobs added in 2013. The Unemployment Rate dropped from 5.8% to 5.6% but the Labor Force Participation Rate (LFPR) dropped by 0.2% to 62.7% The LFPR shows that the drop in unemployment rate was not so much because people are going back to work but that 300,000 people dropped out of the workforce so are no longer counted in the unemployment rate.

In other Economic News, the Price of Oil has dropped to about $48 a barrel which almost has the price of Oil was a year ago. This has caused the price of gasoline to drop drastically at the pump. The low price of oil does not bode well for jobs in the Energy sector which have made up 40% of the jobs created in the recovery.

The Weekly Initial Jobless Claims for the week was released on Thursday and showed 294,000 claims which are a drop of 4,000 claims from the previous week. This is the 15th week out of the last 16 weeks that Jobless Claims are coming out under 300,000 jobless claims.

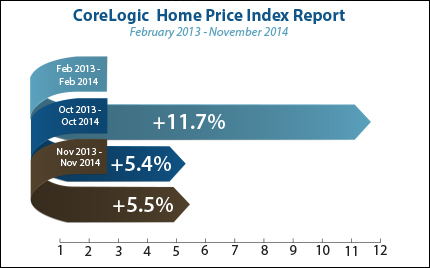

In Housing News, CoreLogic released its Home Price Index for November 2014 which showed home prices increased 0.1% from October 2014 and are up 5.5% year over year from November 2013. If you look at the chart below you can see Home Price Appreciation has slowed considerably from the beginning of the year. Home Price Appreciation of 5% is very sustainable over the long term.

The prediction for mortgage rates in 2015 is for them to remain low as inflation will remain very low throughout 2015 as there is no wage growth in the U.S. The Feds will keep short term interest rates low until inflation moves up to 2% which means short term rates will remain low in 2015.

FHA Mortgage Loan Update – FHA is reducing the Annual Mortgage Insurance Premium on January 26, 2015, by 05%. This will be for both purchase mortgage loans and refinance loans. This will home buyers about $80 to $100 a month on their monthly mortgage payment on average. Anyone who got an FHA loan since 2012 should look into an FHA Streamline Refinance to lower their rate and their mortgage insurance and save thousands of dollars a year. Call 302-703-0727 for a No Cost analysis from The John Thomas Team or APPLY ONLINE

FHA Mortgage Loan Update – FHA is reducing the Annual Mortgage Insurance Premium on January 26, 2015, by 05%. This will be for both purchase mortgage loans and refinance loans. This will home buyers about $80 to $100 a month on their monthly mortgage payment on average. Anyone who got an FHA loan since 2012 should look into an FHA Streamline Refinance to lower their rate and their mortgage insurance and save thousands of dollars a year. Call 302-703-0727 for a No Cost analysis from The John Thomas Team or APPLY ONLINE

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, January 17, 2015, n Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, March 7, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713