Mortgage Rates Weekly Update 12-12-2016

Mortgage Rates Weekly Update for December 12, 2016

Mortgage Rates Weekly Update for December 12, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week slightly higher after trying to rallying off support but falling to sustain after stock market has two days of record highs. If you look at the mortgage bond chart below you can see mortgage bonds have been trading in a “down escalator” pattern trading between the two green lines. Mortgage bonds tried to break out of the pattern higher which would have moved interest rates lower but were pulled back on Friday. Mortgage bonds ended on Friday just above support so we are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can bounce higher off support and move mortgage interest rates lower.

In Economic News

Consumer Sentiment for November 2016 came in much better than expected at 98 versus 94.1 expected and well above last month’s reading of 93.8. Consumer Sentiment is a survey of 500 households each month for their attitudes toward their financial situation and the economy. The rise in Consumer Sentiment is probably from the rapid rise in the US Stock Market.

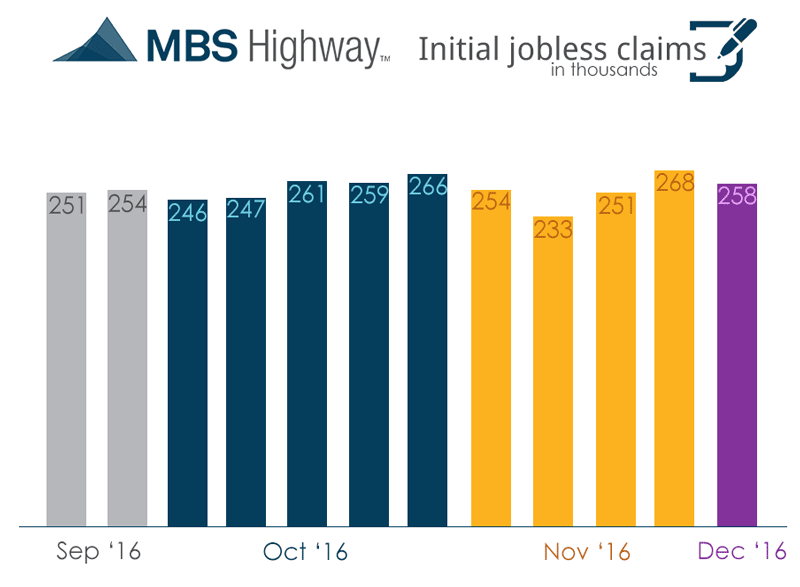

Weekly Initial Jobless Claims were released on Thursday and dropped 10,000 claims from previous week to 258,000 jobless claims. This is the 92nd consecutive weeks jobless claims remain below 300,000 which is the best since 1970. Jobless claims show employers are holding onto good employees.

In Housing News

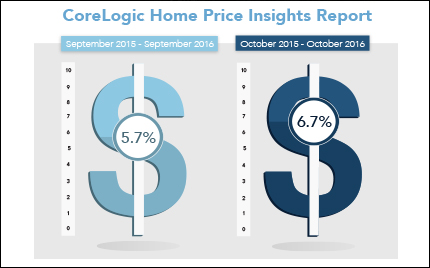

CoreLogic Released its Home Price Index for October 2016 which showed home prices nationally are up 6.7% from October 2015 and rose 1.1% from September 2016 to October 2016. This supports a very strong housing market. In the local market, Delaware was up 1.8%, Maryland was up 3.3%, Pennsylvania was up 2.8% and New Jersey was up 1.2%

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday December 17, 2016 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday January 21 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate