Delaware Mortgage Rates Update for December 15, 2014

Delaware Mortgage Rates weekly mortgage market update for the Week of Dec. 15, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware.

Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

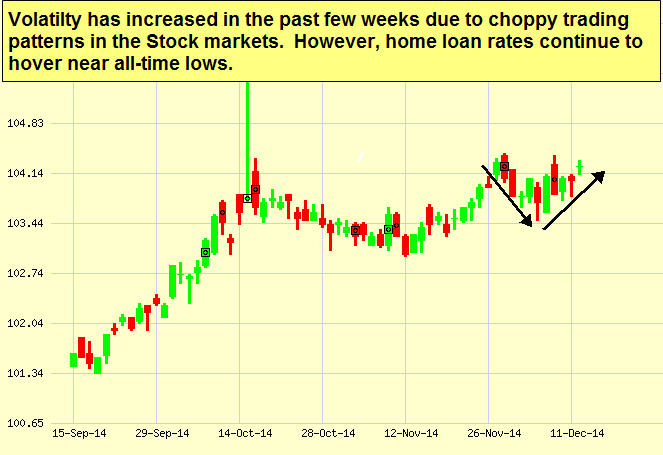

Delaware Mortgage Rates were able to recover last and move back to all-time lows for the year. If you look at the mortgage bond chart below you can bonds were able to bounce off support last Monday and rally higher to end the week. Mortgage Bonds are once again sitting at the highs for the year and could move either direction from here.

I recommend LOCKING in your Delaware Mortgage Rate if closing in the next 30 days or if you can’t risk rates moving higher. If you are closing in 45 days or longer you can risk FLOATING to see if mortgage bonds can rally enough support to break through the ceiling of resistance and move interest rates even lower.

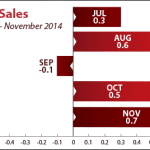

In Economic News, the Producer Price Index (PPI) was released on Friday and came in at 0.2% lower. The PPI measures inflation at the wholesale level so a drop in the PPI shows inflation remains very tame and the headline PPI is 1.5% year to date. Consumer Sentiment for December 2014 surged higher to 93.8 which is the highest level since January 2007. In line with higher Consumer Sentiment, we saw Retail Sales for November 2014 jump higher by 0.7% from October which was above expectations of only 0.4%.

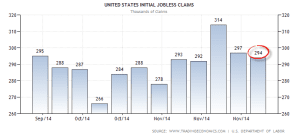

Thursday we saw the release of the Weekly Initial Jobless Claims by the Labor Department which came in at 294,000 which is down 3,000 claims from the previous week. This was another good report with claims below 300,000.

In other economic news, Oil hit at $56 a barrel last week which is really helping consumers save money at the gas pump but the longer-term effect could be negative on the economy and some fear that OPEC might want Oil price to stay low. Why?

If the price of Oil stays low then it isn’t feasible to keep drilling for new oil as the cost now out ways the profit so Oil exploration and production will shut down. OPEC hopes that low price of Oil will shut down production in the U.S. of Oil production using the fracking method.

We have already seen lays by Oil Companies because the price of oil is dropping and we have seen oil rigs shut down.

In Housing News, Fannie Mae announced that they are bringing back 97% LTV financing for qualified first time home buyers and some homeowners to refinance to 97% LTV if don’t qualify for HARP.

This will allow potential first time home buyers to put only 3% down versus the current 5% down on conventional loans through Fannie Mae. This will provide qualified home buyers options for low down payment loans outside of using FHA Loans. For more information on the qualifications for 97% LTV financing, please visit Fannie Mae 97% LTV Conventional Loan

The next Delaware First Time Home Buyer Seminar is Saturday, January 17, 2015, n Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, January 10, 2015, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, December 20, 2014, in Towson, Maryland Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713