Delaware Mortgage Rates October 2 2017

Delaware Mortgage Rates Update for October 2, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Delaware Mortgage Rates moved higher last week as mortgage bonds continued to sell off since hitting the highs of the year at the beginning of September. If you look at the bond chart below you can see the pattern for mortgage bonds has been to sell off and trade lower. Mortgage bonds did hit a very important floor of support on Friday which did hold. If mortgage bonds break beneath this support it will be very bad sign for mortgage bonds and we will see rates continue to move higher. We are recommending LOCKING your Delaware mortgage rate to start the week as mortgage bonds have been trading lower and closed just above a floor of support. We would like to see a bounce off support before we switch to a floating stance.

In Economic News

Consumer Inflation continues to drop as the Fed’s favorite measure of inflation the Personal Consumption Expenditure (PCE) dropped to 1.3% for August 2017 which was the lowest level since November 2015. Low inflation is good news for bonds as will keep long term rates low as long as we don’t have inflation.

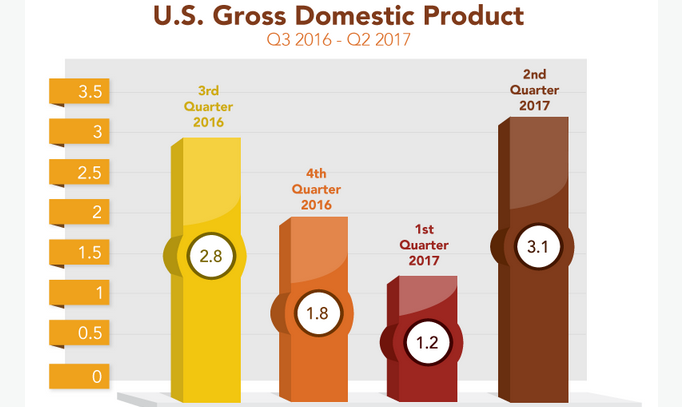

The final reading for Gross Domestic Product (GDP) for 2nd quarter of 2017 came out at 3.1% which is a big increase from 1.2% for the first quarter. This was the best reading for GDP since the 3.2% recorded in the first quarter of 2015. The reason for the higher GDP reading was from inventory build up.

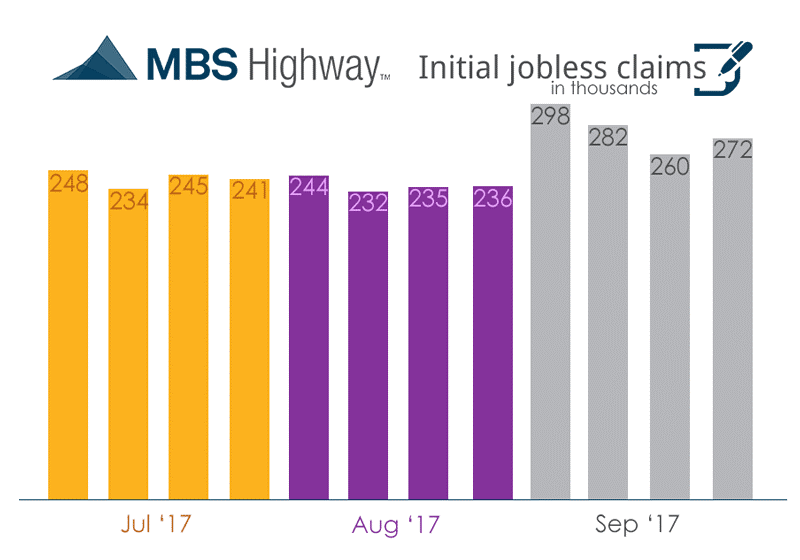

Weekly Initial Jobless Claims were released on Thursday and moved higher by 12,000 claims to 272,000 claims for the week. The jobless claims are still being skewed by hurricane Harvey and hurricane Irma. Last week’s jobless claims were revised higher from 259,000 claims to 260,000 claims and this is also the sample week for the September Jobs Report which will be released this Friday.

In Housing News

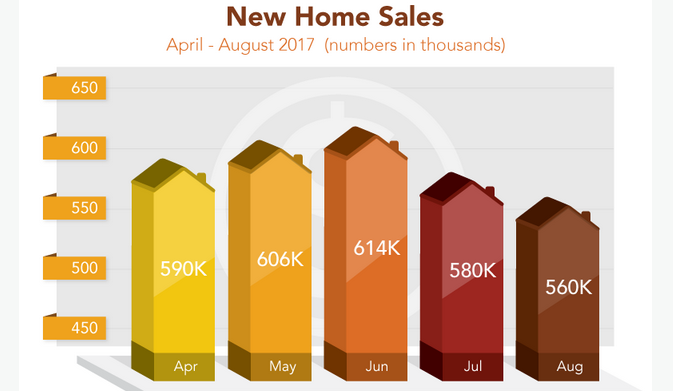

New Home Sales for August 2017 were driven down by 3.4% because of hurricanes Harvey and Irma to 560,000 units on an annualized basis. This was an eight month low for New Home Sales but the Commerce Department reported that it only had status for about 65 percent of the areas affected by Hurricanes in Texas and Florida where they typically get a 95 percent response rate so this may have a revision higher next month.

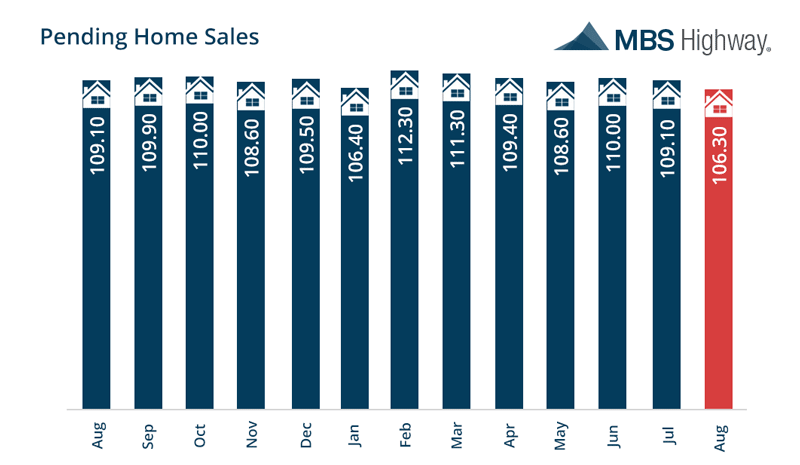

Pending Home Sales for August 2017 fell by 2.6% from July 2017. There were two main culprits to the drop in Pending Home Sales, low inventory and effects of hurricanes Harvey and Irma. The National Association of Realtors said we could see home sales slowed in Texas and Florida for months from the aftermath of the hurricanes.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 21, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage