Mortgage Rate Weekly Update Aug 15 2016

Mortgage Rate Weekly Update August 15 2016

Mortgage Rate weekly update for the Week of August 15, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to move lower last week as mortgage bonds once again were able to break above the 25 day moving average. If you look at the mortgage bond chart below, you can see mortgage bonds sold off the previous Friday after the Jobs Report was released for July 2016 but bonds were able to find a floor of support on Monday and move higher throughout the week. Bonds were able to rally higher above the 25 day moving average so we are recommending FLOATING your mortgage rate to start the week to see if mortgage bonds can continue to rally and move mortgage interest rates even lower.

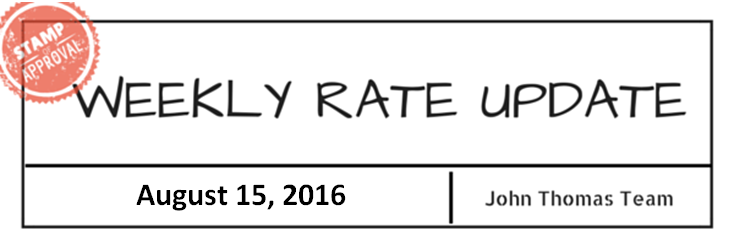

In Economic News, Retail Sales for July 2016 were reported on Friday and came in worse than expected at 0%. Economists were predicting 0.4% increase in Retail Sales. On a brighter note, Retail Sales were up 2.3% year over year.

The Bureau of Labor Statistics reported that hourly wage compensation decreased by 0.4% for first quarter of 2016 as opposed to the originally predicted 4.2% increase in wage compensation. Wage compensation for the second quarter of 2016 also decreased but by greater amount of 1.4%

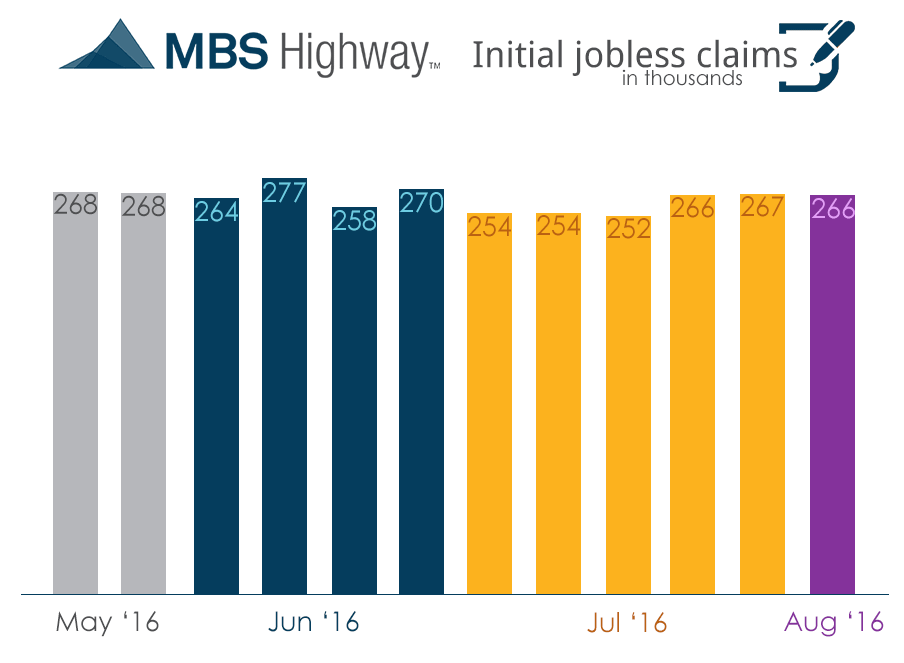

Weekly Initial Jobless Claims were released on Thursday and showed 266,000 jobless claims filed for the week which was down a 1,000 claims from the previous week. In the labor market, the story remains the same companies are firing less and holding on to their qualified workers.

The Producer Price Index (PPI) for July 2016 was released last week which is a measure of inflation at the wholesale level and it showed a 0.4% decline. Tame inflation readings are very good for your mortgage rate for the purchase or refinance.

Housing News:

FHA Loan Update – President Obama signed into law HR Bill 3700 which is the Housing Opportunity Through Modernization Act which will make it easier for FHA borrowers to purchase condos.

The bill requires regulators to rewrite the rules for condos being approved for FHA financing. The highlights are as follows:

- Lowering required owner occupied condo units from 50% to only 35%

- Relax Rule on Condos Charging Transfer Fees

- Simply the re-certification process that must be done every 2 years

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday August 20, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate