Mortgage Interest Rates Weekly Update 1-16-2017

Mortgage Interest Rates Weekly Update for 1-16-2017

Mortgage Interest Rates Weekly Update for January 16, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Interest Rates ended the week slightly higher as mortgage bonds sold off on Thursday and Friday to end the week. If you look at the mortgage bond chart below you can see Mortgage bonds have reversed their upward trend and are now trending lower after being turned lower at a tough ceiling of resistance. We are recommending LOCKING your mortgage interest rate to start the week to lock in the gains we have seen the last couple of weeks with a tough over head ceiling of resistance putting a cap on mortgage bonds.

In Economic News

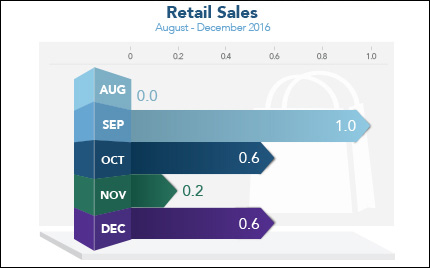

The US Commerce Department reported Retails Sales for December 2016 and they jumped 0.6% which is a 4.1% increase in retail sales from December of 2015. This is a strong report and could signal better retail sales in 2017 which would be a good for the economy.

The Producer Price Index for December 2016 came in hotter than expected at 0.3% which is a measure of inflation at the wholesale level. The PPI moved up 1.6% from December 2015 to December 2016 which was the largest gain since 2014. If inflation continues to trend up on Wholesale level and Consumer level than that could be bad news for mortgage rates as mortgage bonds could sell off on the news.

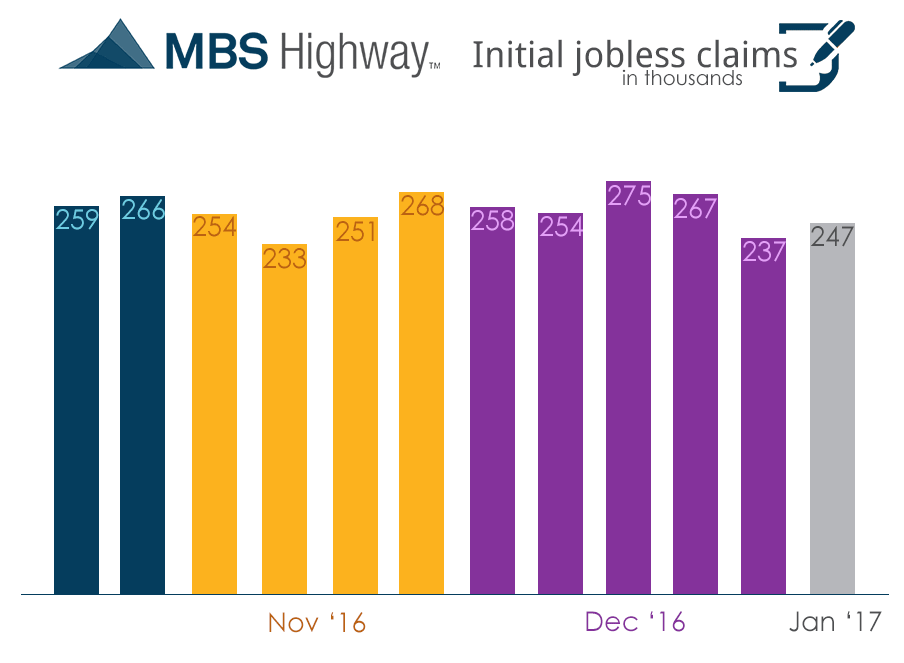

Weekly Initial Jobless Claims were released on Thursday and showed 247,000 claims for the week which was up 10,000 from previous week but again we need to take this report with a grain of salt because of the New Year’s Holiday on Monday of the report week. This week’s report will give us a true picture of where we stand with weekly initial jobless claims.

In Housing News

CoreLogic Released its National Foreclosure Report for November 2016 which showed only 325,000 homes in some type of foreclosure status which is down from 465,000 homes last November which is an improvement of over 30%! The foreclosure inventory represents only 0.8% of all homes for sale which is down from 1.2% in November 2015.

HUD announced that it will decrease the Annual Mortgage Insurance Premium of FHA loan effective with loans closed or disbursed on or after January 27, 2017. The reduction in mortgage insurance premium (MIP) is 0.25% for most FHA Loans. This is applicable for FHA purchase loans and FHA refinance loans. Read the full story at FHA Mortgage Insurance Reduction This will help FHA borrowers qualify for more purchase price.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday February 18, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday January 21 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate