Mortgage Rates Weekly Update [December 4 2017]

Mortgage Rates Weekly Update for December 4, 2017

Mortgage Rates Update for December 4, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

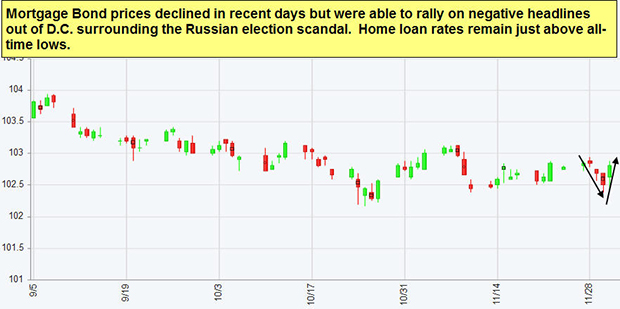

Mortgage Rates moved higher last week as mortgage bonds sold off on news that the tax bill will be passed. If you look at the mortgage bond chart below you can see mortgage bonds sold off till Friday where they were able to rebound on news that Michael Flynn will testify against President Donald Trump. The Senate passed their version of the tax bill on December 2, 2017 which is bad news for mortgage bonds so we are recommending LOCKING your mortgage rate to start the week.

In Economic News

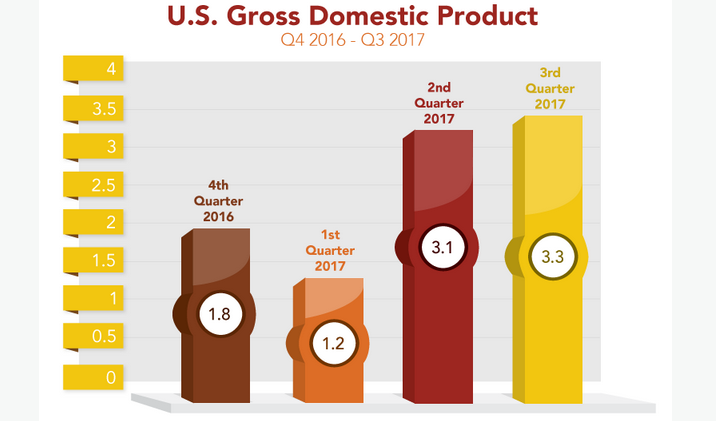

The second reading of the Gross Domestic Product (GDP) for 3rd Quarter of 2017 came in at 3.3% which was up from the first reading of 3.0%. The first quarter GDP for 2017 was 1.2% and second quarter GDP was 3.1% so GDP is trending upward from beginning of the year. The third quarter reading of 3.3% was best GDP reading since third quarter of 2014.

Inflation continues to remain very tame as the Personal Consumption Expenditure (PCE) was up 0.2% from September to a year over year reading of only 1.4% which is well below the Federal Reserves target rate of 2.0%.

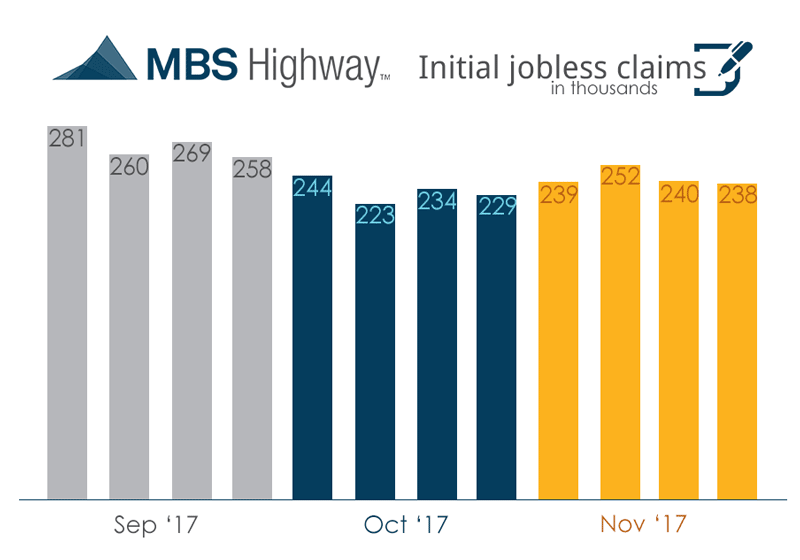

Weekly Initial Jobless Claims were released on Thursday and was essentially unchanged at 240,000 claims for the week. The jobless claims point to a very strong Jobs Report for November which will be released this Friday December 8, 2017.

