Mortgage Rates Update for December 19 2016

Mortgage Rates Update for December 19, 2016

Mortgage Rates Update for December 19, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates set another record high for 2016 last week as mortgage bonds continued to sell off. If you look at the mortgage bond chart below you can see mortgage bonds broke below support on Wednesday after Federal Reserve announced it was raising Fed Funds Rate. The big red candle stretched all the way down to the next level of support. We are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can rebound off support and move higher to move interest rates lower. Now is the time to get out and buy a home as the longer your wait, the higher the rates will be and the higher the price of the home.

In Economic News

The Federal Open Market Committee voted unanimously to increase the Feds Funds Rate by 0.25% at December 14th meeting and stated they will increase the rate at least 3 times in 2017. The Bond Market reacted to the news by selling off and moving mortgage interest rates to the highs of 2016.

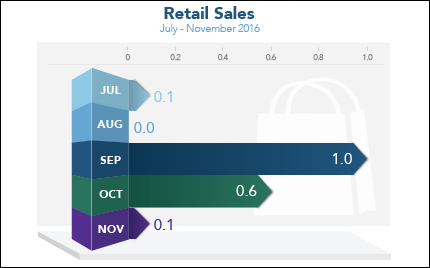

The US Commerce Department reported Retail Sales for November 2016 last week which showed retail sales were up 0.1% which was down from October’s Retail Sales of 0.6% increase. Retail Sales were up 3.5% from November 2015. The first half of November was slow but Retail Sales picked up after the election and into Black Friday.

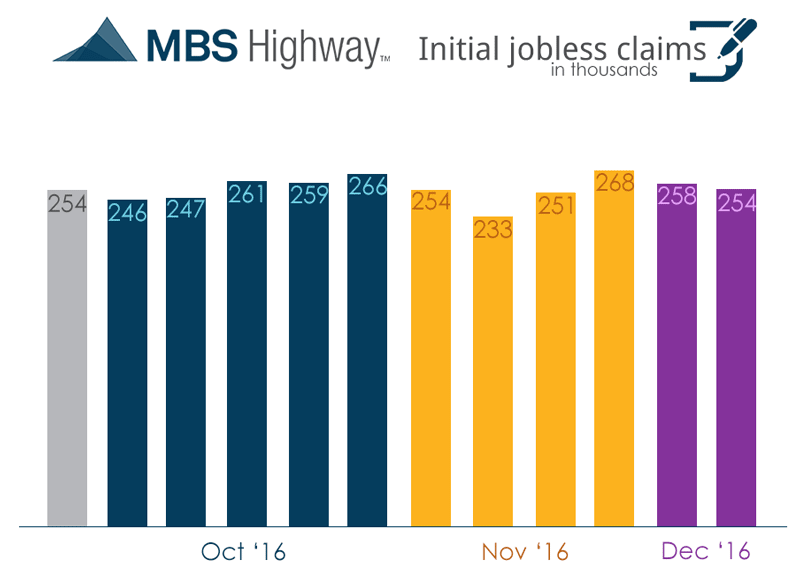

Weekly Initial Jobless Claims were released on Thursday which showed claims dropped 4,000 claims to 254,000 claims for the week. This was the 93rd straight week of jobless claims below 300,000 claims.

In Housing News

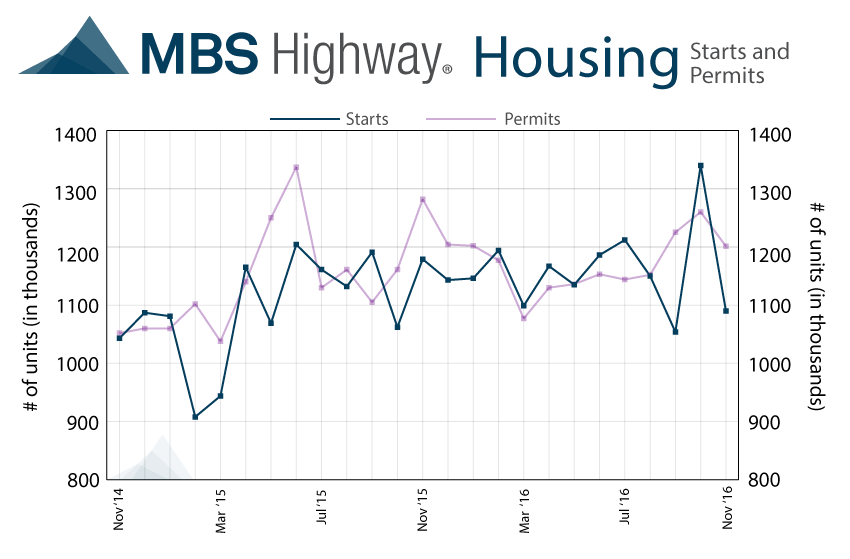

Housing Starts for November 2016 were down 18.7% from previous month at 1.090 million units. This was big drop but last month was a 24% increase and best number in 9 years so we would expect a pull back so this number doesn’t signal any slow down in new construction. Building Permits for November 2016 dropped 4.75% to 1.201 million units on annualized basis.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday January 14, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday January 21 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate