Mortgage Rates Weekly Update [August 7 2017]

Mortgage Rates Weekly Update for August 7, 2017

Mortgage Rates Weekly Update for August 7, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week about where they started as mortgage bonds sold off to end the week. If you look at the mortgage bond chart below you can see mortgage bonds had rallied all week until Friday when the July Jobs Report was released and mortgage bonds sold off and dropped below the level of support which has been a strong ceiling of resistance for the past month. We are recommending LOCKING your mortgage rate to start the week as mortgage bonds are again below a tight ceiling of resistance and could be pushed even lower as yields on the treasuries broke above their 50 day moving average.

In Economic News

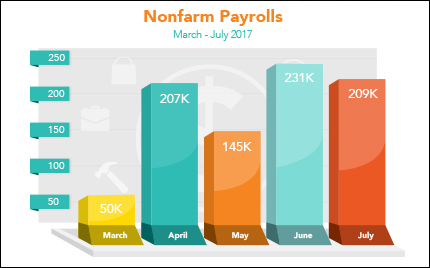

The Bureau of Labor Statistics released the Jobs Report for July 2017 on Friday which showed 209,000 jobs created for July. This was above expectations of 178,000 jobs by 31,000 jobs and this caused the stock market to rally and the bond market to sell off which moved mortgage interest rates higher on Friday. The Unemployment Rate dropped from 4.4% to 4.3% which is the lowest rate since March 2001. Average hourly earnings rose 0.3% which kept year over year wage growth at 2.5%. This shows that we still don’t have any wage pressured inflation.

The Feds favorite measure of inflation was released last week which is the Personal Consumption Expenditures (PCE) was 1.5% year over year. The PCE measures price changes in personal goods and services. This shows inflation is still very tame and well below the Feds target of 2.0%. Low inflation is mortgage bond friendly news.

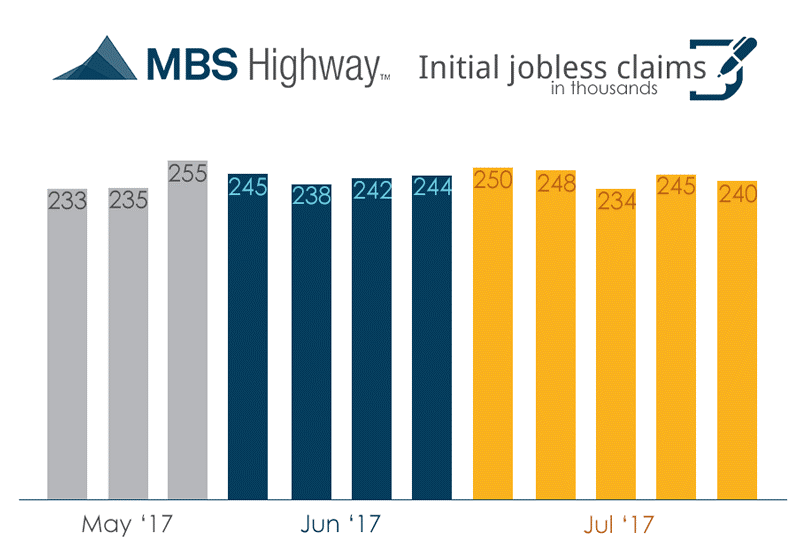

Weekly Initial Jobless Claims were released on Thursday which showed 240,000 claims for the week. This was down 5,000 claims from the previous week.

In Housing News

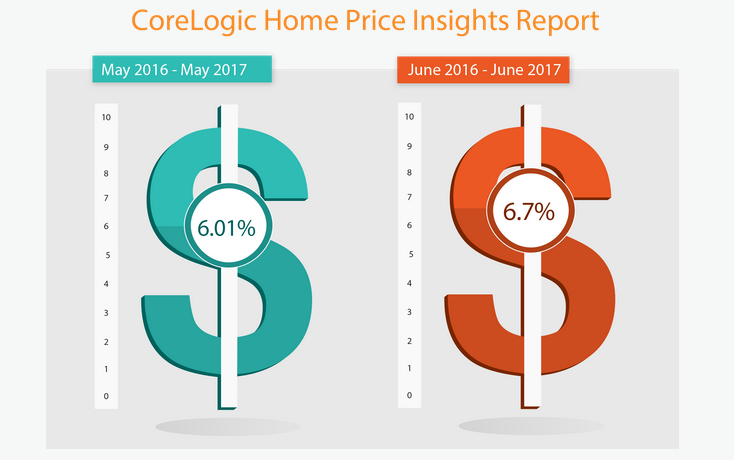

CoreLogic released its Home Price Index for June 2017 which showed home prices were up 1.1% from May 2017 and were up 6.7% from June 2016. The limited number of homes for sale is the major impetus for the rise in home prices and will continue to put upward price pressure on homes as their seems to be no end in sight for the low inventory problem.

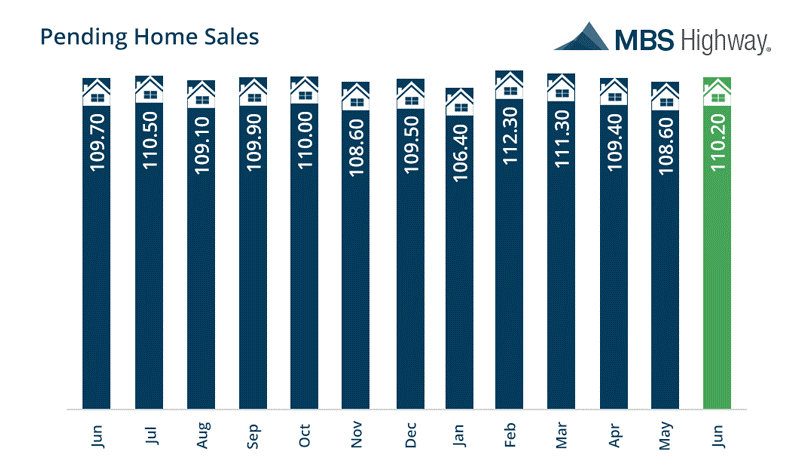

Pending Home Sales for June 2017 rose 1.5% from May 2017 t0 110.2 Million units which was above expectations of 0.9%. The year over year pending home sales from June 2016 are up 0.5%. Pending home sales measure the number of signed contracts on existing homes for sale.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday August 19, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday September 16 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage