DSHA SMAL Down Payment Assistance Loan

DSHA SMAL Down Payment Assistance Loan Program

(DSHA SMAL Program NO LONGER AVAILABLE!!!)

DSHA SMAL Down Payment Assistance Loan Program is a Delaware Down Payment Program for qualified Delaware home buyers who meet the income restrictions and credit requirements. The program was discontinued by DSHA in May of 2018 and replaced with the DSHA Preferred Plus Down Payment Program. The Delaware State Housing Authority Small Mortgage Assistance Loan (SMAL) program is a second mortgage loan of up to $8,000 at 3% interest for the term of the loan. You can apply for a SMAL loan by calling 302-703-0727 or online at SMAL Loan Application

What are the qualifications for a DSHA SMAL Loan?

In order to apply for a DSHA SMAL down payment assistance loan you must meet the following requirements:

- Must be purchasing the home as your primary residence

- Must be under the maximum household income limit for the SMAL

- All borrowers MUST have at least a minimum 640 FICO credit score

- Must use DSHA first mortgage loan program to purchase the home

- Non-Occupying co-borrowers are not allowed on the first mortgage loan

- The maximum debt to income limit for the program is 45%

- Must NOT exceed the maximum purchase price limit for the county

- Must Complete 8 Hours of HUD Approved Home Buyer Counseling

The SMAL Loan can used with a DSHA first mortgage loan that is either a FHA Loan, a USDA Rural Housing Loan, or a Conventional Mortgage Loan.

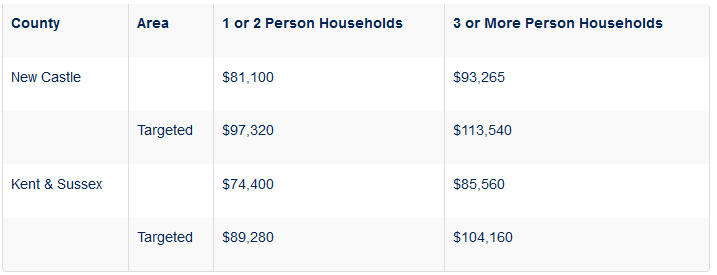

What are the maximum household income limits for SMAL?

The maximum household income restrictions for a DSHA SMAL loan for 2017 are as follows:

The household income calculated by DSHA includes all members of the household that earn income whether or not they are on the loan. So if husband and wife are looking to purchase a home in New Castle County Delaware and want to apply for the SMAL program but only the wife will go on the loan, we will still need to review the husband’s income as he is part of the household. So if wife makes $50,000 a year she is under the income limit but if husband makes $75,000 then their total household income would be $125,000 which is over the 2 person income limit of New Castle County which is $81,100 so they would not qualify for the SMAL program.

What are the Terms of the DSHA Small Mortgage Assistance Loan?

The Delaware State Housing Authority Small Mortgage Assistance Loan (SMAL) is a second mortgage loan secured against the property you are purchasing as your primary residence behind a DSHA first mortgage. The SMAL is a loan of up to $8,000 and has an interest rate of 3%. The loan is deferred for 30 years and you do not need to make a payment until 361st month that you have the loan.

BUT interest will accrue each month that you have the loan so if you make no payments, each year the balance of the loan will increase. For example, at the end of the first year you would now owe $8,240 instead of just the $8,000 you borrowed.

The SMAL must be paid off in full if you refinance your first mortgage loan, sell the home, or no longer occupy the home as your primary residence.

*First lien interest rates maybe higher when using a DPA second.

Where can I use the DSHA SMAL?

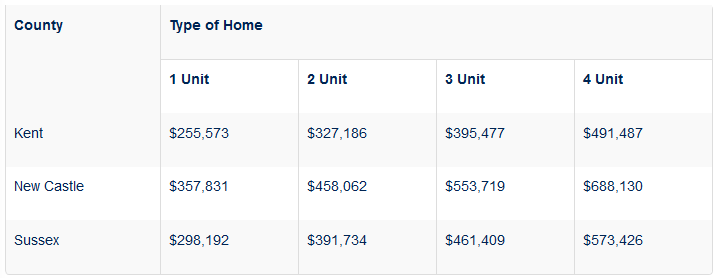

The SMAL can be used in all three counties of Delaware which include New Castle County, Kent County, and Sussex County. The SMAL can only be used in the state of Delaware by someone purchasing a home as their primary residence as long as the purchase price of the home does not exceed the maximum. The maximum purchase price limits for 2017 to be eligible for a SMAL loan are shown below:

How do I apply for the DSHA SMAL DPA?

You can only use the SMAL loan in conjunction with a DSHA first mortgage loan so must apply with a DSHA approved lender. Call 302-703-0727 to speak with DSHA Approved lender or APPLY ONLINE