Mortgage Rates Weekly Update for March 9, 2015

Mortgage Rates weekly market update for the Week of March 9, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

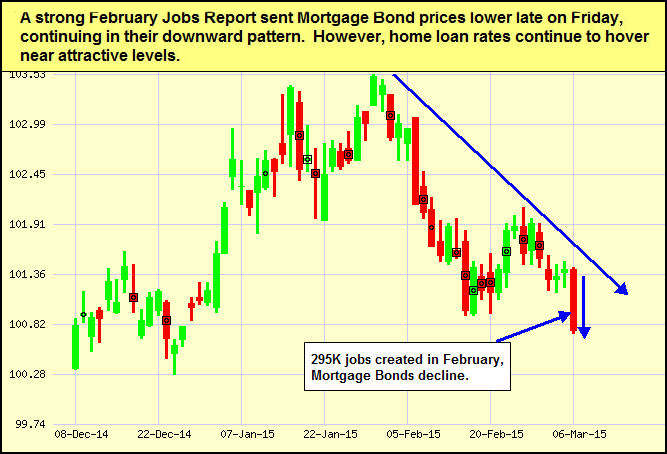

Mortgage Rates spiked higher on Friday after the Jobs Report was released which moved interest rates up 0.375% to 0.5%! If you look at the mortgage bond chart below you can see mortgage bonds have been trading on a downward pattern but had tried to stabilize over the last week and find a floor of support. But on Friday you can see a giant red candle that signals mortgage bonds had a big sell-off and dropped almost 100 basis points causing lenders to re-price mortgage rates for the worse twice in one day as mortgage bonds continued to fall throughout the day. Bonds broke through two floors of support on Friday which will now act as resistance levels. With the next floor of support at the 200-day moving average being still lower and the breakout trend being lower as well, we are recommending LOCKING your mortgage interest rate to start the week.

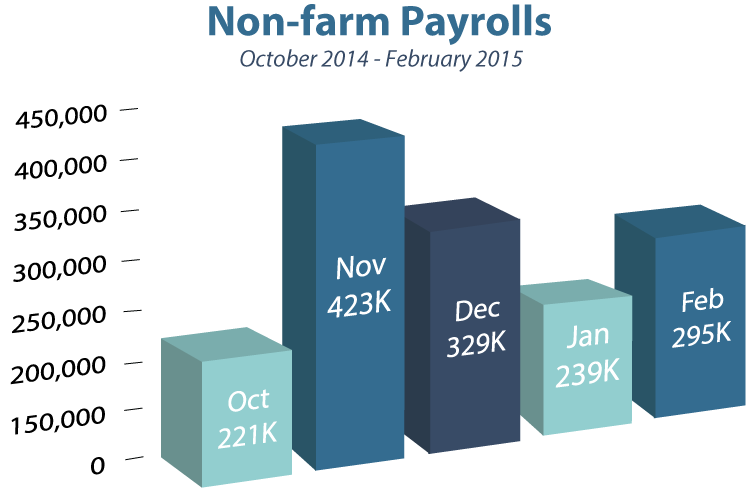

In Economic News, The Labor Department released the February 2015 Jobs Report on Friday and it can out surprisingly higher than expected and rocked both the stock market and the bond market. The Jobs Report showed that 295,000 jobs were created for February 2015 which was well above expectations of 230,000 jobs. The numbers for January and December were revised lower by 18,000.

The February Jobs Report also reported that the Unemployment Rate fell to 5.5% which is the lowest reading since May 2008. The drop in the unemployment rate is not really that great of news because the drop was because 354,000 people dropped out of the workforce, not because more people went back to work and this can be seen in the Labor Force Participation Rate (LFPR) dropping from 62.9% to 62.8%. The LFPR measures the number of people that are eligible to work, that is actually working and this number has remained depressed for quite some time.

The Weekly Initial Jobless Claims were released on Thursday and they jumped higher to 320,000 claims for the week which was higher than expected and an increase of 7,000 claims from the previous week. This was the highest figure seen in about 10 months and 3 of the last 4 readings have been above 300k claims. This data is starting to support the claims we have been making about the loss of jobs in the energy sector from the low price of oil. If this continues, this could lead to a worse than expected Jobs Report for March which would be bond friendly news and could help Mortgage bonds rally higher in the coming month.

In Other Economic News, the Low Price of Oil is a sign of lower demand for Oil around the world. The United States over the last 7 weeks has been producing and importing an average of 1 million more barrels of oil than it is consuming. This has caused Oil Supplies in the US to be at the highest level in 80 years and storage facilities are approaching capacity. This could pressure the price of Oil even lower as much as another $20 per barrel.

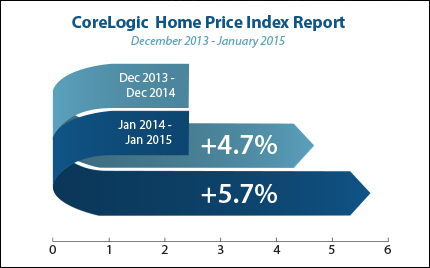

In Housing News, CoreLogic Home Price Index for January 2015 showed home prices increased 5.7% from January 2014. January represents the 35th consecutive month of year over year home price increases nationally. Home Prices were up 1.1% from December 2014 to January 2015. This report shows that housing still remains strong and the report is predicting home prices to increase by 5.3% by January 2016.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 3/6/2015 they are working on reviewing files that have been submitted on 2/25/2015 so they are taking about 10 days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

There is a Dover Delaware First Time Home Buyer Seminar Saturday, March 7, 2015, in Dover, Delaware.

The next Delaware First Time Home Buyer Seminar is Saturday, March 14, 2015, in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713