In Housing News

Conventional Loan Limits for 2018 have been raised by the FHFA from $424,100 to $453,100 effective with loans delivered to Fannie Mae and Freddie Mac on or after January 1, 2018. The high cost area conventional loan limit was raised to $679,650 which is 150% of the $453,100.

Veteran Loan Limits for 2018 also were raised from $241,100 to $453,100 by the Department of Veterans Affairs effective with loan delivered on or after January 1, 2018. THe VA loan limit is the amount a veteran can finance 100% of the purchase price, a veteran can go above the loan limit but must put down 25% of the amount above the loan limit. The VA high cost area loan limit for 2018 was also raised to $679,650 like the conventional loan limit.

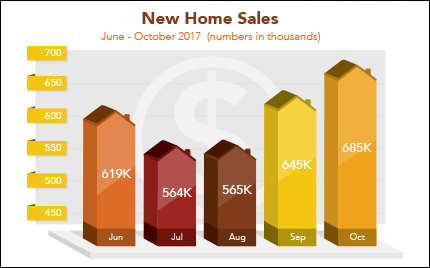

New Home Sales for October 2017 rose 6.2 percent from September 2017 to 685,000 units which was the highest in 10 years. New Home Sales were up 18.7 percent year over year. Nationally there is only a 4.9 month supply of new homes for sale which is very tight. A 6 month supply is a healthy balance, anything less creates a seller’s market.

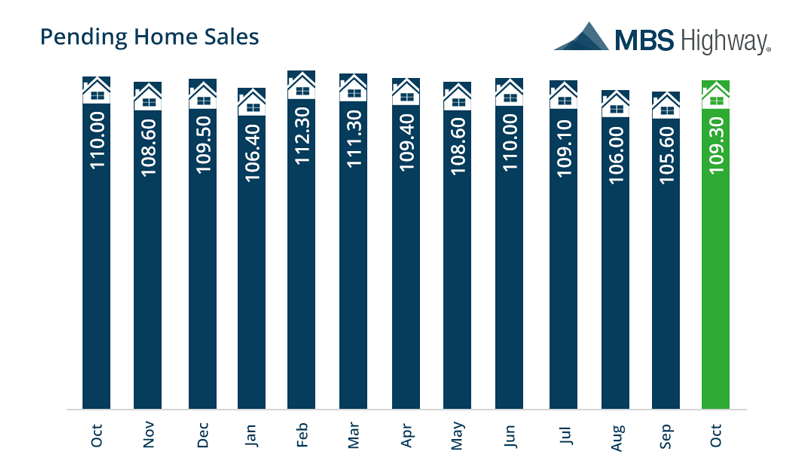

Pending Home Sales for October 2017 were up 3.5% which was better than expectations of 1.5%. The pending home sales index was up to 109.30 which was the highest since June. Pending home sales measures the number of new contracts on existing homes for sale.

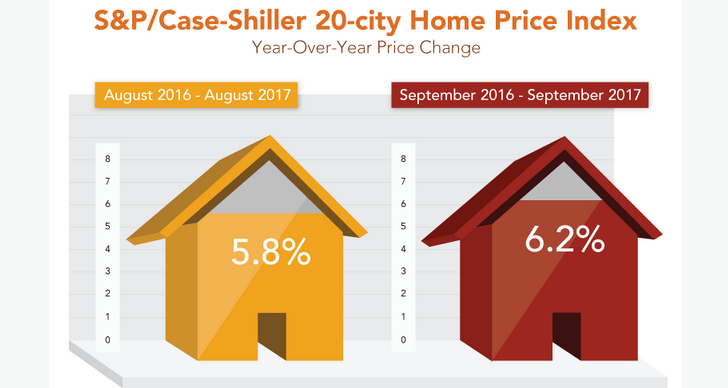

Case-Shiller 20 City Home Price Index for September 2017 showed home prices up 6.2% from September 2016 which was the biggest increase in 3 years. Low mortgage rates and a continued shortage of inventory of homes for sale can continue to push home prices higher.

First Time Home Buyer Tax Credit may be going away December 31, 2017 if the Tax Bill passes with the version from the House that eliminates Mortgage Credit Certificates. The House version of the tax bill eliminates MCCs so effective 12/31/2017 there will be no more mortgage credit certificates issued. People that already have a mortgage credit certificate are grandfathered in but if they refinance, they will not be able to transfer it to the new loan because there will be no new Mortgage credit certificate to issue.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday December 16, 2017 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday December 9, 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages